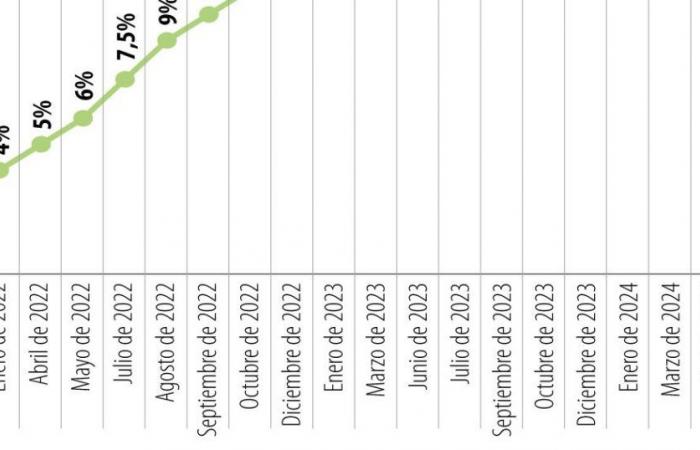

The Bank of the Republic again cut its reference interest rate by 50 basis points, to 11.25%, less than the Government expected, but in line with market analysts’ expectations.

The decision of the Board of Directors was not made unanimously, but by a majority of four votes to two. This reduction confirms the caution that the Issuer has been taking despite the pressure from the Government and of some productive sectors to accelerate the pace of monetary policy easing to revive economic growth.

It was the fifth rate cut since the central bank began its easing program in December 2023.

According to analysts consulted by LR, The Bank’s Board is showing caution in reducing rates. From November 2023,The Issuer has reiterated that it wants to bring inflation to 3% by mid-2025, said Jackeline Piraján, director of Capital Market Research at Scotiabank Colpatria.

At this point, “the cycle of cuts has been slow but consistent, leaving the real interest rate, defined as the nominal interest rate minus inflation, remains above the neutral level of 2.4%; That is, it is contractionary for the economy and contributes to reducing inflation,” the analyst noted.

It was already budgeted

Several analysts agree that the decision is not a surprise. For example, Corficolombiana pointed to this cut and ratified a projection of the 2024 closing rate at 8%.

“Although inflation expectations have continued on a downward trend, the 12-month figures still remain at an upper limit of the tolerance range, which is 2% to 4%; which means that, As long as this is not consolidated, the Bank will continue to remain cautious,” Diego Gómez, local economy analyst at Corficolombiana, told LR.

Additionally, Daniel Velandia, director of Economic Research at Credicorp Capital stated that, The manager of the Bank of the Republic emphasized that although inflation is on the right track, it is still far from reaching 3%.

On the other hand, “the recent upward behavior of the dollar and all the fiscal discussion that took place in the last month also called for caution on the Issuer. It should not be forgotten that the Bank’s Board expressed concern that fiscal discussions and political uncertainty could alter the behavior of the dollar,” Velandia added.

To this, the expert added that there may be sudden increases in the exchange rate and an increase in the country’s risk premium, “which has in fact been partially materialized in recent months and in the TES rates in the public debt market,” he emphasized.

He said that, to the extent that the expectation of the first rate cut at the Fed has been postponed, “it prevents the Issuer from accelerating easing.”

What can be coming for the future?

Daniel Velandia from Credicorp points out that “there is an expectation that in July the interest rate will be cut by 50 points and starting in September, there may be cuts of 75 basis points.” This is due to greater clarity regarding inflation, economic growth and the Federal Reserve’s monetary policy, he said.

For Adrián Garlati, professor at the Universidad Javeriana, the decision of the Federal Reserve must be awaited; “But what could be expected is a slight reactivation, accompanied by a little inflation,” he concluded.

50 basis points was the cut in interest rates made by the Bank of the Republic, This being the fifth reduction.