For Santiago Montenegro, president of Asofondos, with the project approved on Friday not only was an opportunity lost but mistakes were made that young people will pay for in a few years. “The Senate text is, in some chapters, more harmful and leaves a greater debt for young people,” said the union spokesperson in an exclusive interview with EL TIEMPO, just a few hours after knowing the result of the Chamber plenary debate. of Representatives in which the pension reform was approved.

According to the criteria of

And given the result of the process, he said that it will be the Constitutional Court that will determine whether said ‘Plan B’ complied with the Constitution. “We respect the decision made by the House of Representatives and the Congress of the Republic,” said the union spokesperson.

What reading do you make of the Government’s ‘Plan B’ with which the pension reform was carried out?

It will be the Constitutional Court that determines whether said ‘Plan B’ complied with the Constitution. We respect the decision made by the House of Representatives and the Congress of the Republic. Likewise, we call for the Government to respect the decision made by the Court in this regard, whatever it may be.

Accepting the text approved by the Senate, when it is known that it required important adjustments, such as in article 85 (tax treatment) or the one that enables the president to choose those who will manage the savings fund that the Issuer will manage, what implications will it have for the Colombians?

In addition to those you mention, the Senate approved article 94 that mandates differential treatment of indigenous peoples, black, Afro-Colombian, Raizal and Palenquera communities, and peasants. Obviously we share the objective of protecting these communities, but we are concerned that this article never had fiscal support, and would have a colossal cost on the system.

Likewise, The Seventh Commission of the Chamber had corrected a point that we had insistently requested, and that is that a return be recognized for those who do not retire and request a refund of contributions for having less than 300 weeks. Today our members receive fair returns for their savings, and with the Senate text this population will not receive any return. There are many Colombians affected by this measure.

For these and other reasons we consider that the text advancing in the House of Representatives was better on several issues than the one approved by the Senate. For Colombians, the Senate text is, in some chapters, more harmful and leaves a greater debt for young people.

Finally, the project ended up ‘pupitriated’, ignoring the recommendations of the funds, academics and other market actors. What is coming for Colombians and the funds themselves with a pension reform like this?

A reform such as the one approved with such a high mandatory contribution threshold to Colpensiones, without a doubt, significantly cuts member savings and national savings, and will very negatively affect young people and lower-income workers, who are the most informal. The reduction in savings will have all the negative effects indicated by experts not only in the financing of future pensions, but also for the stock market and investments, which have contributed to the country’s economic growth.

Where are the biggest risks for the country and Colombians from this approved pension reform?

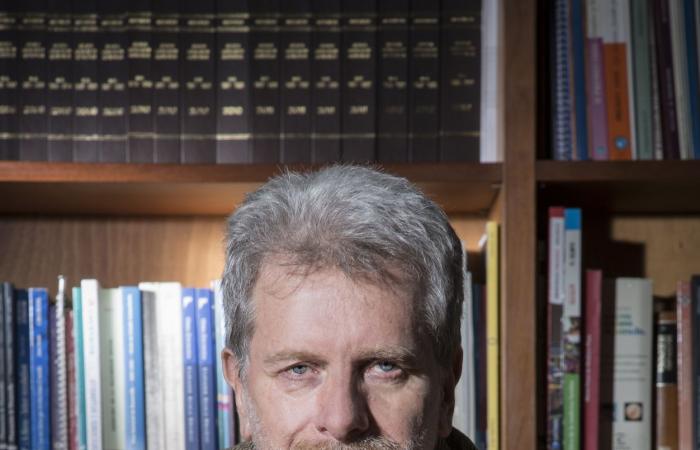

Santiago Montenegro Trujillo, president of Asofondos, a union that represents private pension funds (AFP)

Photo:Asofunds

Without a doubt, the greatest risk for Colombians is that this reform ignores the aging process that Colombia is experiencing and strengthens an unsustainable model in the face of the demographic transition. Families have fewer children or do not want to have them. Every day there will be more Colombians of pension age and fewer who are of working age and contributing to the system. When today’s young people are older adults, there will not be enough young people to pay them their pensions.

The Government itself recognizes that the reform it presented is not sustainable over time. According to the bill that was approved, the Government’s savings fund runs out in 2064 and immediately the public regime’s deficit skyrockets to 5 percent of GDP. Although the reform included a savings fund, it is very low (it only saves 22 pesos of every 100 pesos of contributions) and will be exhausted in 2062. But in addition, the savings that have been built in the funds will also have been spent by that date, since the flows that feed it are diverted 80 percent to Colpensiones, and as members reach pension age, they will have to transfer the saved stock to this entity. The Autonomous Committee on Fiscal Rule (CARF) has indicated that pension debt rises from 105 percent to 182 percent of GDP. Even the Ministry of Finance recognizes a 40 percent increase in said debt.

