- An analyst identifies a bullish flag pattern that suggests Bitcoin could soon reverse its June downtrend.

- The MVRV ratio and the exchange stablecoin ratio provide key insights into Bitcoin market conditions.

Bitcoin [BTC]the flagship cryptocurrency, has shown signs of a possible reversal of its recent downtrend, sparking discussions among market analysts and investors alike.

After a challenging month that saw prices drop as low as $58,000 earlier this week, Bitcoin has staged a modest recovery and is trading at around $61,516, at the time of writing.

This recovery includes a brief rise above the $62,000 mark earlier today, signaling to some experts that a more significant breakout could be on the horizon.

Prominent market analyst Rekt Capital has gone so far as to suggest that the current bearish trend that characterized June could soon be coming to an end, fueled by emerging patterns in Bitcoin’s daily trading data.

Emergence of the Bitcoin bull flag

Capital Rekt pointed to the formation of what appears to be an early-stage Bull-Flag pattern on the daily price charts. This pattern, if fully realized, could signal that Bitcoin is preparing to challenge and potentially break out of the downtrend it has been experiencing.

Traders closely monitor these technical formations for signs that current price action could translate into a major move higher.

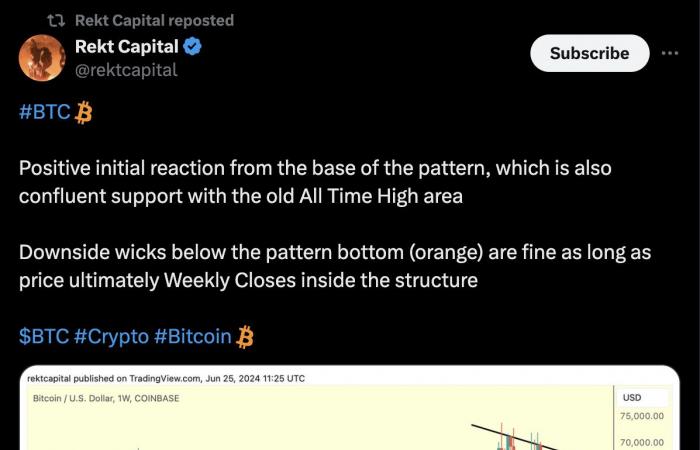

Rekt Capital noted:

“Let’s see if this current price action on the Daily continues to form this small early-stage bull flag.”

Furthermore, Rekt Capital has recently revealed that the recent pullback in Bitcoin price is approaching the common 22% correction seen across several market cycles. This adjustment is initially receiving positive responses that correlate with the support levels previously seen at all-time highs.

Rekt Capital emphasizes the importance of Bitcoin price closing above the lower boundary of the pattern on weekly charts to maintain this critical support level, although brief dips below it are considered tolerable.

Source: RektCapital

Are there signs of a bullish breakout?

