Published in: April 27, 2024

- The value of WIF has fallen by more than 10% in the last 24 hours

- The performance of the derivatives market highlighted the presence of important bearish sentiments

The price of the memecoin based on Solana dog hat [WIF] has fallen double digits in the last 24 hours alone. For the same reason, it is now one of the market’s top losers during the aforementioned period, according to CoinMarketCap’s data.

At the time of writing, the altcoin was valued at $2.69, having lost 12% of its value in 24 hours. During the same period, daily trading volume also decreased by 38%.

WIF traders begin to lose bullish conviction

An assessment of WIF market activity revealed an increase in negative sentiments in recent days. In fact, at the time of this publication, memecoin’s weighted sentiment was -0.546, according to sentiment. The negative value of this metric highlighted that bearish sentiment outweighed bullish sentiments among WIF market participants.

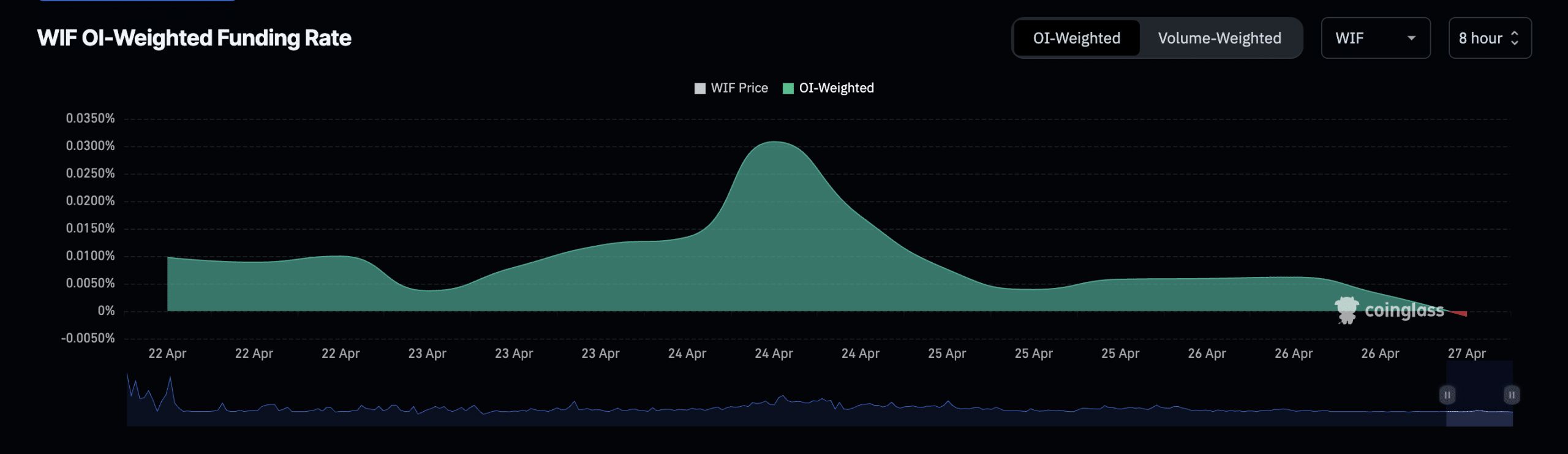

Confirming the bearish trend, the WIF funding rate was also negative. According Coinglass’ According to data, the token funding rate on cryptocurrency exchanges was -0.0009%. This is significant because it is the second time the token’s funding rate will be negative since February 8.

Funding rates are a mechanism used in perpetual futures contracts to ensure that the contract price remains close to the spot price.

The funding rate value of an asset is positive when its contract price is higher than its spot price, and traders who hold long positions pay a fee to traders who short the asset.

Is your wallet green? Check dogwifhat Earnings Calculator

Instead, it returns a negative value when its contract price is lower than the spot price and short traders pay a fee to long traders.

When the funding rate on an asset is so negative, more traders hold short positions. This means that there are more traders waiting for the price of the asset to fall than traders buying the asset with the expectation of selling it at a higher price.

Source: Coinglass

In addition to a negative funding rate, WIF futures open interest has also been steadily declining since April 9. Valued at $302.45 million at press time, it has since fallen 41%.

Thanks to the constant decline in WIF prices, its long traders have suffered more liquidations than those with short positions over the past week. In fact, as of April 26, long liquidations amounted to $1.7 million, while the amount of forcibly closed short positions was “only” $1 million.

Next: XRP – SEC Case Update: Is there good news for Ripple after FBI crypto tip?

This is an automatic translation of our English version.

Next: XRP – SEC Case Update: Is there good news for Ripple after FBI crypto tip?