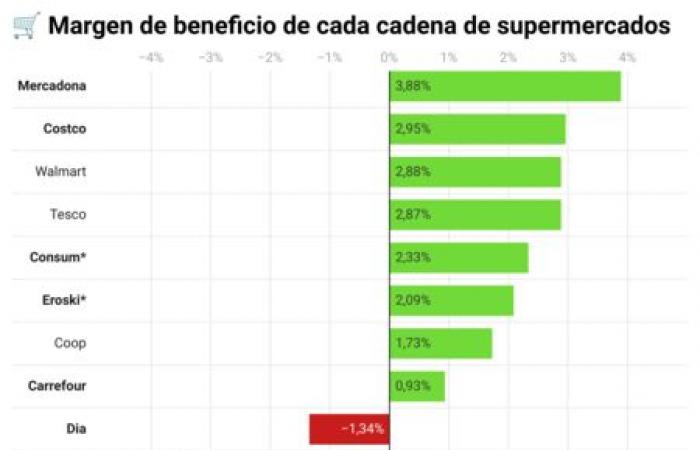

Mercadona has achieved something that seemed impossible in the saturated food distribution sector: A net margin of 3.88% in 2024. Well above not only Spanish or European rivals, but even world giants such as Costco (2.95%), Walmart (2.88%) or Tesco (2.87%).

The figure, a trifle compared to other sectors, is stratospheric if we compare it with rivals such as Carrefour, with just 0.93%. Others, such as Dia, Casino or Auchan directly record losses.

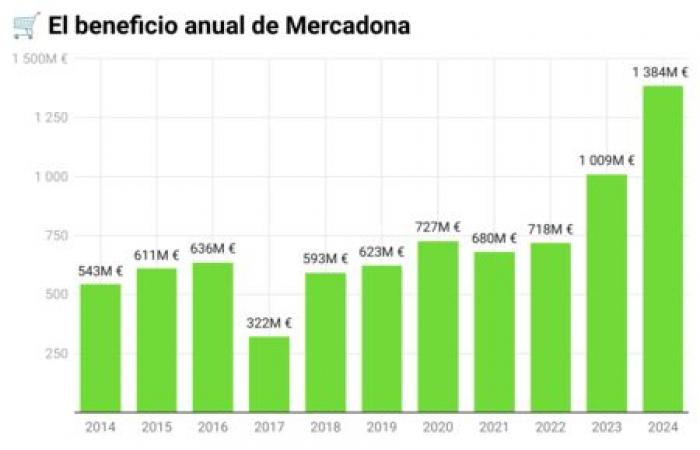

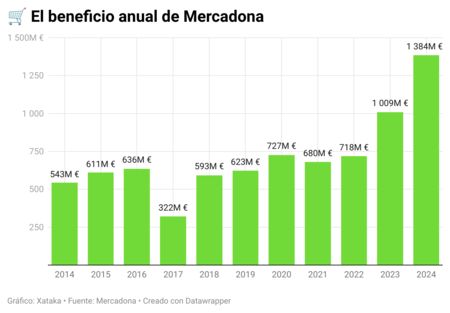

The supermarket business historically operates with HEAD MARGINS (1-2%) compensated for its high volume and cash flow. Mercadona, touching 4%, is an anomaly. And he has achieved it mainly in the last five years, in which it has gone from 2.7% of 2019 to 3.88% of 2024.

In addition, its net benefit has shot 37%, to 1,384 million euros.

The 6 keys to unprecedented profitability

1) “Total efficiency” model. The figures obey a polished strategy for decades. Juan Roig described the results of 2024 as “from ‘very good’ to ‘spectacular’” during his presentation at the central offices in Paterna. He attributed them to “the good progress of the economy, a great business model and brave decision making,” according to Castellón Plaza.

One of Mercadona’s distinctive elements is its commitment to an “efficient assortment.” In other words: a short catalog. Other chains offer between 15,000 and 20,000 references, Mercadona has a rather lower number, prioritizing high -rotation products.

It is one of the points that highlights the analysis of Food Retaila strategy that “allows you to be more efficient, reach economies of scale and boost the quality of your own brand, all this while offering low prices.”

That goes in the next point …

2) The domain of the own brand. The weight of the distributor brand in Mercadona is overwhelming: its landowner brands, green or deliplus forest represent 58.2% of its sales, according to data from Actuality distribution About 2018. The chain then controlled approximately 44%of the total Spanish market of white brands, far ahead of competitors such as day (16%) or Lidl (11%).

This strategy eliminates marketing costs and intermediaries associated with commercial brands. And allows you to set competitive prices without sacrificing margin.

Mercadona has constantly invested in improving the quality of these products, developing them together with specialized suppliers to match or overcome the quality of leading brands.

3) A unique relationship with suppliers. The Valencian chain has changed the distributor-professional relationship since the late nineties, when Roig promoted the “interproved” model.

