- Finding stocks with a very high percentage (95%) of buy ratings and no sell ratings is always interesting to take into account.

- From the list we can list Amazon (NASDAQ:), Delta Air Lines (NYSE:), Zoetis, Schlumberger (NYSE:), Microsoft (NASDAQ:) and Mondelez International (NASDAQ:).

- The stocks we will look at in more depth today will be Amazon, Delta Air Lines, Zoetis and Schlumberger.

- How to get the most out of dividends? Try InvestingPro and win in your decisions! NOW WITH SUMMER SALES! Subscribe HERE for just over 6 euros per month (20 cents per day) and get almost 50% off your 1-year plan! HALF-PRICE!

It is always interesting to know which stocks have the most market support, specifically in relation to those with a higher percentage of buy ratings (minimum 95%) and 0% sell ratings.

Among the actions that meet this requirement we can list the following six:

-

amazon

-

Delta Air Lines

-

Zoetis

-

Schlumberger

-

Microsoft

-

Mondelez International

We are going to see some of them using the InvestingPro tool that will provide us with important information in this regard.

1. Amazon (AMZN)

It is engaged in the retail sale of subscription products and services. It was incorporated in 1994 and is headquartered in Seattle, Washington.

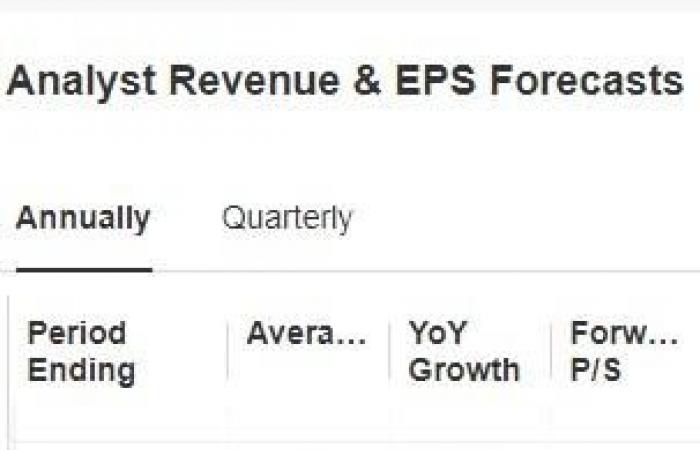

On July 25 it presents results and an increase in EPS of 93.50% is expected.

Source: InvestingPro

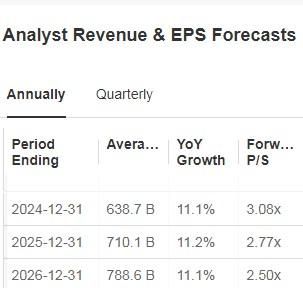

It is expected that advertising will continue to be a strong tailwind for the company’s margins and the market is increasing its revenue estimates for 2025 and 2026. For example, for 2024 an increase of 11.1% is expected, for 2025 of 11 .2% and by 2026 11.1%. EPS is not far behind either, rising 56.5% in 2024, 26.3% in 2025 and 29.2% in 2026.

Source: InvestingPro

95% of all the ratings it presents are buy and it has no sell ratings.

The average price target given by the market is $218.28.

Source: InvestingPro

2. Delta Air Lines (DAL)

It is an airline that has a fleet of approximately 1,273 aircraft. It was founded in 1924 and is headquartered in Atlanta, Georgia.

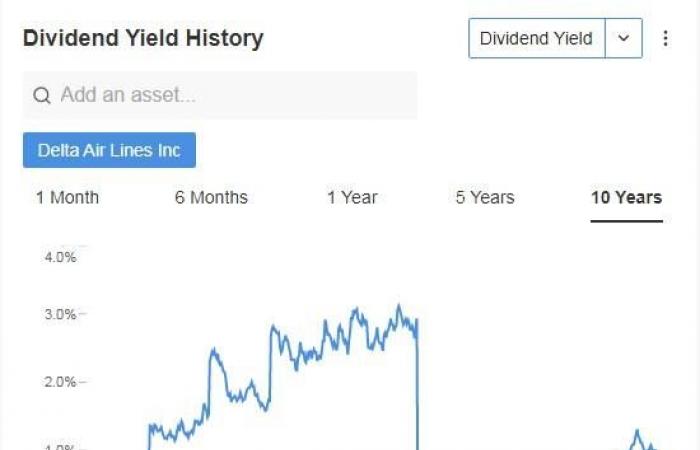

It announced a significant increase in its quarterly dividend, setting it at $0.15 per share, which is a 50% increase over previous distributions. The distribution will be on August 20 and to receive it you must have shares before July 30.

