Gold prices rose on Monday as U.S. Treasury yields eased, as investors awaited the inflation figure expected later this week, which could influence the path of Federal Reserve interest rates. .

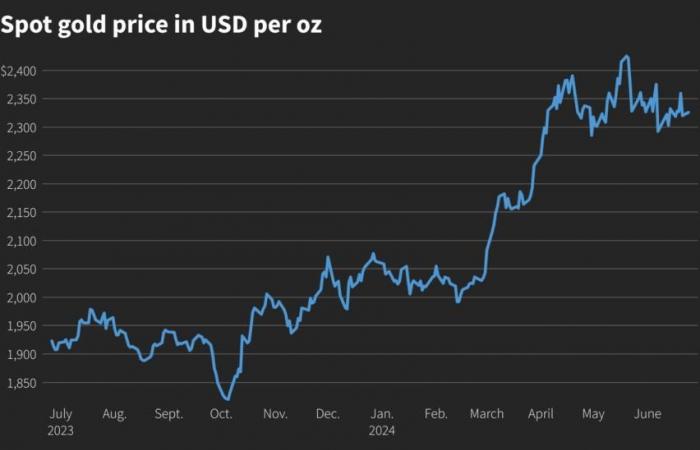

* Spot gold GOLD It was up 0.3% at $2,327.58 an ounce by 1152 GMT, after falling 1% on Friday due to the strength of the dollar. US gold futures GOLD They advanced 0.4% to $2,340.00.

* The return of the benchmark 10-year US Treasury bond US10Y fell, making non-yielding bullion more attractive to investors.

* “The focus remains on the upcoming US economic data and, if that data confirms a soft landing, it will allow the Federal Reserve to cut interest rates,” said UBS analyst Giovanni Staunovo.

* “We continue to see support for gold, with the goal of reaching a price of $2,600 per ounce by the end of the year.”

* Personal Consumption Expenditures (PCE) data, the Federal Reserve’s preferred measure of inflation, will be released on Friday. Throughout this week, at least five central bank officials will make public appearances, including San Francisco Fed President Mary Daly and Fed Governors Lisa Cook and Michelle Bowman.

* Traders are currently pricing in a 66% chance that the Fed will cut rates in September, according to the CME FedWatch Tool. (FEDWATCH) Lower rates reduce the opportunity cost of holding bullion.

* Among other precious metals, spot silver XAGUSD1! rose 0.5% to $29.66 per ounce and platinum

PL1! it gained about 1% to $1,002.60. The palladium

XPDUSD1! It advanced 4.1% to $987.56.