As it details Revista Info RetailMercadona “selected a manufacturer by category and granted long -term exclusivity to produce its brands”, working in “open book”: the chain knew the costs of the supplier and jointly set objectives of productivity improvement.

Although this model has evolved since 2018 to a broader base of 1,400 “Totaler suppliers”, the vertical integration philosophy and joint optimization remains.

Mercadona negotiates block for all its stores, and that allows you to get conditions that other distributors do not get. The success of this symbiosis is such that, according to The economist“Mercadona suppliers are made of gold”, with growth of more than 10% in their sales during the last year.

4) Logistics and automation. Mercadona operates one of the most sophisticated logistics networks in Europe, with 16 large highly automated blocks that supply their 1,674 supermarkets daily. In 2024, it allocated 276 million euros (26% of its total investment) to strengthen this infrastructure, according to Digital economy.

The company has implemented advanced technologies such as the Picking Puente crane (PPG) system in its fresh warehouses, which speeds up the preparation of orders: it allows it to carry fresh products from the field to the store in 24 hours. Less losses and better perceived quality.

This obsession with efficiency has raised productivity per employee at 313,545 euros per year, the highest in the sector.

5) Almost zero expenses and marketing control. Unlike other chains with a lot of advertising presence, Mercadona allocates nothing to conventional advertising, and when it does, it usually has more to do with its technological department (here is an example in this house) and not so much with announcing products. Trust more on the mouth-a-or and the repetition of purchase. This savings in marketing, which for competitors can mean 1-2% of sales, is direct to the net margin.

The company also maintains a relatively simple directive structure. In 2024, he even reduced his management committee to only six members, in front of the sixteen he came to have, according to reports Castellón Plaza.

The six members of the Management Committee with Juan Roig in the presentation of results of exercise 2024. That committee came to have sixteen members. Image: Mercadona.

The six members of the Management Committee with Juan Roig in the presentation of results of exercise 2024. That committee came to have sixteen members. Image: Mercadona.6) Without promotions or discounts. Mercadona has no loyalty program, points, coupons or specific discounts. Instead, opt for stable and competitive prices throughout the year. He no longer entrusts his motto ‘Always low prices’ that started at the end of the nineties, and in fact he has explicitly said that it is not its goal to be cheap, but the idea of SPB remains in a certain way: fixed prices instead of specific offers.

This saves you promotional marketing costs and constant price changes. In 2024 he reduced 2,000 prices, but permanently and without this affecting its profitability, according to the company itself.

In fact, its gross commercial margin remained stable at 24.7%, confirming that the increase in net profit (37%) compared to sales (9%) is mainly due to internal efficiency improvements, not to make products more expensive.

Internationalization problems

Mercadona has a 28% market share in Spain and is a baggy leader, but it is having difficulties when leaving other markets. In Portugal he has been for five years but “only” has sixty stores.

Although the Portuguese is a market that has begun to give benefits (7 million euros in 2024), Roig has admitted that “it costs a lot” to grow there. As collected The avant -garde“after being forty years in Spain” it is not easy to adapt the model, and international expansion requires “generating managers in the country through internal promotion, which is a long process.”

Mercadona has had to adapt its assortment to Portuguese taste and develop a local supplier network. According to MERCA2although store sales in Portugal are 10% higher than those of Spain, its market share remains far from the domain it has in the Spanish market.

Portugal already had two large dominant distributors (Sonae and Jerónimo Martins) that control about 46% of the large consumption market, according to MERCA2. These local companies have defended their fee by adjusting prices and improving their offer.

Something similar would happen in other European countries, where Mercadona would face consolidated competitors:

- France: Carrefour, Leclerc o Intermarché.

- Germany: Aldi, Lidl o Rewe.

- United Kingdom: Tesco o Sainsbury’s.

In addition, to impose your model you need A scale that still does not have outside of Spain. The Mercadona model works magnificently when a critical mass is reached that allows all synergies (logistics, negotiation, strong brand).

In Spain, with a 28.2% share and more than 1,600 stores, it has enormous negotiating power. In Portugal, with less relevance, history and market share, it still does not enjoy the same economies of scale.

Roig has been clear about it: the expansion to a third country is in “stand-by“Until Portugal is” just as dominated as Spain. “

Future

Mercadona foresees by 2025 a more moderate growth of 3.5% in sales, up to 40,100 million euros, and the creation of more than 1,000 jobs.

The plan includes an investment of another 1,000 million, with special emphasis on Portugal (200 million) where he expects to “fold the benefits obtained this year, improve their relationship with suppliers and improve the assortment,” he said Castellón Plaza.

Mercadona’s lesson is clear: in a sector where selling more does not always mean winning more, “Sell better” – controlling the entire chain, optimizing processes and understanding the consumer— It is the key to sustainable profitability.

It is a model that, paradoxically, is more difficult to export the more perfected it is for a specific market.

In Xataka | Aldi is testing something radical in its stores without boxes: a pre-load of 12 euros to buy

Outstanding image | Mercadona