The Ministry of Economy will place debt in pesos again this Wednesday with the objective of, at least, refinancing the nearly $6 billion that expire in the next few days. To do this, it will offer investors five titles. On the table there will be four LECAP, the fixed rate bills with which the Ministry of Finance promised to reestablish a scheme of positive returns against inflation. But the main novelty is the return to the menu of a linked dollar bond: Luis Caputo decided to propose it again in days of expanding exchange rate gap and despite the express rejection of the International Monetary Fund (IMF).

The placement will be the second and last of June. In the previous tender, which occurred after days of strong tension in the financial markets, the economic team decided to pause the debt migration process from the Central Bank to the Treasury and awarded what was necessary to renew the mid-month maturities. This debt handrail was part of the strategy to dismantle the BCRA’s remunerated liabilities, which the Government decided to accelerate in May, in exchange for a growth in the treasury’s short-term net debt.

On that occasion, the Secretary of Finance, Pablo Quirno, announced that the period of negative real interest rates (which until then was used to liquefy the pesos in the economy) had come to an end. And it awarded LECAP to September with a guaranteed minimum monthly effective rate (TEM) of 4.25%, slightly above the 4.2% inflation rate in May.

For this Wednesday’s tender, the Treasury Palace once again put up a rate reference in a single instrument. This is a new LECAP as of September 30which will also have a minimum performance of 4.25% TEM. At the City tables they point out that it is not certain that it will end up being positive, since the majority of consulting firms predict that the June CPI will be higher than that of May and there are doubts about what will happen in the following months.

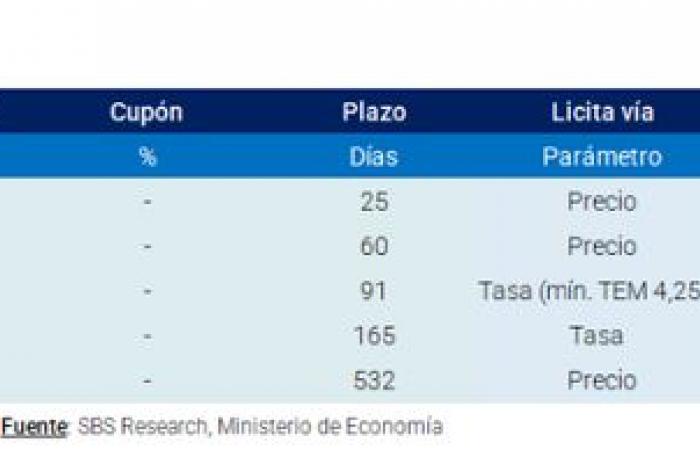

Caputo’s team will also reopen a LECAP on July 26 and another on August 30, which will not have a rate reference and will be tendered by price. Finance determined for these three bills together a maximum amount to be placed of $6 billion, in line with the maturities to be renewed (mainly concentrated in a LECAP that expires on July 1 and a Dual bond that pays inflation or variation of the dollar, which that makes the fork more profitable). The fourth letter that will be on the table will be a LECAP on December 13, which will also be auctioned based on rate indication but does not have a predefined minimum yield.

Debt, linked dollar and IMF

However, the main novelty will be the return to Treasury tenders for a title indexed to the official exchange ratethat is provides coverage against eventual devaluation. This is a new linked dollar bond with a zero coupon that will expire on December 15, 2025. Both this instrument and the LECAP as of December have no preset limit and can be awarded “up to the maximum amount authorized by current regulations.”

The return of the linked dollar occurs at a time of expansion of the exchange gap up to levels between 44% (in the case of CCL) and 49% (in that of blue). He market opened question marks regarding the sustainability of the current exchange rate scheme given the very low level of net foreign currency purchases by the BCRA in June and the Fund’s requests to accelerate the pace of depreciation of the peso. In this framework, this Monday, in a largely negative day for debt in pesos, dollar-linked bonds marked a rise of 2.3%, Cohen said.

There are those who take the offer of this bonus as a sign from Caputo that he trusts in maintaining the “crawling peg” at 2% monthly, as he assured last Friday when he came out to deny versions of devaluation. The truth is that, if this occurs, those who subscribe to it will receive a greater benefit and the cost for the Treasury will increase.

Anyway, The offering of a linked dollar title goes against one of the IMF’s proposals, which was recorded in writing in its recent Staff Report. There, the organization made reference to the commitment of the Government of avoid placing indexed debt both the dollar and inflation and its replacement by fixed-rate securities, as it did in the last auctions.

“To reduce debt vulnerabilities and build the Treasury yield curve, efforts continue to shift toward fixed-rate instruments (away from inflation- and exchange-rate-indexed securities), elimination of costly central bank insurance (puts) and change from BCRA securities to Treasury securities,” stated the Fund’s report, published after the last review of compliance with macroeconomic goals.

In another chapter of the same story, in recent days, Caputo came out to deny (in addition to the acceleration of the rate of devaluation) the end of the so-called blend dollar, the differential exchange rate that exporters access by being able to liquidate 20% of its sales abroad through the cash market with settlement. The IMF, which wants these currencies to enter reserves and not be used to contain the price of the CCL, had insisted in the aforementioned report that the blend would end in the middle of the year.

As Ámbito pointed out, another of the counterpoints with the organization exceeded the limits that Washington posed to Javier Milei’s idea of advancing dollarization and the closure of the Central Bank. In the Staff Report he indicated that, in a future “currency competition” scheme, the dollar will not be legal tender and that the BCRA will maintain functions related to the issuance to purchase foreign currency, liquidity management and the safeguarding of the system. financial institution as lender of last resort.

For now, the market will closely follow the result of this Wednesday’s tender. In this regard, the SBS Group stated: “We believe that the key points will be whether it finally happens as in the previous tender, in which the short LECAP was declared void and only the minimum TEM was awarded, and how much demand (and rate) will finally have the new S13D4 (the LECAP in December).”