He believes that, with what has been approved, another reform will have to be made in 15 years or sooner, as Minister Ramírez herself said…

As we have argued and said previously, the project itself recognizes that the proposed system is not sustainable. The public savings fund runs out, when a public savings fund should never run out. The best examples are in the public funds of the Scandinavian countries, Australia and other countries, which are growing more and more, and which are taking into account the demographic transition and the aging of the population.

Furthermore, the Minister of Labor recognized a few weeks ago that in 12 years another reform will have to be made, and former Minister Ocampo said the same thing in his column recently. And, on the day of approval, the coordinating speaker of the project in The House of Representatives, Martha Alfonso, said that it was the responsibility of Congress to present a new project on July 20 to correct the bad aspects of the Senate text that was approved. I repeat, the same speaker coordinator said that another bill must be filed next July 20.

Moments in which the Pension Reform was approved in the Plenary of the House of Representatives.

Photo:Nestor Gomez

A new reform, then, will have to address the issue of age, the replacement rate and raise contributions?

The Government itself has also recognized this, it is written in the fiscal guarantee document of the Ministry of Finance. Before the savings fund is exhausted, a parametric reform will be necessary. What does this mean? It will be necessary to raise the pension age, increase the percentage of the salary that is deducted for contributions, reduce the amount of pensions, or a combination of the above. We consider it a missed opportunity because if savings had been privileged from now on, when we are a young society, these adjustments could be mitigated as we age.

In Friday’s debate it was mentioned that there was sufficient illustration, but in your opinion, what was needed for there to be a greater understanding of the negative implications of this government proposal?

For the citizens who followed the debate It was evident that the congressmen did not know what text they were voting on, since since its approval in the Senate it had been subject to modifications both in the seventh committee of the House and in the presentation. In fact, several congressmen pointed out during the debate the negative consequences of adopting the text approved by the Senate Plenary without modifications.

For example, the pension tax that was enshrined in article 85 of the reform means that allowances of 3,600,000 pesos or more will pay taxes starting with the reform. Many of the corrections that the speakers of the Chamber and the Government itself proposed as the best protection for those who receive a benefit from the semi-contributory pillar were left out, resulting in the expropriation of the savings of the poorest and the incentives for informality. They were approved due to this lack of understanding of the text being voted on.

Decree 1083 of 2015 regulates employment and functions of the public sector.

Photo:Jaime Moreno

Although Colpensiones’ lack of preparation to receive the avalanche of affiliates was evident, the validity of the reform was not modified, there is very little time to finish adapting, do you fear that this will cause a greater problem than the one you face today? the entity, as the workers themselves denounced it this week?

Putting this reform into operation requires an enormous adjustment of organizational capabilities, in several aspects, it is not only about strengthening the technological infrastructure and advancing the development of software and applications that are required, the entity must also be strengthened at the corporate governance level.

A year is a very short time, considering, also, that a large number of articles must be regulated by the Government, so only when the decrees are in place will it be possible to know what the process that must be implemented will be like.

Putting this reform into operation requires an enormous adjustment of organizational capabilities, in several aspects, it is not only about strengthening the technological infrastructure and advancing the development of software and applications that are required, the entity must also be strengthened at the corporate governance level. , processes, member service, human talent, risk management and physical plant, among others.

In addition to making this major organizational adjustment, Colpensiones must maintain and improve current systems and processes, since a very significant volume of affiliates will be in the transition regime, which must be administered under the current rules for a long period of time, it could last more than 40 years. Just to give you an example: a change infinitely smaller than this reform, such as the implementation of double counseling, took two years. In the end, what is being put at risk is the attention to the millions of members of the pension system.

Do you see that in the process of regulating the standard things could get complicated or, perhaps, there is an opportunity to adjust something?

There are probably opportunities to look for simple processes that do not make it more difficult for affiliates to interact with this already complex pension system; for this it would be necessary to have spaces for dialogue and agreement with the Government.

But since the devil is in the details, it may be difficult to reach the specific definitions that are required and that are in charge of the Government, another issue that plays against the very limited time for the implementation of the reform.

In any case, it is not possible to correct the text approved through decrees, only a new law could correct the most egregious errors.

It is said that all that remains of the effort is fatigue. What things do you think could have been corrected in the 6 days of debate that the pension reform still had?

The approved text of the reform has several inconsistencies and contradictions that will make its regulation and subsequent implementation much more complex. Many of these inconsistencies had been corrected in the paper presented to the House of Representatives. Now we will have to wait for a new bill to be presented on July 20 as proposed by speaker Martha Alfonso.

* EL TIEMPO is part of a conglomerate of companies to which an AFP belongs