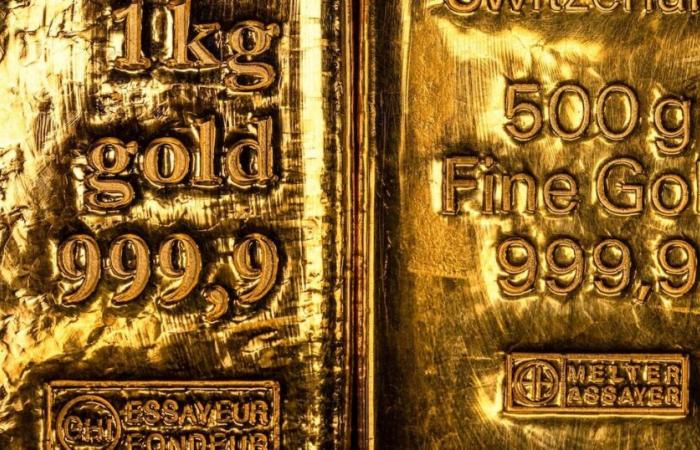

Bloomberg – This Friday, gold rises slightly as the dollar weakens, but still the precious metal is directed to its first consecutive weekly loss this year, since the attractiveness of refuge decreased before the signs of a thaw in the commercial war between the United States and China.

Gold rose 0.8%, while an indicator of the dollar fell 0.6%. A weaker dollar usually benefits gold, lowering it for those who buy other currencies.

See more: Trump shakes metals: gold rises and copper reflects disruptions

In the last two weeks, the attractiveness of precious metal as a refuge has faded slightly, since the appetite for the risk returned to Wall Street thanks to the solid profits of technological and economic data, which led the operators to moderate their bets on the cuts of interest rates in the US.

And most importantly, China has declared that it is evaluating the possibility of establishing trade negotiations with the US, The first signal since Donald Trump uploaded the tariffs last month that negotiations between both parties could begin.

On Thursday, a report showed that the manufacturing activity contracted in April at a slightly upward pace. The markets reduced their bets on the magnitude of the monetary flexibility trajectory of the Federal Reserve this year, with the first reduction of a quarter of a percentage point already discounted in July. Both the increase in rates and yields tend to ballast interest without interest.

See more: Bitcoin exceeds gold and technological actions in April during tariff chaos

Despite this week’s strong fall, gold has risen approximately 25% this year And it reached a record of more than US $ 3,500 last week, before losing ground before indications that the rebound had overheated. The rise is due to the fact that investors have taken refuge in this active refuge in the face of the growing fear that the unconventional policies of the White House can slow the world economy.

The speculative demand in China and the purchases of the central banks have also supported the profits.

The operators will analyze on Friday the US Employment Report, the last significant fact this week.

The gold in cash rose to $ 3,263.45 at 10:42 h in London and has dropped 1.7 % this week. The index Bloomberg Dollar Spot 0.6 %fell. The platinum and the paladium remained stable, while the silver climbed.

Read more at Bloomberg.com