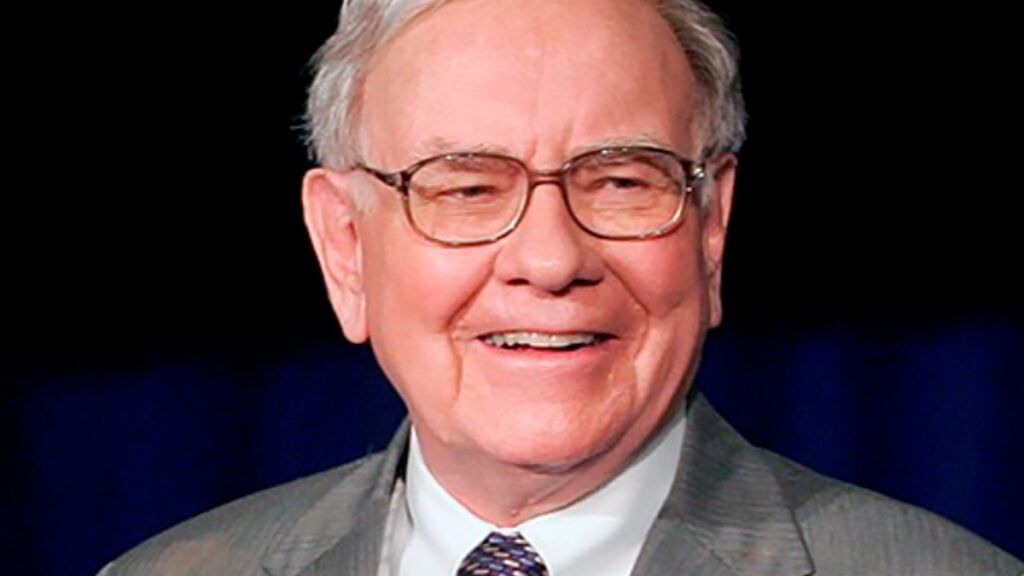

This Saturday the Berkshire Hathaway Shareholders’ Board, the financial conglomerate led by Warren Buffet, space in which announced his retirement as CEO from the firm at the end of this year.

“I think that The time has come when Greg (Abel, vice president) should become the executive director From the company at the end of the year, ”says Buffett.

According to the investor, will notify the 11 directors of the company at the board meeting. “At the subsequent meeting, which will be held within a few months, we will make a decision on the opinion of the 11 directors. I think they will unanimously agree.”

“That would mean that, at the end of the year, Greg would be Berkshire’s executive director. I would remain present and would be useful in some casesbut the last word would have Greg, ”said Buffet, quoted by Reuters.

Buffett said at the annual meeting that he celebrated his 60 years in command of Berkshire that he would not sell a single action.

“I would add this: The decision to conserve all actions is an economic decision because I believe that Berkshire’s prospects will be better Under Greg’s management that under mine, ”he said.

After the Shareholders Board, Buffet and Abel informed Becky Quick of CNBC that They would discuss on the Board of Directors what will be the formal position of Buffett, who is currently executive director and president of the conglomerate. So it is not clear if Abel will also assume the role of president.

Recommended: Warren Buffett ‘The Oracle of Omaha’ turned 94: this was the construction of a legendary fortune

Buffet postures on tariffs, protectionism and commercial war

during the Berkshire Shareholders Board, Buffet warned the dangers of protectionism and argued that trade should not be used as a political weapon and qualifying the “act of war” tariffswhich may have harmful consequences.

“I think he has had negative consequences. Simply for the attitudes he has generated. In the United States, I mean, we should seek trade with the rest of the world and we should do what we know best, And they should do what they know best about, ”said the American businessman at the shareholders meeting.

These comments are The most direct to date on tariffs and occurred after the White House imposed the levies on higher imports in generationswhich shocked the world last month and triggered extreme volatility on Wall Street, says CNBC.

Warren Buffet position against protectionism and volatility

Buffet also manifested Against insulation commercial policies, suggesting that alienating the global community could have serious consequences In the long term for the United States.

“In my opinion, It is a big mistake to have 7.5 billion people who do not appreciate you and 300 million who, in some way, boast of how good they have gone“, said. “I do not think it is correct or sensible,” collects investing.com.

In relation to market volatility, The CEO of Berkshire Hathaway fell from these movements and said that “what has happened in the last 30, 45 days really is nothing,” Taking into account that the last six decades Berkshire Hathaway shares have fallen 50 % three times.

“This has not been a dramatic bearish market or anything like that, ”said the investor known as the” Oracle of Omaha “at a time when investors wonder what the next thing will be for markets after the movements observed amid the concerns about tariff policy.

According to a CNBC publication, Buffett has been defensive, selling actions during 10 consecutive quarters. Berkshire got rid of shares worth more than US $ 134,000 million in 2024mainly due to the reduction of its two largest participations: Apple and Bank of America.

As a result of this sales wave, the Berkshire cash reserve reached a new record, of US $ 347,000 million at the end of March.