Argentine late corn prices began to take distance from early corn values - which are in full collection process – before the competence of the Brazilian offer of late corn.

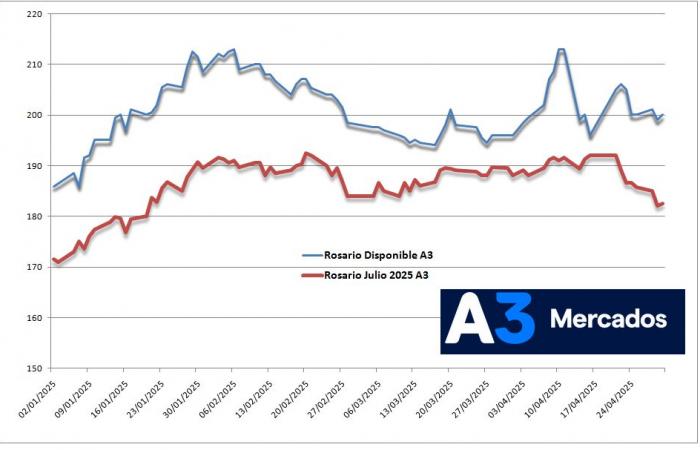

In the last week, the Rosario Julio 2025 A3 contract (former Matba Rofex) lost more than $ 10 s/ton, while the price of available rosary corn remains firm.

“The contribution of the Argentine corn continues to climb for the strong external demand. Since the end of last year, international buyers turned to our country in the face of the shortage of supply in the other great global supplier: Brazil,” says a report from the Rosario Stock Exchange (BCR).

Although Brazilian production grew in a sustained way over the years, internal consumption increased proportionally more. Brazil is practically outside the corn export market until next July, which is when the production of late corn begins to enter.

“In this context, the Argentine cereal stands as the main candidate on the southern hemisphere, promoting the premiums negotiated in the FOB market over Chicago (CME Group),” says the BCR.

“In this context, the Argentine cereal stands as the main candidate on the southern hemisphere, promoting the premiums negotiated in the FOB market over Chicago (CME Group),” says the BCR.

“Today a ton of corn that is negotiated from the UP-River (Rosario) to embark during May quotes around 225 US $/ton. The current conditions not only improved with respect to last month, but also exceed the values of the same period of 2024,” he adds.

The second corn harvest of Brazil would be a record with an expected production of 97.9 million tons, according to official estimates (CONAB).

Happy anomaly: More than 18 million tons of corn have already entered the Argentine market and prices are still firm

However, although the productive perspectives are imposing, Brazil would not flood the global market with corn: Conab expects exports for 34 million tons in the 2024/25 commercial cycle, 12% less than in 2023/24 and the lowest volume in four years. This is explained by the insatiable domestic demand, as well as in forage use, as the growing corn participation in bioethanol production.

The commercial dynamics of corn in the second half of the year 2025 will also depend on the situation of the change market, since commercial flows tend to accelerate with a cereal depreciation.

With regard to Argentina, the exportable offer of corn in 2024/25 would be 33.5 million versus 36.2 tons in the previous cycle. In the first two months of the commercial cycle (March and April 2025), shipments (DJVE) were recorded for 7.50 million tons, while so far exports were declared for 2.35 million for the months of May and June of this year.