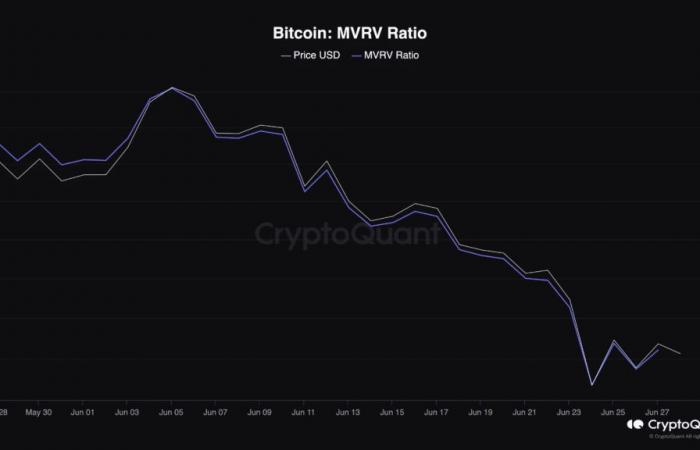

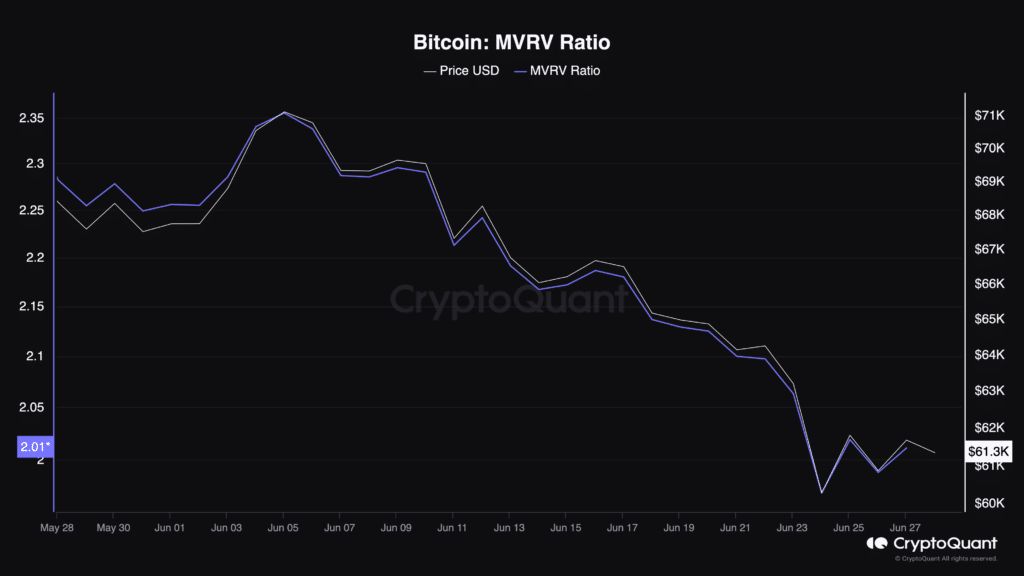

Despite Rekt Capital’s bullish technical analysis, it is crucial to consider the leading Bitcoin market indicators to understand if the cryptocurrency is truly primed for a bullish breakout. One such indicator is the MVRV ratio, which currently stands at 2.01.

The market value to realized value (MVRV) ratio compares Bitcoin’s market capitalization to its realized capitalization, providing insight into whether the asset is undervalued or overvalued compared to its historical price norms.

A ratio above 2.0 typically suggests that Bitcoin is in a zone where selling pressure could begin, as holders might start to see the profits attractive enough to liquidate some of their holdings.

