U.S. stocks closed mixed on Friday, hitting their fifth consecutive all-time high at the close, as investors continued to assess when the Federal Reserve might begin cutting interest rates.

For the week as a whole, the tech-heavy Nasdaq was up 3.2% and the benchmark index was up 1.6%, while the benchmark index was down 0.5%.

Source: Investing.com

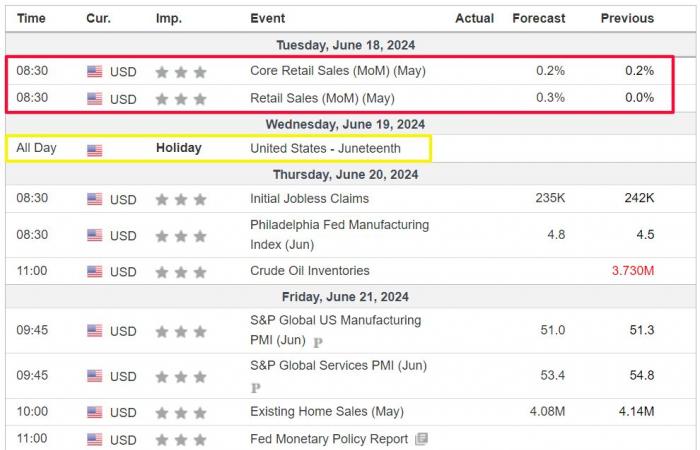

Next week — with U.S. stock markets closed on Wednesday to mark Liberation Day — looks set to be another busy week, with investors weighing how much steam is left in the rally. Wall Street inspired by artificial intelligence and when the Federal Reserve will decide to cut interest rates.

Top of the economic agenda will be the US retail sales report for May, which is expected to show a small increase for the month as a whole.

Source: Investing.com

In addition, the Fed will have a large group of spokespersons, such as district governors Lisa Cook, Thomas Barkin and Adriana Kugler. According to Investing.com, traders now believe there is a 70% chance that the first rate cut will occur in September.

Meanwhile, some of the top earnings reports to pay close attention to include Lennar (NYSE:), KB Home (NYSE:), Darden Restaurants and Kroger (NYSE:).

Regardless of the direction the market takes, below I highlight some stocks that are likely to spark strong demand and others that could suffer further declines. Remember, however, that my time frame covers only this week, from Monday, June 17 to Friday, June 21.

Stocks to buy: Hewlett Packard Enterprise

I think Hewlett Packard Enterprise (NYSE:) stock will outperform this week as the edge-cloud computing company holds its long-awaited “HPE Discover” summit, where it’s likely to showcase its latest advancements in computing applications. frontier and artificial intelligence.

The four-day conference, titled “Discover What’s Next (LON:),” will begin Monday at the Venetian Convention and Expo Center in Las Vegas.

Most of the attention will be focused on CEO Antonio Neri’s keynote speech on Tuesday at 6:00 p.m. (CET). He will be joined on stage by Jensen Huang, CEO of Nvidia (NASDAQ:).

According to the description, Neri and Huang will showcase cutting-edge strategies and provide valuable insights into emerging trends and innovations across edge computing and networking, hybrid cloud, and artificial intelligence.

Additionally, other key members of HPE’s leadership team, including Chief Technology Officer Fidelma Russo, are expected to share the latest announcements, partnerships and innovations from the company and from customers around the world.

Hewlett Packard Enterprise stock tends to rise during the week of its annual “Discover” event. The hardware, software and business consulting company has a history of attracting several analyst upgrades following its presentations at the summit.

Source: Investing.com

HPE shares closed Friday at $21.60, a new 52-week high and their highest level since February 2017. The Texas-based technology company is valued at $28.1 billion.

The stock has remained in a major uptrend since the start of the year, rising around 27% so far in 2024, thanks to growing enterprise demand for its AI-powered hybrid cloud and frontier computing solutions.

