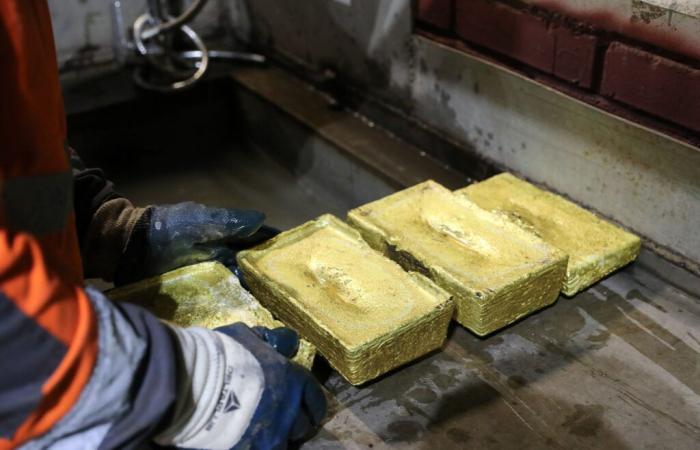

Gold prices were strengthened on Monday, helped by a weakest dollar, while investors expected more clarity about commercial policy between the United States and its commercial partners, and they were waiting with interest in the monetary policy of the Federal Reserve scheduled for the end of the end of this week.

The gold in cash rose 0.7 % to 3,261.59 dollars an ounce, at 02:17 GMT. Gold futures in the US rose 0.8 % to 3,269.60 dollars.

The dollar dropped 0.3 % against its rivals, which caused gold to be more attractive to holders of other currencies.

“The US dollar is moderate before the federal reserve meeting this week, allowing gold to experience a slight climb,” said Tim Waterer, KCM trade Chief Analyst.

“It is possible that gold continues to quote in the range of 3200-3350 dollars before the Fed meeting. However, any news about the trade agreement could cause a new rebound in volatility.”

The market will be aware of the decision on the monetary policy of the US Central Bank and the statements of several responsible for the FED planned for this week, in search of clues about the future trajectory of monetary policy.

The operators now expect cuts of types of 80 basic points this year from July, after the report of the US Department of Labor on Friday, which showed an increase in employment in April higher than expected.

Gold, which does not generate performance, acts as coverage in the face of world uncertainty and inflation, and tends to prosper in an environment of low interest rates. The president of the United States, Donald Trump, said he will not dismiss Jerome Powell as president of the Fed before he finished his mandate in May 2026, while reiterating his request to the Fed to cut the interest rates.

Trump said on Sunday that the United States was meeting with many countries, including China, to negotiate trade agreements, and that its main priority with China was to guarantee a fair trade agreement.

The Chinese markets will remain closed by the holiday of Labor Day, from May 1 to 5, and will resume their activities on Tuesday, May 6.

The money in cash rose 0.1 % to $ 31.99 an ounce, the platinum fell 0.4 % to $ 956.09 and the paladium fell 0.1 % to $ 952.63. (Information from Anushree Mukherjee in Bangalore; edition of Rashmi Aich and Janane Venkatraman)