Key points:

-

The 15% increase in Solana and its possible closure above the 50 -week EMA indicate a strong bullish impulse, which previously led to a rally of 515% in 2024.

-

The 120 million dollars in liquidity transferred to Solana reflect a growing confidence in the network.

The price of Solana (Sun) won 18% this week, indicating a growing bullish impulse. The Altcoin approaches a crucial point, with a possible closure above the 50 -week exponential (EMA) mobile average, a level that historically has catalyzed significant rallies.

In March, Sol fell below the EMA of 50 weeks and briefly declined under 100 dollars on April 7. Since then, Solana has starred in a strong recovery, recovering key levels of EMA (100W and 200W), with the EMA of 50 weeks (blue line) now in the spotlight.

Historical patterns reinforce an upward perspective. In October 2023, Sol exceeded the EMAS of 50 and 100 weeks, consolidating over these levels before rally 515% by March 2024.

Notably, the relative force index (RSI) was below 50 during both periods, reflecting the current configuration, with the indicator bouncing above 50 after the 50 -week EMA became support. If the 50 -week mobile average is maintained, the price objectives for sun could be between 250 and 350 dollars for September 2025.

The daily chart supports this narrative. Solana recently closed above the 200 -day EMA, with an immediate resistance in 180 dollars. A rupture above this level in the coming weeks and the conversion of this range at a support level could potentially trigger a parabolic rally for the third quarter of 2025.

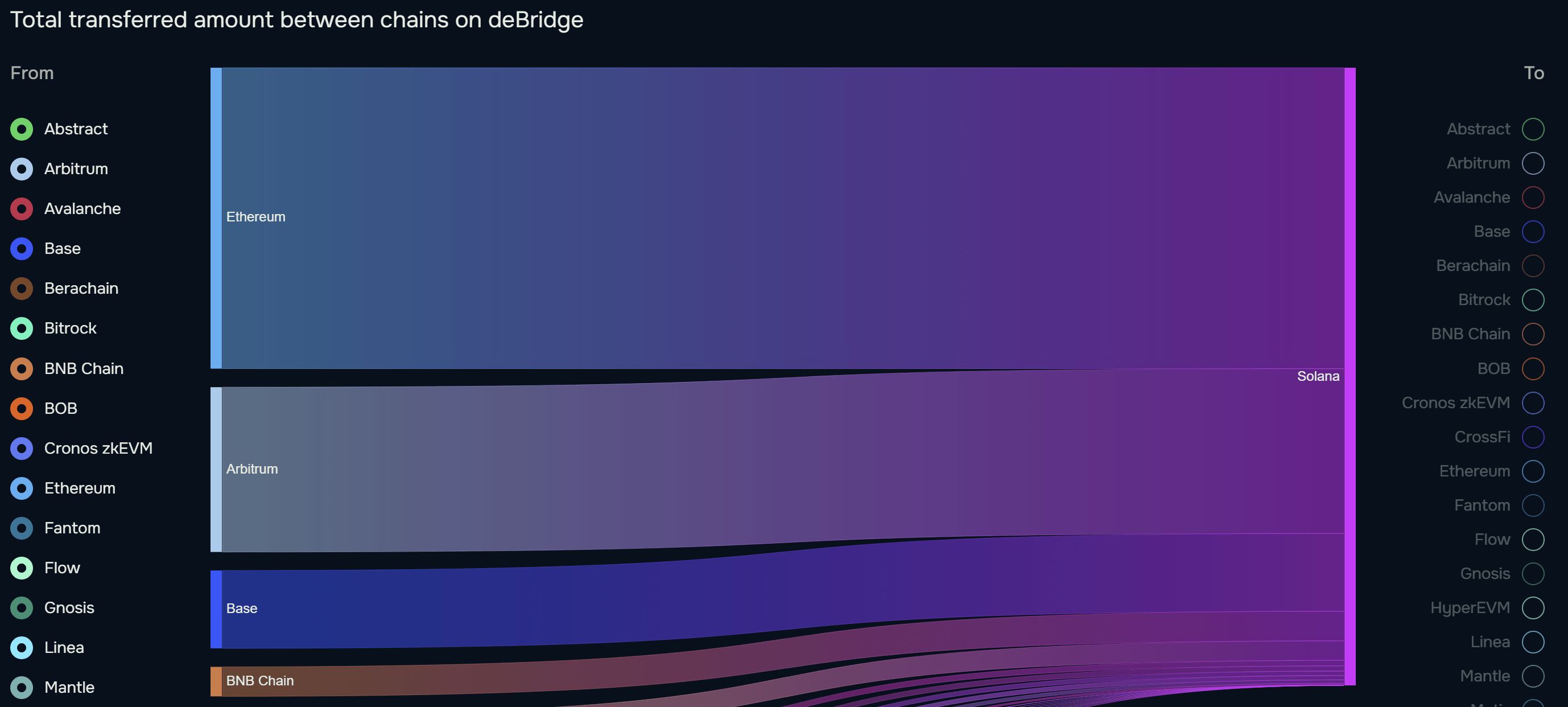

Users transfer 165 million dollars to Solana

In the last 30 days, more than 165 million dollars in liquidity have been transferred to Solana from other blockchains, which reflects a growing network confidence. Ethereum led with 80.4 million dollars in transfers, followed by arbitr with 44 million dollars, according to Debridge data. Base, BNB Chain and Sonic contributed 20 million, 8 million and 6 million dollars, respectively.

Similarly, Defillama data indicate that Solana registered the largest volumes in the Decentralized Exchange (DEX), 3,320 million, in the last 24 hours. The network currently has 28.99% of the market share among other chains.

With a market share of 28.99% among competitive chains, Solana dominance in the activity defi highlights their scalability and adoption by users.

Currently, substantial liquidity flows and strong volumes in Dex position Solana for a sustained price breakout.

This article does not contain tips or investment recommendations. Each investment and trading movement implies risks, and readers must carry out their own research by making a decision.