Bloomberg — Brazilian beef fat is finding its way into U.S. biofuels as U.S. processors look abroad for cheaper raw materials. Often overlooked, manganese is outshining other raw materials this year. And the world is awash with electric car batteries, a situation that threatens to undermine future demand.

Below are five notable charts to watch in global commodity markets as the week progresses.

See more: Asian stock markets down due to deterioration in global confidence

Copper

The price of copper, which has given some ground after reaching all-time highs in May, is in a tug-of-war between supply difficulties and signs of weakness in short-term demand. The deterioration in the production of the main supplier, Codelco, is favoring the industrial metal.

The Chilean state-owned giant posted its worst production month in almost 18 years in April following a series of setbacks at mines and projects, despite management saying production is bottoming out.

Codelco registers the month of lowest production in almost 18 years | The world’s main copper supplier, affected by setbacks in mines and projects(Cochilco)

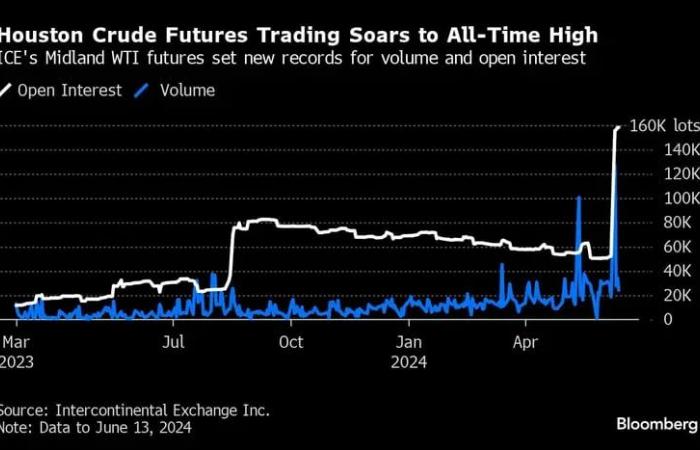

Petroleum

Booming U.S. crude exports are helping to break oil contracting records in Houston. The crude oil futures contract on the Intercontinental Exchange Inc. in Houston last week hit record highs in both daily trading volume and open interest as supplies of U.S. oil flooded European markets.

ICE’s Midland West Texas Intermediate futures contract – which is delivered in Houston – on June 10 saw daily volume nearly five times the May average, while open interest for the week was nearly three times the average. average of May.

Houston is quickly becoming one of the busiest oil trading centers in the US, as crude shipments out of the region soar.

Houston crude oil futures reach all-time highs | ICE WTI futures in Midland break new records for volume and open interest(Intercontinental Exchange Inc.)

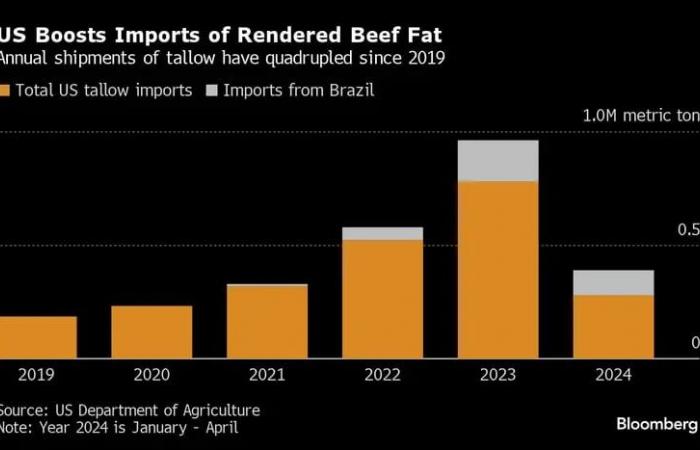

Biofuels

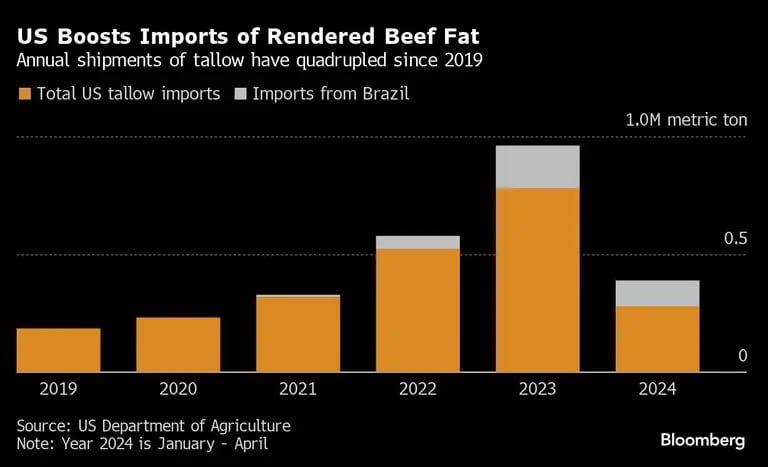

Brazil is benefiting from the biofuels boom in the United States, hurting American farmers by flooding the market with a little-known feedstock that can be used to make renewable fuels.

