The Dax 40 index has reached a new historical maximum after the recent trade agreement between United States and the United Kingdomwhich has promoted optimism in European financial markets. The Frankfort bag experienced an increase of 0.7 %, standing at 23,609 points, thus consolidating its upward trend.

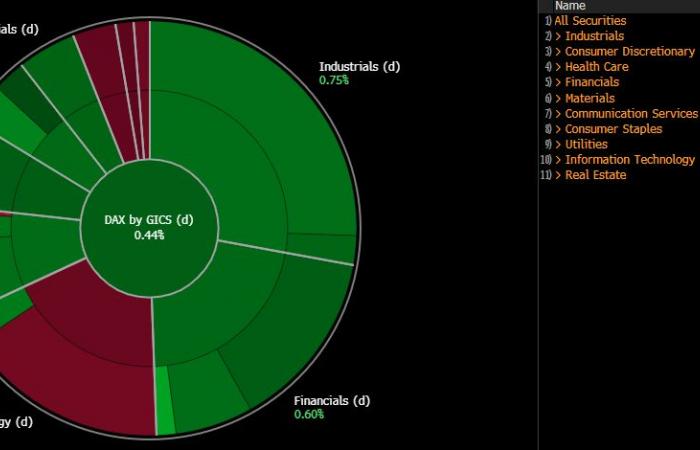

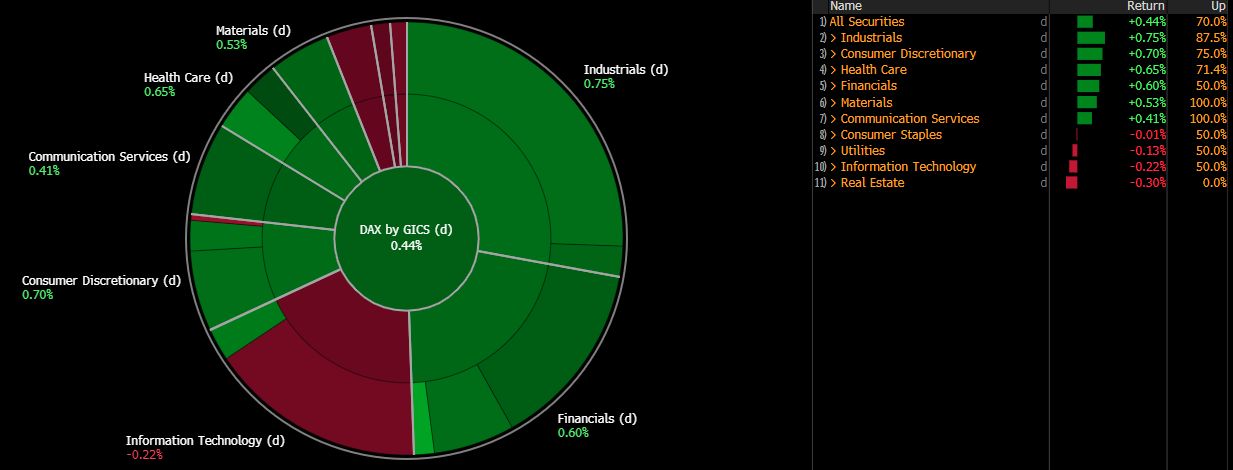

Dax profitability by sector. Source: Bloomberg Financial LP

This advance adds to an accumulated gain of 18 % so far this year, reflecting the Investor trust in economic stability and growth prospects after the elimination of certain commercial barriers. In addition, the agreement has generated expectations that the United States can establish similar agreements with other countries, which could continue to benefit global markets.

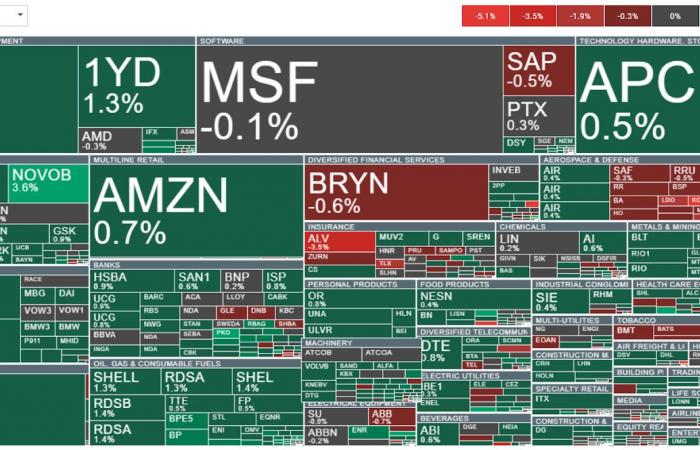

Volatility is currently observed in the European market in general. Source: Xstation

Dax 40 Quote

El Dax It maintains its bullish impulse, approaching a new historical maximum and quoting above the fibonacci recoil level of 23.6% and the simple mobile average (SMA) of 50 days. The bulls will seek to stay above the recent maximums, while the bassists will try to boost the price below it, pointing to the simple mobile average (SMA) of 50 days. The RSI continues to show bullish divergence with higher minimums, while the MACD is expanding after an upward crossing. Source: Xstation

Market news

International Airlines Group (IAG) He announced an important order of 53 new long-distance aircraft, composed of 32 Boeing 787-10 for British Airways and 21 Airbus A330-900neo that could be assigned to other IAG airlines, such as Aer Lingus, Iberia and Level. This adds to a previous order in March 18 additional airplanes (six Airbus A350-900 for Iberia, six Airbus A350-1000 and six Boeing 777-9 for British Airways). The company delivered five new aircraft in the first quarter and maintained positive financial perspectives despite the challenges of the sector and amortizing more than 1,000 million euros of debt, which led to the rating agencies to Raise the IAG and British Airways qualification to investment grade.

Commerzbank AG shares rose 2.5% After the second largest bank of Germany announced its greatest quarterly benefit since 2011. The net profit increased 12% year -on -year to 834 million euros, far exceeding the expectations of analysts of 698 million euros. Total revenues increased by 12% to 3,100 million euros, promoted by interest and commissions higher than expected, while the provisions for insolvencies stood at just 123 million euros, well below the 162 million planned, despite economic difficulties. These solid results They occur at a time when Commerzbank seekswhich has acquired a 28% participation in the bank and has received authorization to increase its direct participation by just less than 30%. The executive director, Bettina Orlopp, who assumed the position in October, highlighted the bank’s capacity to “grow even in difficult economic times” while implementing its independent strategy, which includes plans to cut 3,900 jobs and increase profitability in two thirds by 2028. Bank’s actions have risen more than 70% in the last 12 months, which reflects the growing confidence of investors and speculation about their board Annual General next week.

How to invest in Dax 40?

Within the wide range of financial instruments of XTB, our users can acquire ETHFS of the Dax 40, such as the XDAX.DE. As with the rest of ETFs or actions of our portfolio, The first 100,000 euros of monthly negotiation do not have a purchase or sale commission. In addition, those who want to invest in various types of assets at the same time can do so through our investment plans, a functionality that allows combining different titles, programming the contributions periodically and choosing both the amount and the term or payment method. Specifically, they can create their investment plan from only 15 euros, being able to choose up to 9 different ETFs in each of their plans.

“This report is provided only for general information purposes and for educational purposes. Any opinion, analysis, price or other content does not constitute an investment advice or recommendation in understanding of Belize’s law. The performance in the past does not necessarily indicate the future results, and any person who acts on this information does so at their own risk. XTB will not accept responsibility for any loss or damage, including, without limitation, any loss of benefit, any loss of benefit. of the use or trust of such information.