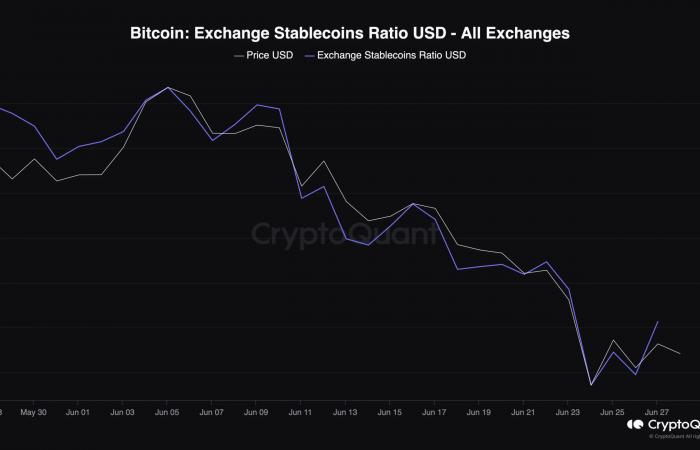

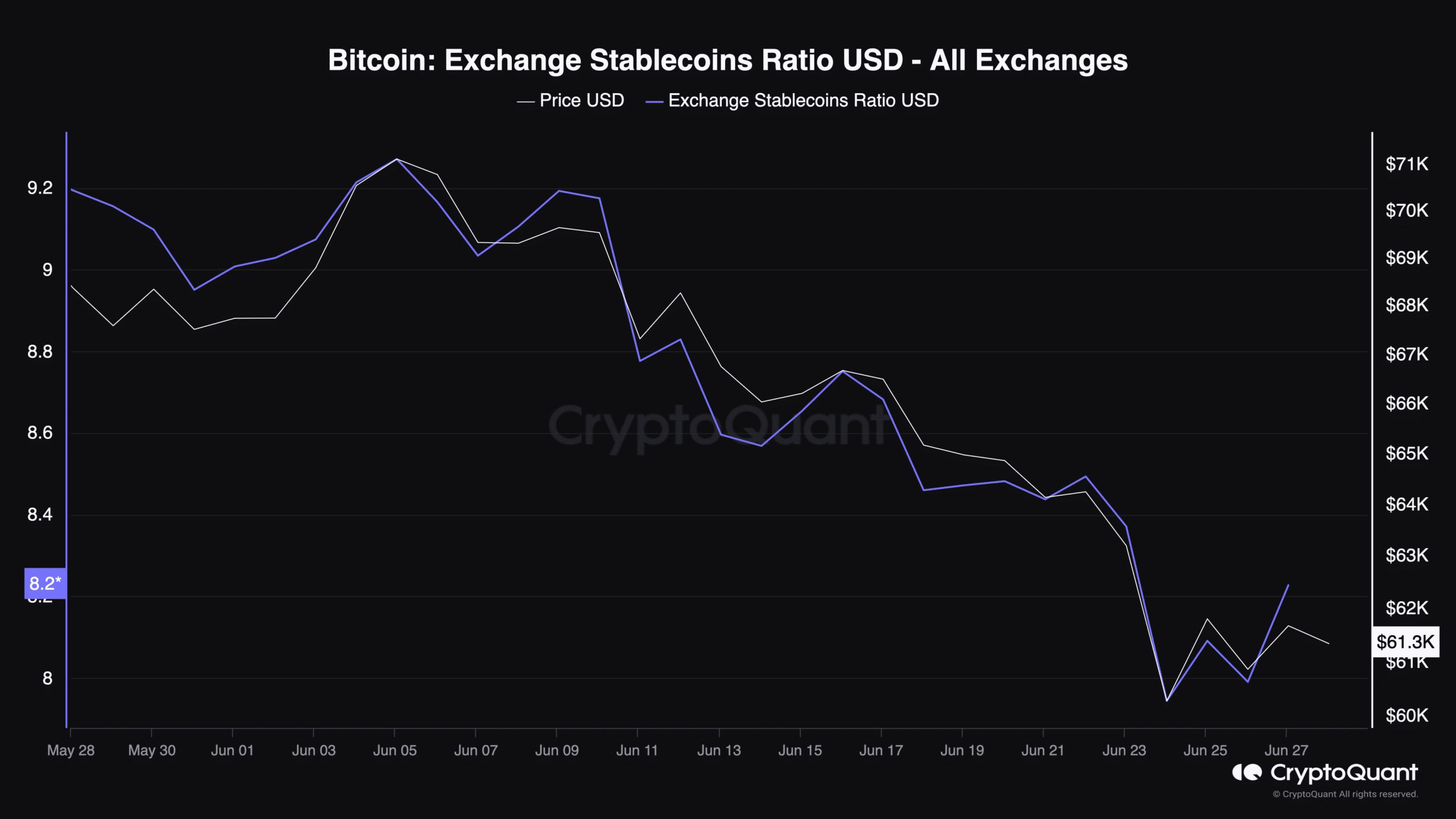

Additionally, the stablecoin exchange ratio has seen a spike of 2.33%, now at 8.22. This metric, which compares the total supply of stablecoins held on exchanges to Bitcoin reserves, can indicate whether there is potential purchasing power to push prices higher.

Read Bitcoins [BTC] Price prediction 2024-25

A higher ratio suggests that traders may be willing to convert stablecoins into Bitcoin, potentially boosting prices.

Source: CryptoQuant

However, the cryptocurrency market remains divided, with other prominent analysts such as Willy Woo signaling caution, noting that Bitcoin bears are still in control, as AMBCrypto recently reported.

Next: Neither Biden nor Trump talk crypto, but Bitcoin keeps rising: what’s going on?

This is an automatic translation of our English version.