American purchases of Brazilian beef tallow – a form of residual fat – are soaring. Tallow, used in a variety of products from pet food to soap, is abundant in Brazil, which slaughters more cows than any other country outside China.

The US boosts imports of rendered beef fat | Annual tallow shipments have quadrupled since 2019(US Department of Agriculture)

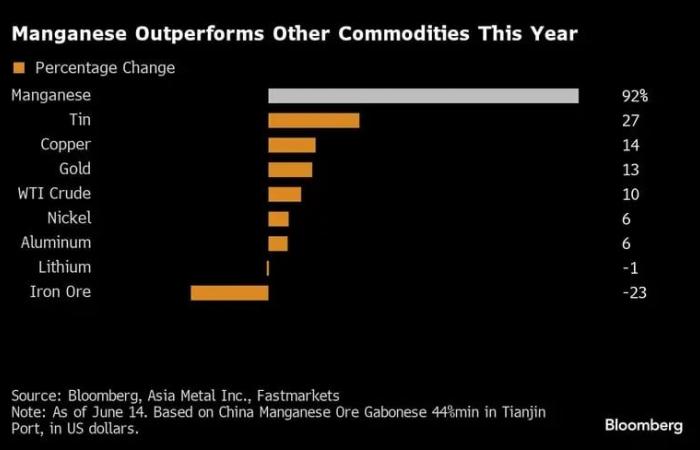

Manganese

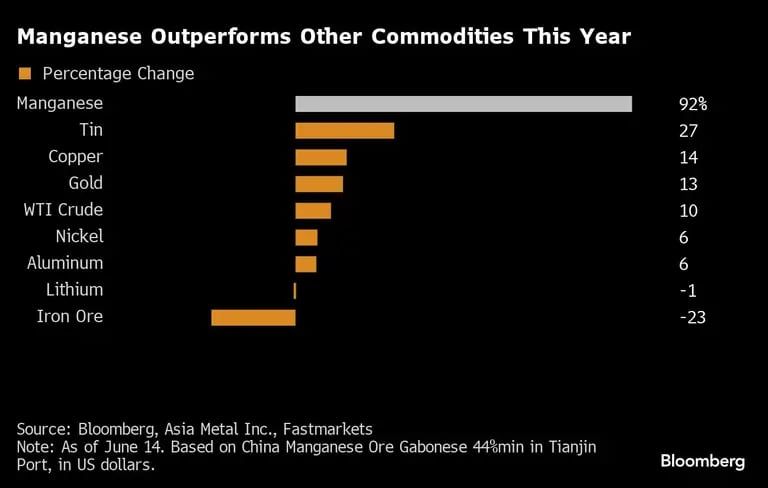

Manganese – an essential ingredient for steelmaking – is outperforming copper, gold and many other commodities this year following disruptions at a key Australian mine. Prices for 44% grade manganese ore have almost doubled since the start of the year, and this month hit the highest level since 2018.

Cyclone damage in March forced the world’s second-largest manganese mine to halt exports, with shipments from Groote Eylandt Mining Co. (GEMCO) suspended until 2025. Manganese helps strengthen steel and is also Used for aluminum alloys and electric vehicle batteries.

Manganese outperforms other commodities this year(Bloomberg, Asia Metal Inc., Fast)

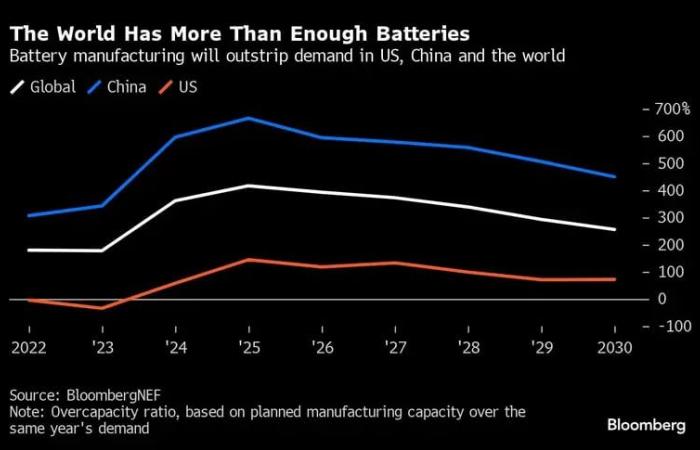

Batteries

The switch to electric cars will require a lot of batteries. But so many manufacturers have announced plans to build new battery plants around the world that capacity is likely to outstrip demand for the rest of the decade, BloombergNEF warns in its latest Electric Vehicle Outlook report.

The oversupply is most acute in China, where manufacturing capacity will exceed annual battery demand by at least 400% for the rest of the decade. It’s also an issue in the US, where President Joe Biden has made creating a national battery supply chain one of his top climate and economic goals.

The world has more than enough batteries | Battery manufacturing will exceed demand in the US, China and the world(BloombergNEF)

© 2024 Bloomberg LP