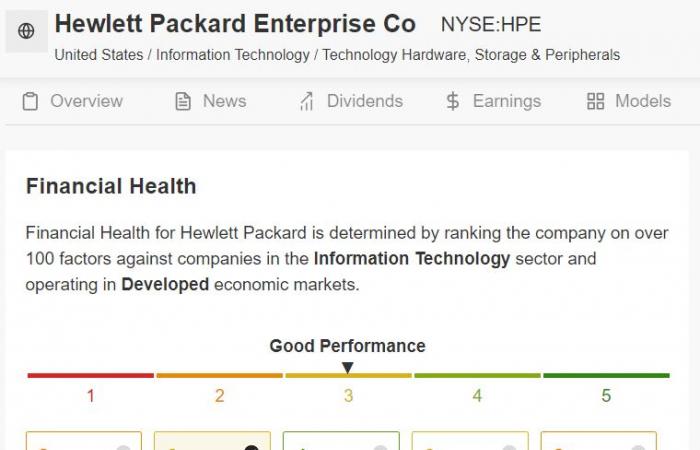

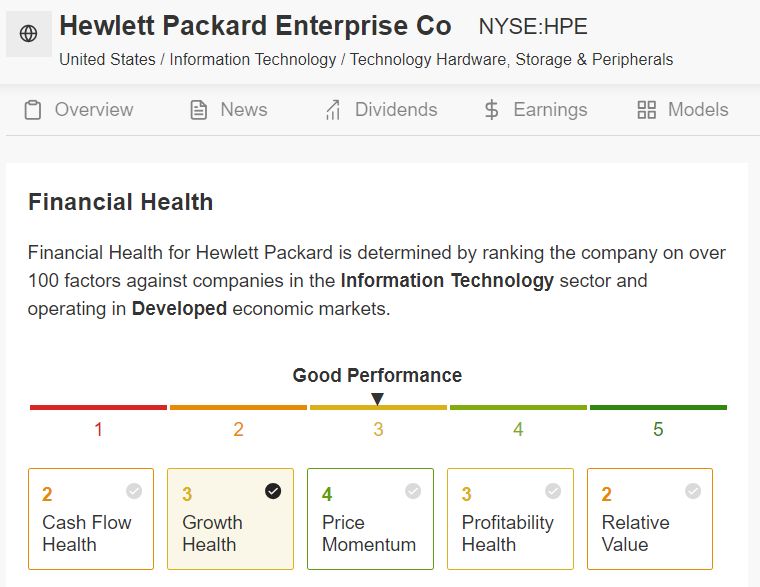

Source: InvestingPro

As ProTips notes, Hewlett Packard Enterprise boasts an above-average financial health score of 2.9 out of 5.0, supported by its solid profitability outlook and strong sales growth prospects.

Subscribe to InvestingPro now and put your portfolio one step ahead of others.

Stocks to sell: Kroger

I think Kroger is in for a tough week, as the supermarket giant’s latest results will likely reveal a sharp slowdown in both profit and sales growth due to the uncertain macroeconomic environment.

The Cincinnati, Ohio-based company will report its first quarter report before the US market opens on Thursday at 2:00 p.m. (CET), with results expected to be weighed down by rising operating costs. and fierce competition from retail giants like Costco (NASDAQ:), Walmart (NYSE:), and Amazon (NASDAQ:).

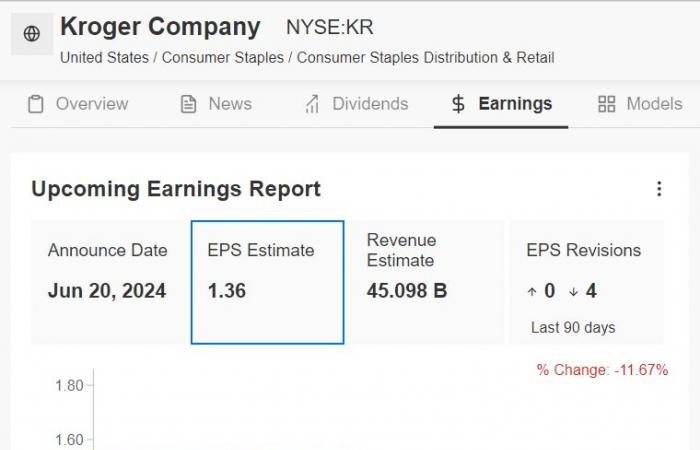

Unsurprisingly, an InvestingPro survey of analyst earnings revisions points to growing pessimism ahead of the release. All four analysts covering the company have cut their estimates over the past 90 days, as Wall Street becomes increasingly bearish on the supermarket chain.

Market participants expect a significant swing in Kroger stock following the release of the report, with a possible implied move of around 6% in either direction, according to the options market.

Source: InvestingPro

Everything indicates that Kroger, which has more than 2,700 stores in 35 states in the United States, will obtain an earnings per share of $1.36 in the first quarter, 9.9% below the earnings per share of 1.51. dollars from the same period last year, due to cost pressure and reduced operating margins.

For its part, revenue will decrease by 0.3% annually, to $45.09 billion, due to competition and lower consumer spending.

Looking ahead, I believe Kroger management will provide disappointing guidance for this quarter reflecting declining operating margins and slowing customer traffic in its stores in the current macroeconomic environment.

Kroger shares closed at $50.38 on Friday, their lowest level since March 6. At current valuations, Kroger’s market capitalization is $36.3 billion, making it the largest supermarket chain in the country.

Source: Investing.com

Shares have underperformed the market so far this year, rising 10.2% versus the S&P 500’s gain of about 14%.

Be sure to check out InvestingPro to stay on top of where the market is trending and what it means for your trading.

Readers of this article can enjoy a limited offer with an additional 40% discount on annual and bi-annual plans with coupon codes PROTIPS2024 (annual) and PROTIPS20242 (biannual).

Whether you are a novice investor or an experienced trader, taking advantage of InvestingPro can open up a world of investment opportunities while minimizing risks in the difficult environment of runaway inflation and high interest rates.

Subscribe here and get access to

- ProPicks: Winning stocks selected by AI with a proven track record.

- Market value: Find out instantly if a stock is undervalued or overvalued.

- ProTips: Simple information to simplify complex financial data.

- Advanced Stock Finder: Find the best stocks based on hundreds of filters and selected criteria.

- Featured ideas: Find out which stocks Warren Buffett, Michael Burry and George Soros are buying.

Disclaimer: As of this writing, I am long the S&P 500 and {{0|Nasdaq 100}, via the SPDR S&P 500 ETF (SPY) and the Invesco QQQ Trust ETF (QQQ).

I periodically rebalance my portfolio of individual securities and ETFs based on an ongoing assessment of risk of both the macroeconomic environment and company financials.

The views expressed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohen_Inv for more stock analysis and insights.