06/29/2024 11:42

Updated on 29/06/2024 11:42

The supply of materials and components is becoming an increasingly complex challenge in various industrial sectors, including electric vehicles. This market has experienced notable growth in recent years, and the IDTechEx consultancy predicts that sales will quadruple in the next decade.

Although much of the debate centers on battery materials, rare earths used in the electric motor magnets They are also a key supply. These materials are produced almost exclusively in China and have experienced considerable volatility in their prices. Despite these concerns, a new IDTechEx study concludes that rare earth permanent magnet motors have maintained more than 77% of the electric car market for the past 9 years. Why is this happening?

The results of the report

The IDTechEx report estimates that the electric vehicle market will require more than 140 million enginesAlthough the share of rare earth motors is expected to decline, the majority of the market will still be using permanent magnet motors by 2034.

China controls the supply of rare earths, causing great price volatility. In 2011, after the restriction of exports by China, the prices of neodymium and dysprosium They rose between 750% and 2000%, respectively. Prices rose again in 2021 and 2022, peaking in 2022 at four times the average of the previous eight years. Although prices stabilized in 2023 and early 2024, doubts persist for the coming years.

He local sourcing of materials and improving national supply chains have become priorities for many industries and governments seeking to secure their future. Furthermore, rare earths have environmental problems related to mining and processing, as well as the waste generated in these processes.

Current state of technology

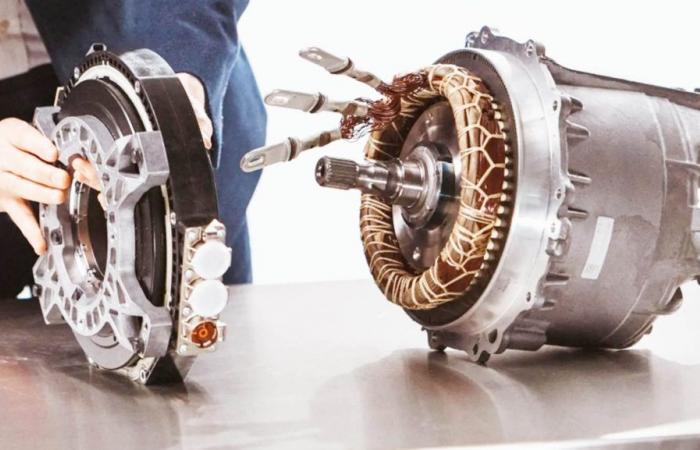

Among the alternative developments without rare earths, renault has used externally excited synchronous motors (EESM) in a model like the Zoe. Other manufacturers, such as BMWhave also adopted this technology. Although these motors reduce costs on the material side, their manufacture is usually more complicated due to the copper windings of the rotor and the need to excite it externally, so they are more expensive to manufacture.

Another solution is the rare earth magnets, with different levels of commercial preparation. Companies like Proterial They claim their ferrite magnets “deliver the highest levels of performance in the world.” Niron Magnetics is developing iron nitride magnets, with future versions planned to match the performance of neodymium.

The European project PASSENGER is working on strontium-manganese ferrite, aluminum and carbon alloys. Although these materials are unlikely to completely replace rare earth magnets in the short term, their lower cost and stability of supply could tip the market in this direction.

Why are permanent magnets preferred?

Permanent magnet motors continue to be the predominant technology in electric vehicles. There are two main factors that influence the choice of engine technology: performance and cost.

Permanent magnet motors offer higher power and torque density, high efficiency and low manufacturing costs. Its main disadvantage is the cost of materials. Magnets represent approximately a third of the total.

Since the 2022 price peak, rare earth costs will have stabilizedmaking them competitive again and reducing the urgency to look for alternatives. Currently, most suppliers offer both permanent magnet motors and EESM motors, leaving the final decision in the hands of the manufacturers.

According to IDTechEx, most have options to assemble EESMs of their own manufacture or through suppliers who generally reserve for situations where magnet prices increase significantly or where there is a need to increase localization of material supply due to geopolitical or regulatory pressures.

The scenario for the next decade

Unless there are significant advances in the development of rare earth-free magnet technology or there is a strong regulatory push, rare earth permanent magnet motors are likely to remain most of the market.

This conclusion is especially relevant given that China, the largest EV market, does not have strong incentives to abandon rare earth magnets. In this scenario, IDTechEx predicts that magnets free of rare earths will occupy 12% of the market by 2034.