The price of the dollar in Colombia continues to generate great uncertainty. This, because it remains above the $ 4,000 and in April it was impacted, mainly, by the commercial war that began the president of the United States, Donald Trump, with the imposition of tariffs on their main commercial partners and, then, negotiation with them.

Thus, the North American Divine closed the fourth month of 2025 on average of $ 4,222.30, which meant an increase of $ 23.47 compared to the representative rate of the market (TRM), which was located at $ 4,198.83. While on May 2, the first day of negotiations, after May 1 was holiday, closed an average of $ 4,243.42, which meant a rise of $ 21.17 in front of the TRM, which was located at $ 4,222.25.

Now you can follow us in Facebook and in our WhatsApp Channel.

Now, about what could happen in May, the month in which Mother’s Day (May 11) is celebrated and many Colombians buy gifts through the Internet in other countries, The monthly exchange market report of the Directorate of Economic, Sector and Bancolombia Markets leaves bittersweet sensations and there could be discouraging news.

The entity said that, during April, the Colombian peso registered a depreciation of 1.1% monthly, despite the weakening of the dollar globally and in line with the fall in the price of oil and the increase in risk premium.

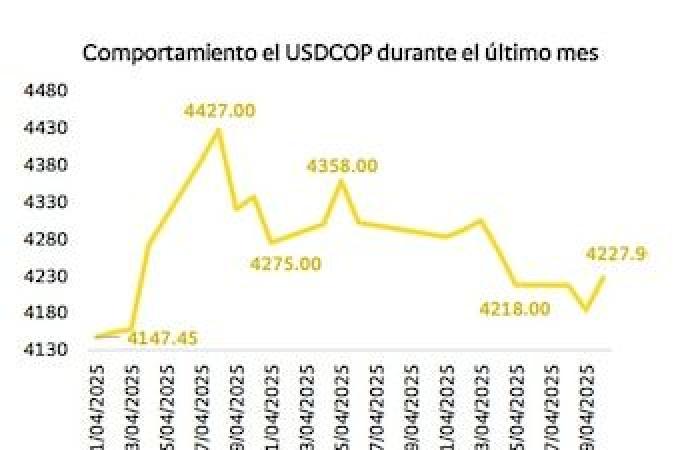

Similarly, he indicated that during the month, the average of the dollar against Colombian peso ranged between $ 4,105.0 and $ 4,479.5, and ended at $ 4,227.9 ($ 46.6 above the closure of March), with high volatility days due to tariff turbulence, the sell-off (mass sale) of financial assets and uncertainty about the course that will take the commercial war between China and the United States.

Also, what Intradía volatility averaged $ 119 in the second week of April. Meanwhile, during Holy Week the transactions were significantly reduced.

Taking this into account, the entity noted that “We foresee that the USDCOP will average $ 4,275 in the second quarter of 2025, before a dollar that, although depreciated in the last month, remains strong globally.” According to the same, “this would be a result of slow monetary flexibility by the Federal Reserve, amid inflationary pressures from the demand and by the entry into force of multiple tariffs.”

On what can happen, in what has to do with his vision he pointed out the following:

- The risk premium will remain high and tariff uncertainty could generate volatility in the exchange rate in the coming months, especially in July, when the 90 -day pause of the reciprocal tariffs would end.

- The local fiscal situation will continue to generate pressure depreciation. The International Monetary Fund (IMF) suspended the country’s access to the flexible credit line in the absence of a specific fiscal plan.

- Bmpharity risks associated with the payment of taxes of large taxpayers persist in June.

There is no doubt that the commercial war will impact Colombia. That also referred the main economist of Scotiabank Colpatria, Jackeline Piraján. The expert stressed that The country has a high commercial exposure with the United States, its main partner, which represents 27% of its exports.

He recalled that, from this figure, 39% corresponds to oil and gas, products that for now remain exempt from tariff measures, which reduces the direct negative impact.

However, he warned that a slowdown in the United States economy and global level could affect local economic recovery, which has been slow but sustained. In addition, that “the fall in oil prices raises fiscal challenges before the reduction of tax revenues in the sector.” On the other hand, he emphasized that “Colombia could be favored if competitors such as China and Vietnam face greater barriers in key markets such as coffee and textiles.”

Taking these facts into account, from Scotiabank Colpatria, they foresee that The dollar in Colombia in 2025 will remain at an average of $ 4,367, while they hope that by 2025 this is located near the $ 4,364.