Goldman Sachs raised its projection of growth For the Argentina In 2025, from 4.5% to 4.7%driven by a economic performance Better to the expected in it first quarter of the year.

The US investment bank also highlighted the benefits of New exchange flotation regime and the Relaxation of capital controlsbut warned that the government should not focus solely on containing the inflation: It must also Take advantage of the context to accumulate International reserves.

Also read: official dollar today and dollar Blue: how much they quote this Tuesday, April 6 without stocks

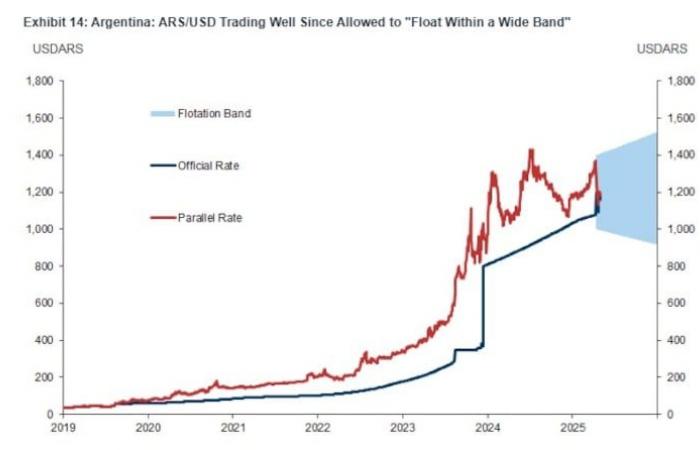

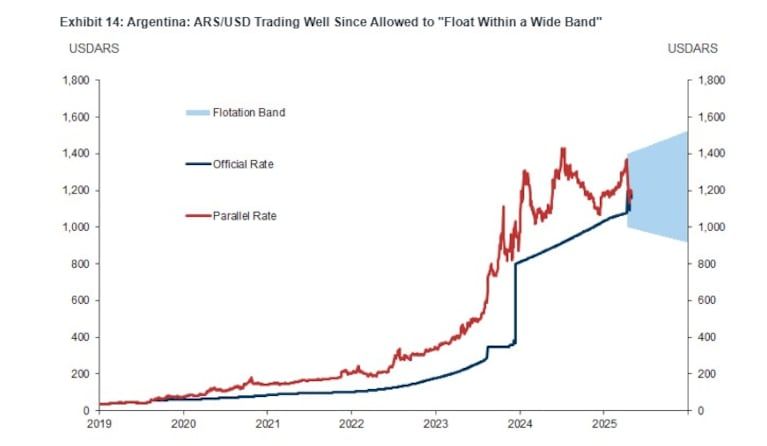

The Argentine economy 5.8% year -on -year grew in February and 0.8% monthly desestationalized, which led the Wall Street giant to review its forecasts. The report, in a report signed by the analyst Alberto Ramos, points out that the recent adoption of a floating exchange rate within a band (between 1000 and 1400 pesos per dollar) and the liberalization of access to the exchange market are contributing to sustainability of the macroeconomic adjustment program.

From the implementation of the new scheme, The official exchange rate depreciated around 8%while the parallel dollar It went from 1367 to 1220 pesos, which significantly reduced the exchange gap, suggesting a “Bounded impact” About inflation.

Goldman Sachs, one of the most important investment banks in the world. (Photo: Reuters)

However, Goldman Sachs warns that, although the government of Javier Milei It seems inclined to Let the weight touch the lower limit of the bandthe most convenient would be to use that margin to accumulate international reserveseven if the exchange rate is maintained within the established limits.

In that sense, the report recalls that the agreement signed with the International Monetary Fund (FMI) On April 11 it contemplates the accumulation of some US $ 8000 million in net reserves For the rest of the year, in addition to a Primary fiscal surplus of 1.3% of GDP (below the official goal of 1.6%).

-Also read: Milei meets with the cabinet in the middle of the collective strike and waiting for the money laundering measure

The new program with the IMF, which provides for a disbursement of US $ 15,000 million in 2025 Within an extended facilities scheme (EFF) for US $ 20,000 million, it was considered a key support for economic policy. The decision of the Banco Central to emit Bonds in dollars (Brepreal) to pay accumulated dividends before 2025, and the Liberalization of the official market For individuals and companies.

In it plano regionalthe report also addressed the impact of duty applied by the United States. The most Latin American countries —Inal Argentina, Brazil, Chile, Colombia, Ecuador, Peru and Uruguay – were reached only by the 10% base tariffwhile Venezuela faced 15%.

The evolution of the official and parallel dollars in the flotation band, in the latest Goldman Sachs report. (Credit: Goldman Sachs)

By him Low volume of exports to the United States as a percentage of GDP (Little more than 1% in Argentina2% in Brazil, and between 3% and 7% in Peru, Colombia, Chile and Ecuador), the Direct effect In the economies of the region It is anticipated limited.

In an external environment marked by the uncertainty and a commercial architecture under review, the Argentina’s performance stands out how One of the strongest in the region.

Also read: Luis Caputo gave details of the measure to deregulate the use of dollars

Together with Brazil —Beneficized by a record harvest— and Colombia —What reduced arrears in budgetary payments, “the country contributed to the Grupo La7 (the seven main countries in Latin America) will show a 0.8% growth in the first quarter of 2025reversing the weak expansion of 0.2% recorded in the fourth quarter of 2024.