Javascript is disabled in your web browser.

Please, to view this site correctly,

enable javascript.

To see instructions for enabling javascript

In your browser, click here.

The persistent downturns of recent weeks have brought the market’s attention back to companies like Enel Chile, whose shares are looking for direction amid the range of estimates for upcoming profits.

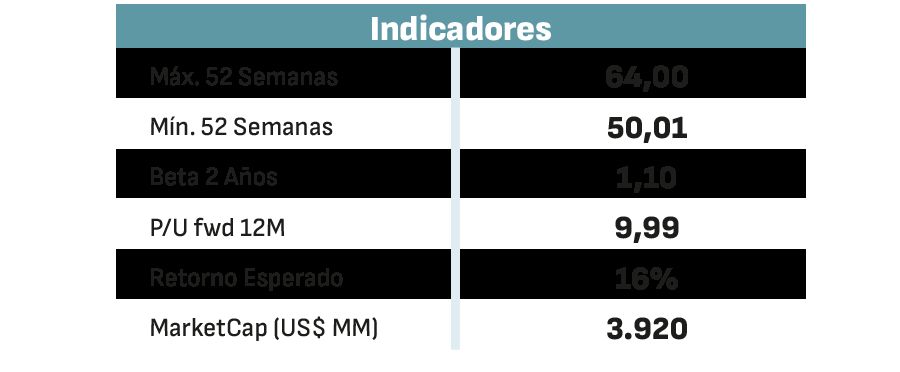

Since its mid-2022 floor on the local stock market, the electricity company has tended to stabilize, oscillating between $50 and $55 per share during the first half of 2024.

Recommendations

In the eyes of Itaú BBA Securities, there is a clear buying opportunity. Its target price (PO) of $70 per share implies an expected return of 30% from Wednesday’s close, being the most optimistic valuation of the seven recommendations from study departments compiled by Bloomberg.

Itaú Equity Research Associate Ignacio Sabelle highlighted the company’s high exposure to the non-conventional renewable energy sector and the competitiveness this gives it in electricity tenders.

“By 2026, Enel expects to increase its renewable generation to 35%, and thus have an even cleaner and more competitive generation matrix. These qualities make Enel Chile the top pick in the sector for Itaú, in addition to the fact that the company is trading at a discount compared to its historical multiples,” the analyst argued to Señal DF

Bci Corredor de Bolsa is also in favour, recommending its clients to “overweight” Enel Chile with a price horizon of $65 per share at the end of 2025.

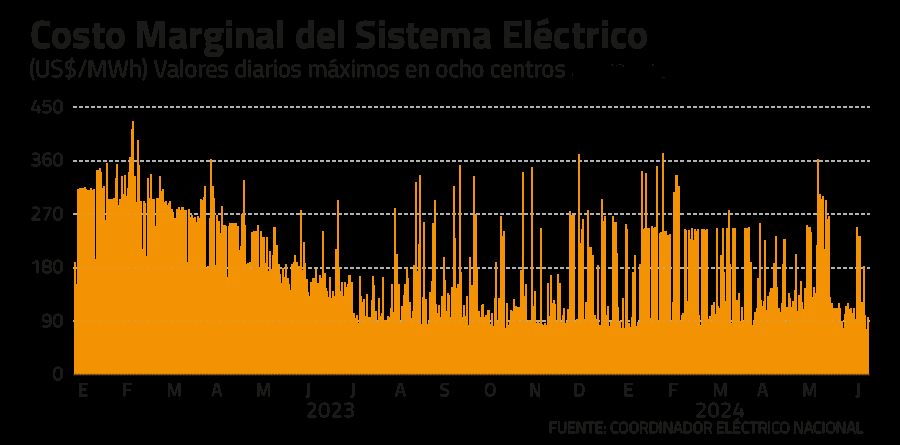

“In the electricity sector we have seen quite significant rainfall, and when the reservoir quotas are monitored by the regulator, they are at maximum levels. There is a lot of water available,” said Francisco Domínguez, an analyst at Bci’s Corporate & Investment Banking Studies, adding that “marginal costs have moderated considerably.”

The deputy manager of Variable Income Studies at BICE Inversiones, Aldo Morales, is betting on “holding” with a PO of $56.3 per share. Although he anticipated that his estimates could be revised upwards, “they are based on a more conservative hydrological scenario than that of 2023, considering that the projections continue to point to a 65% probability of a La Niña phenomenon between July and September.”

And in fact, he pointed out that “the company’s current guidance continues to be for hydro generation of less than 10 TWh in 2024. The above, together with lower income from gas trading, leads us to expect a positive year, but moderating in relation to 2023.”

Contrasting with Itaú’s stance, Morales also said that “the multiples have come quite close to historical averages and to what integrated utilities trade in Latin America.”

According to Bloomberg data, Enel exhibits an enterprise value to Ebitda ratio of 5.6 times, aligned with the average of its comparables, but at the lower end of the average range when compared to its history.

Dividend Forecast

The board of directors of Enel Chile announced that it intends to distribute an interim dividend of up to 15% of the profits achieved as of September 30 of this year, and a final dividend of 50% of the profit for the entire fiscal year 2024. These dividends would be paid during the first months of next year, and in any case are subject to the evolution of the results, among other factors.

Itaú’s estimates are in line with the lower end of what was presented in Enel’s 2024-2026 three-year plan. “With this, our dividend yield (DY) is around 6% and 6.5%. In the plan, the company announced that it is seeking partnerships (between US$ 500 and US$ 900 million), which could eventually increase this DY,” said Sabelle.

With the $482 billion profit expected in 2024 that Domínguez expects, his estimate is for a DY between 5.9% and 6% with respect to that year. In this regard, Morales said that “we should expect returns closer to 5% under normal conditions, which is attractive, but not so much if you look at what fixed-income alternatives with much less risk pay.”

Rate effect

Generation is the key segment for Enel, as it has been representing close to 90% of its Ebitda, with the remainder in the distribution segment. That is why a direct impact from the increase in electricity rates is not estimated, in a context where the debate has intensified due to the recognition of the inflationary pressure that it will generate, according to the latest Report of the Central Bank.

According to Morales, “the main positive effect on the generation side would have to do with a lower investment in working capital, since the rate freeze was accounted for as an account receivable.”

In addition, “there are fears related to the Government that may add some noise to the sector,” Domínguez observed. How is the Government going to handle this new information from the Central Bank? It is one of the questions that must be taken into account when valuing Enel, according to the executive.

And while the increase in rates will boost revenue, “there may be other factors associated with the Central Bank’s long-term interest rates that could affect financial spending,” Domínguez explained.

“The effects of different rates are important in the financing of these companies,” said Sabelle, noting that “in the case of Enel Chile, more than 90% of its debt is financed in dollars, so international rates are also relevant.”