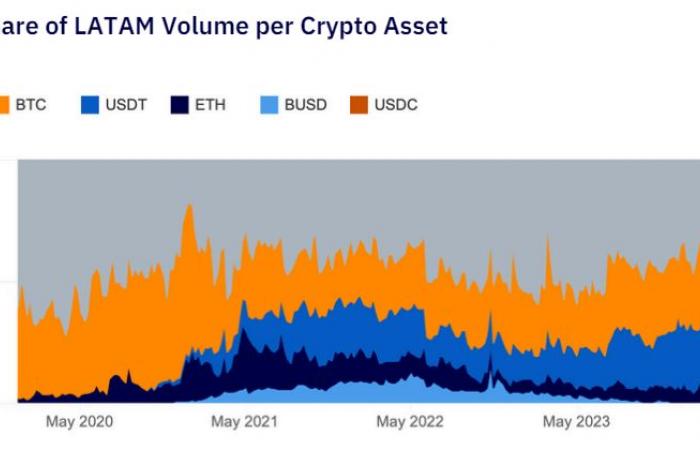

A lower interest in bitcoin (BTC) along with a boom in trading with stablecoins is a constant that characterizes the cryptocurrency market in Latin America. This is what analysts from the research company Kaiko observe, in a study published a few days ago.

According to the research data, focused on the figures shown by the regional market, so far in 2024 more than 40% of all cryptocurrency transactions involve the USDT stablecoin. The numbers place bitcoin in second place, followed – to a lesser extent – by ether (ETH).

This is an indicator that shows a decline in interest in the pioneering digital currency, after having reigned in first place in the region for several years. The study shows that the phenomenon began to gain strength from 2023.

Kaiko’s figures coincide with the data presented by the Bitso exchange at the beginning of the year, which also highlights the space that stable currencies have gained in Latin America.

An inflation-driven preference

Analysts Underline How Stablecoins Became in the most used crypto asset for commerce Latin American. A preference that – according to Kaiko – was seen for the first time at the beginning of 2021 and that they relate to inflation.

Inflation has historically been a major driver of cryptocurrency adoption in Latin America, which may explain merchant preferences for certain tokens and which now impacts the use of stablecoins.

Kaiko Report.

It is thus pointed out that the inflationary phenomenon, which previously promoted greater use of bitcoin, now directs the interest of merchants towards stablecoins, seeing them as a mechanism to alleviate the devaluation of their local currencies.

Data indicates that stablecoins pegged to the dollar are the favorites by Latin American operators to make transactions with fiat currencies. This, taking into account that trading with peers stablecoin-to-fiat represented 63% of trading volume in the last semester.

The data managed by analysts includes all volumes denominated in regional currencies, including the Mexican peso (MXN), the Colombian peso (COP), the Argentine peso (ARS) and the Brazilian real (BRL). They cite the Brazilian and Mexican currency as the most used for trading with stablecoins.

Based on the information collected, they also draw attention to the notorious process of bitcoin appreciation against local currencies of the countries in the region during 2024, reaching peak points in the conversion of some currencies and making their acquisition more expensive.

“BTC gained more than 100% against the Argentine peso (ARS) and more than 70% against the Brazilian real (BRL) between January and May, outperforming other fiat-denominated pairs in those months,” Kaiko notes.

The increase in the price of the digital currency has also been significant with respect to the Mexican peso, especially after recent political events derived from the election of Claudia Sheinbaum as the new president of the country. This is why many Mexicans put ripple (XRP) and USDT above BTC in pairs trading.

Despite this regional context, we are facing an appreciation of bitcoin that offers significant upside potential for the currency created by Satoshi Nakamoto (which reached a new all-time high in the last frame).

And although stablecoins are now the most popular assets in Latin exchanges, in Kaiko’s opinion “bitcoin continues to offer citizens in precarious situations an alternative as a refuge of value.”

Analysts highlight the significant improvement in global confidence in the digital currency, especially after the approval of ETFs in the United States. A fact that which is not foreign to Latin America.

Hence, the rise of BTC has also generated its revaluation with respect to the local currencies of Latin American countries. A factor that possibly influences in the rise of stablecoins in the region.