Analyst Dann Trader is optimistic about the price of bitcoin and thinks it has just seen half of the bullish cycle.

The movements of retail investors have become a crucial factor in predicting the peak of a bitcoin bull market, even more relevant than what “whales” do, says a report by the aforementioned specialist shared by the on-chain data firm CryptoQuant. Investors who have more than 1,000 bitcoin are those who are called “whales.”

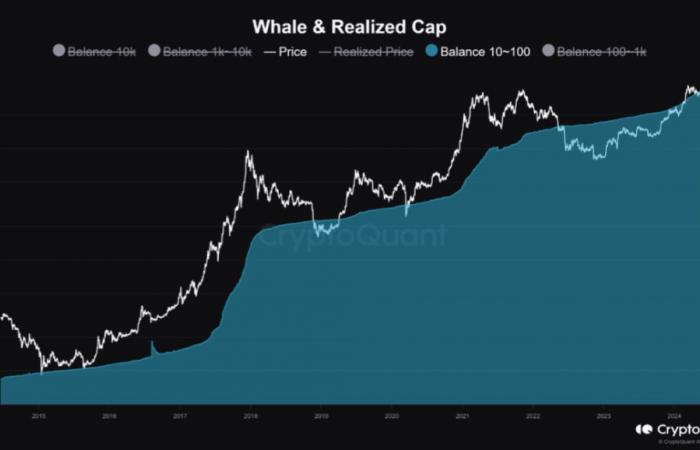

The analyst indicates that bitcoin has experienced an increase in the arrival of funds from small investors or retailers. In the following graph a gradual rise is observed at the beginning of the bullish cycleat the beginning of 2024, followed by a sharp rally until the end, and finally the culmination of the cycle after the strong rise of bitcoin.

This behavior coincided with the all-time high of USD 73,700 reached by bitcoin three months ago.

Despite the current drop in the price of BTC, 2024 has seen a rapid increase in the arrival of small investors.

Since the second half of the bull market has only just begun, the analyst suggests the possibility of additional capital flow and a sharp increase in the price of bitcoin in the near future.

Whales also join the trend

However, “whales” are also entering bitcoin. In fact, the number of entities with more than 1,000 BTC is seeking a new all-time high. This indicates that institutional investors are buying bitcoin.

Market analyst Willy Woo agrees with this perspective and considers that this represents a bullish signal for the price of the digital currency.

Woo explains that in previous cycles, the FOMO (fear of being left out) phase of the bull market begins when whales start selling on the price rally, something that has not happened. “When they sell, they stop being ‘whales’.”

CriptoNoticias confirmed that the behavior of whales is changing. The monthly share of bitcoin purchased by this group rose to its highest level in two months in early June. This “indicates that current prices are suitable for buying and accumulating.”

As there are greater purchases of whales They will continue to push upwards. Therefore, despite the circumstantial correction that bitcoin has experienced in recent days, medium and long-term expectations remain largely bullish.