Bloomberg — Faced with calls around the world in recent years to diversify away from the dollar, the United States has captured almost a third of all the investment that has flowed across borders since the arrival of Covid.

An analysis of the International Monetary Fund sent by request to BloombergNews shows that the share of global flows has increased – not decreased – since the dollar shortage in 2020 scared global investors and the freeze of Russian assets in 2022 fueled doubts about respect for the free movement of capital. According to the IMF, the average proportion before the pandemic in the US was only 18%.

See more: Mergers and acquisitions remain slow in LatAm, but these sectors can change the trend

Despite the angst over the hegemony of the dollar, the rise of interest rates in the US to the highest levels in decades proved to be a great attraction for foreign investors. The United States has also attracted a new wave of foreign direct investment (FDI) thanks to billions of dollars in incentives from the initiatives of the President Joe Biden to stimulate renewable energy and semiconductor production.

This trend marks a radical change from the pre-pandemic era, when capital was pouring into emerging markets, including a rapidly growing China. The US’s great geopolitical rival has seen its share of global gross receipts more than halve since the pandemic broke out.

But with Donald Trump promising to reverse key elements of Bidenomics If he wins the November election, and the Federal Reserve signaling that it will begin lowering interest rates later this year, the US advantages may not last.

See more: Kashkari: Fed well placed to take its time before cutting rates

Political perspectives

“FDI flows to China and portfolio flows to the US have changed radically since the years before the start of the pandemic,” said Stephen Jen, CEO of Eurizon SLJ Capital. “This new pattern of capital flows is only likely to change when policies in the US and China change.”

China’s share of gross cross-border capital flows rose to 3% over the 2021-2023 period, down from around 7% over the decade to 2019, according to IMF data.

These figures show why the president Xi Jinping and his lieutenants have long been fighting to revive foreign investor interest in the country. Xi is also preparing for a conference of Chinese communist leaders at which new reform measures are expected, which could change investors’ narratives about China.

Still, April data showed foreign investment in China slowed for the fourth straight month. And, with interest rates around the lowest levels in the modern era, Chinese domestic capital is pouring out, with local companies buying the most foreign currency since 2016 in April.

Inbound investment in China falls again | FDI falls for the fourth consecutive month in April, after last year’s 8% decline(China’s Ministry of Commerce)

The American economic engine, by contrast, has attracted a growing share of global capital. On Tuesday, the World Bank raised its global growth forecast for 2024 thanks to the strong American expansion, which illustrates the global impact. IMF data shows that, on a net basis, the US received capital inflows worth 1.5% of GDP during the period 2021-23.

For emerging markets, which need more international capital to catch up with advanced economies, the situation is not ideal. The Washington-based IMF estimates that emerging countries have seen net capital outflows in recent years, for the second time since 2000. Last year, gross FDI in emerging markets represented just 1.5% of gross domestic product, the lowest level since the beginning of the century.

According to Jonathan Fortune, an economist at the Institute of International Finance, which tracks global capital, “the big boy in town has gotten all the attention.” “That has dried up some of the money flows to emerging markets.”

Flows to the “big boy” include projects supported by the Biden administration’s economic initiatives. An example: South Korea’s Samsung Electronics Co. will receive $6.4 billion in subsidies to increase chip production in Texas, as part of a broader initiative to invest a total of more than $44 billion.

There are many things that could change

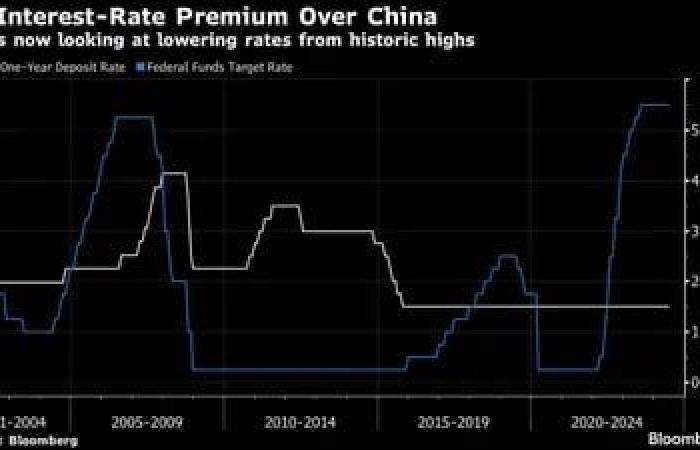

On Wednesday, Federal Reserve policymakers set expectations for a cycle of rate cuts by the end of the year. This could reduce the attractiveness of higher-yielding US assets for international fixed income investors.

US interest rate premium over China | The Fed is now considering lowering rates from historical highs(Bloomberg)

Meanwhile, a divisive presidential election looms in November that will increase political uncertainty, with taxes, tariffs and worsening geopolitical tensions topping the list of concerns.

Rising debt has also raised concerns that the United States is headed toward an inevitable fiscal cliff. This threatens some of the key reasons why the U.S. is attractive to investors, according to Alexis Crow, who leads PWC’s geopolitical investment practice, including the reputation of Treasury securities as a safe investment.

“What could undermine it? The rapid expansion of the fiscal deficit in the United States. “It is a rare moment of political cohesion between Republicans and Democrats in which the deficit does not matter,” she stated.

American politics

Above all is the deep political discord in the US, which is sowing deeper concerns about respect for election results, the rule of law and the role of government institutions, according to Grace Fan of TS Lombard.

“From an institutional point of view, the big question that arises is whether the rule of law, with the help of regulatory clarity, will prevail during the next presidential term, for both foreign and American investors,” he says. “This is critical to maintaining sufficient investor confidence in US assets at a time when the de-dollarization momentum is slowly gaining more traction.”

© 2024 Bloomberg LP