Credit establishments closed April with lower profits. According to Superfinanciera figures, for April the Credit Establishments reported profits of $2.5 trillion, an amount lower than that recorded in April 2023, a period in which these amounted to $4.3 trillion.

By type of entity, Bank profits reached $2.5 trillion, financial corporations $173.7 billion, Financing companies recorded losses of $129.3 billion and financial cooperatives $2.9 billion.

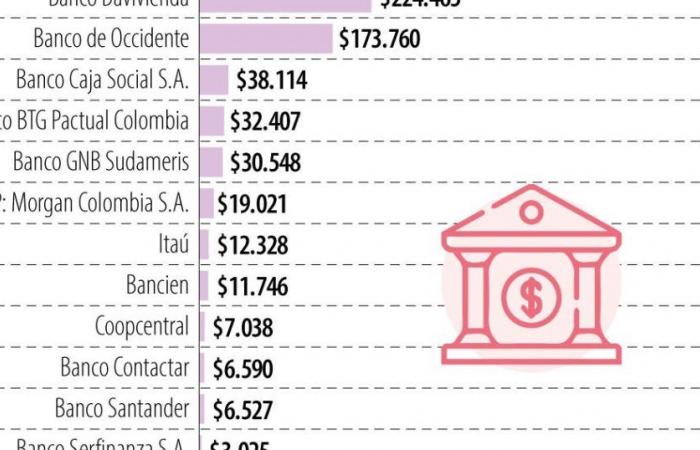

In the case of banks, the highest profits were those of Bancolombia, with $1.8 billion; followed by Banco de Bogotá, with $419,806 million; Citibank, with $250,131 million; and Banco Davivienda, with $224,465 million.

On the contrary, the banks that reported losses in April were Bbva, with $186,689 million; Banco Popular with $131,618 million; Bancamía with $118,013 million; Banco Pichincha, with $91,352 million; Scotiabank Colpatria, with $75,737 million; Lulo Bank, with $29,194 million; AV Villas, with $21,837 million; Mibanco, with $20,162 million; Banco Falabella, $18.6 billion; Bank W, with $14,421 million; and Bancoomeva with $4,353 million.

Alfredo Barragán, banking specialist at the University of Los Andes, explained that these results are due to a series of both national and international contexts. “Inflation, market volatility and political uncertainty can negatively impact banks’ finances, increasing risk and volatility,” he assured.