In financial terms, a “put” is an option that gives the holder the right, but not the obligation, to sell an asset at a specific price within a specified period. In the context of the BCRA, “puts” can refer to financial mechanisms that ensure the value of the reserves or other assets of the Central Bank against significant losses due to exchange rate variability or for other reasons.

Today the reserves go this way:

alonso1.jpg

Description of the graph: Evolution of BCRA reserves from 2020 to May 2024.

Historical Data and Lessons from the Past:

Argentina has implemented the exchange rate several times, most recently in 2011 under the government of Cristina Fernández de Kirchner to stop the outflow of dollars. In 2015, Mauricio Macri lifted the restrictions to normalize the economy and attract investments.

Impacts of the Exit of the Stock in 2015:

- Positives: Greater inflow of foreign capital, stabilization of Central Bank reserves, improvement of confidence in the markets and promotion of exports.

- Negatives: Devaluation of the peso, increase in inflation, erosion of real income and economic volatility due to lack of reserves.

The current government is assessing, in my opinion, these factors to avoid repeating mistakes, underlining the need for confidence and sufficient reserves to release the stocks without generating inflation and uncertainty.

How does the exit from the exchange rate impact on investments?

We have already forgotten how to live without these restrictions, and it is good to clarify what would happen to investments and assets. The exit from the exchange rate has a notable impact on investments in the capital market. The removal of currency restrictions can have profound effects on investor confidence and market activity. Next, I am going to describe what I think are the main ones:

– Greater Liquidity and Trading Volume: The elimination of the stocks allows greater entry and exit of capital, which increases the liquidity of the Argentine capital market. A more liquid market improves the conditions for trading stocks, bonds and other financial instruments, which can attract both domestic and international investors.

– Increased Investor Confidence: The existence of an exchange rate reflects structural problems in the economy and generates uncertainty among investors. Removing these restrictions sends a signal of stability and confidence, which can lead to an increase in investment in both the equity and fixed income markets. After the lifting of the stocks in 2015, an increase in investments in Argentine stocks and bonds was observed, driven by the perception of a more predictable macroeconomic environment.

– Attraction of Foreign Investments: A capital market without exchange restrictions is more attractive to international investors, who seek open and transparent markets. The elimination of the stocks can facilitate the inclusion of Argentina in global equity and fixed income indices, such as the MSCI Emerging Markets Index, increasing the flow of foreign capital and diversifying the investor base in the country.

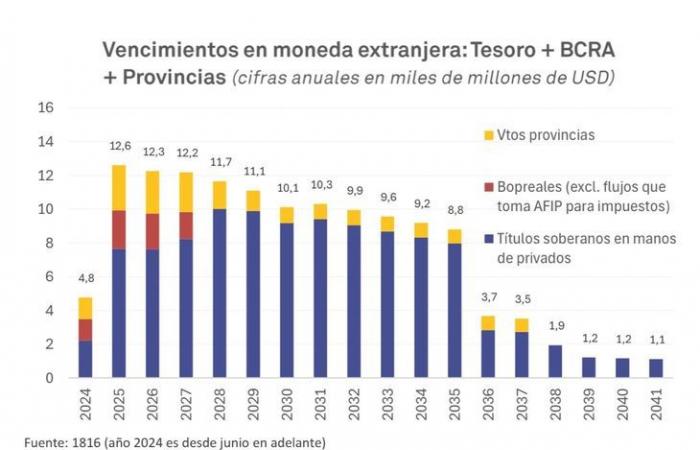

– Decrease in the Risk Premium: With the exit of the stocks and the stabilization of the exchange rate, the country risk premium could be reduced, reflecting a lower perception of risk among investors. This can translate into lower financing costs for the State and companies, encouraging the development of projects and economic growth and allowing the government to issue and decompress 2025 maturities.

alonso2.jpg

Description: This graph from the consulting firm 1816 describes the maturities of the National Treasury, BCRA and the provinces until 2041.

– Volatility and Initial Adjustments: Although the exit from the stocks has positive effects in the long term, in the short term it can generate volatility in the capital market due to adjustments in the exchange rate and rebalancing of portfolios. Investors may adopt cautious stances initially, assessing the impact of currency liberalization and new macroeconomic conditions.

When analyzing this background, it is evident that the elimination of the stocks must be managed gradually and accompanied by coherent and sustainable economic policies over time.

Impact of the exit of the stocks on the economy:

- Stimulation of Foreign Investment:The elimination of the stocks would attract foreign capital, boosting key sectors such as infrastructure, technology and energy.

- Export Promotion:A more competitive exchange rate would encourage exports, improving the trade balance.

- Reduction of the Parallel Market: The need for the parallel foreign exchange market (“blue dollar”) would be reduced.

- Improved Credibility and Economic Stability:Lifting the stocks would send positive signals about a more open and stable economic policy, improving the global perception of the country.

- Dynamization of the Local Market:By facilitating access to foreign currency, the operation of companies would be optimized and the local economy would be stimulated.

- Promotion of Savings and Domestic Investment:A safer environment would be encouraged, promoting productive investments within the country.

Summarizing…

Getting out of the exchange rate trap is an essential measure to reactivate the Argentine economy. It would boost foreign investment, encourage exports, reduce the parallel market, and improve the country’s credibility and economic stability. At the same time, it would energize the local market and promote domestic savings and investment. Ultimately, eliminating exchange restrictions is a necessary step towards a more open, competitive and prosperous economy. The lessons of the past reinforce the importance of a gradual and well-planned implementation, accompanied by policies that protect the economy and the population in the transition process, once the government resolves the issue of puts and reserves we can see this light at the end of the tunnel.