The defeat of Emmanuel Macron’s party in the legislative elections of the European Parliament generated a series of repercussions, not only at the political level, but in The French market, the performance of the euro and the main stock markets in Europe also felt the impact of the elections.

The financial sector has been the most affected in the context of a possible “financial crisis” alleged by the French Finance Minister, Bruno Le Maire.

The victory of the far-right led to the executive’s announcement of the dissolution of the Constituent Assembly and the call to the polls for early elections in French territory. However, this call created a “turmoil” in the French markets and the performance of the French currency against the dollar. As background, the rating agency S&P Global Ratings reduced France’s credit rating to AA- in view of the high level of debt that the country carries.

Faced with a possible victory of the far-right in France, the chief economist for Europe at Capital Economics, Andrew Kenningham He stated that it could increase uncertainty among investors. “In 2022, Marine Le Pen proposed reducing VAT on energy, eliminating income tax for those under 30 and lowering the retirement age to 60 for many employees. In a country with a high fiscal deficit, the arrival of the power of that policy would increase the risks,” she assured.

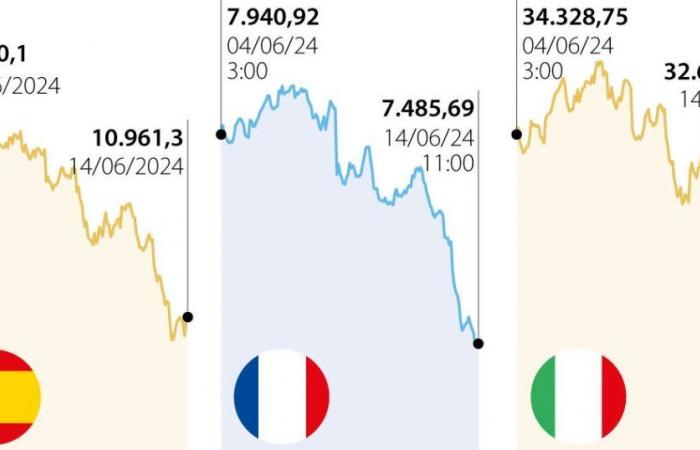

The decision to call early elections caused a loss in government bonds. The CAC 40 stock index had one of the most representative falls in the European stock markets, reaching 6.2% according to Bloomberg (2.66% only on Friday), thus giving up the accumulated gains of the year and representing the largest drop in the index since March 2022.

The drop in the value of the bonds meant a liquidation of US$210,000 million; Large holders of government debt such as Société Générale, BNP Paribas and Crédit Agricole each lost 10% on the stock market.

Following this line, the euro has been another of those affected by the loss of performance against the dollar. Since Monday, The currency has fallen from US$1.07 per euro to US$1.067 on Friday, the biggest drop in the currency in two months.

On the other hand, The weakness of the currency has contributed to the appreciation of the dollar. The dollar index, which compares the US currency to a basket of six peers, rose 0.3% on the day and 0.6% on the week, to 105.57. The dollar’s weight against other currencies also strengthened during the week in emerging markets. In Colombia, for example, it surpassed the barrier of $4,000 per dollar, a fact that had not been seen since the last quarter of last year.

Fall of European stock markets

The greatest risk due to the loss of performance in the French stock market is that other markets in the region become infected with the bearish trend and cause a greater drop in the main indicators.

According to Bloomberg, before Friday’s close, Europe’s seven main stock markets were already reporting falls close to 1.5% on average, France’s CAC 40 being the one with the steepest loss at 2.66%.

The Spanish Ibex index reported a fall of 0.67%, representing the largest loss of the index since March of last year. In the Iberian Peninsula, the sector most affected by the uncertainty in the stock markets of the ‘Old Continent’ was the real estate sector with a fall of 1.65%, with Merlin Properties being the company most affected with a loss of 1.3%.

In second place, the materials sector (steel and iron) suffered a loss of 1.22%. Arcerol Mittal and Acerinox had the steepest losses at 1.71% and 0.46% respectively.

Financial sector crisis

The Eurostoxx index, which groups together the performance of the continent’s 50 main stocks, shows the effects generated by the political-economic imbalance unleashed in France. As the minister announced, The European financial sector has been the hardest hit by the reaction to the executive’s announcements in France.

Unicredit, an Italian bank, is the commercial banking institution with the most significant loss due to a 5.55% drop on Friday. After this, France’s BNP Paribas fell 2.65%, Intesa San Paolo fell 2.49% and ING lost 1.47%. The Bbva bank, which continues with its takeover bid for the Sabadell bank, fell 1.05% in the Eurostoxx index.

From the insurance division, institutions such as France’s Axa and Germany’s Allianz also lost performance, falling 4.91% and 1.13% respectively.