Source: InvestingPro

First-quarter earnings per share beat estimates. On July 11, it presents its accounts and an increase in EPS of 9.06% and revenue of 8.66% is expected.

Source: InvestingPro

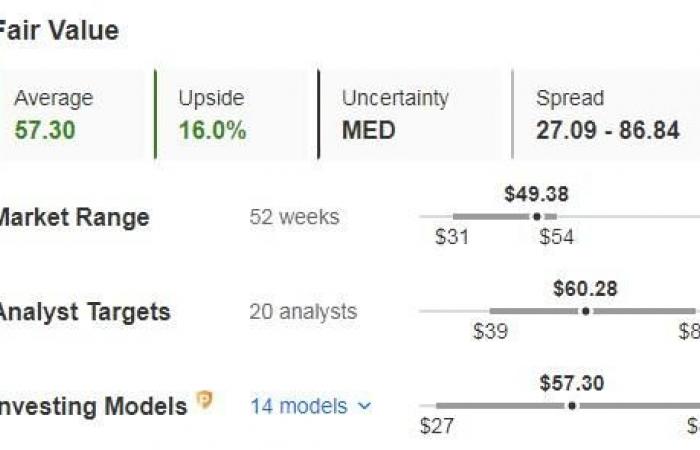

In its favor it has solid operational performance and cost management. With a market capitalization of $32.03 billion and a very attractive P/E ratio of 6.3, it is trading at a low earnings multiple compared to its sector, suggesting its shares could be undervalued.

It has 95% buy ratings and no sell ratings.

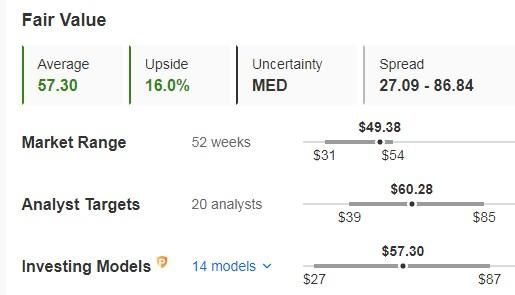

Its fair value or reasonable price based on fundamentals is 16% above its trading price at the end of the week, specifically at $57.30. The target price given by the market would be $60.28.

Source: InvestingPro

3. Zoetis (ZTS)

It is dedicated to the development, manufacturing and marketing of medicines and vaccines for animal health. It was founded in 1952 and is headquartered in Parsippany, New Jersey.

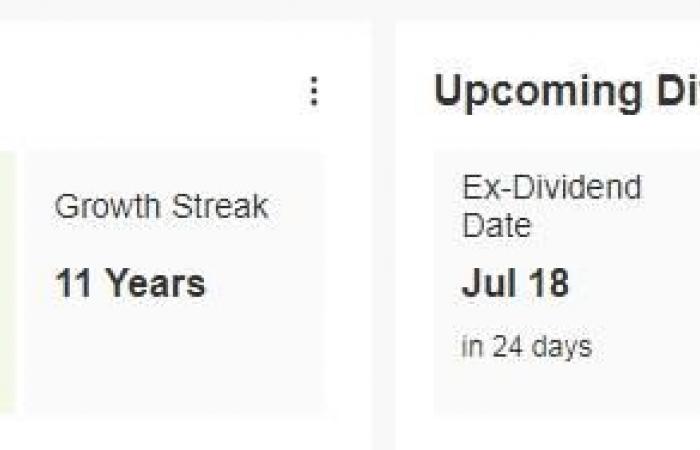

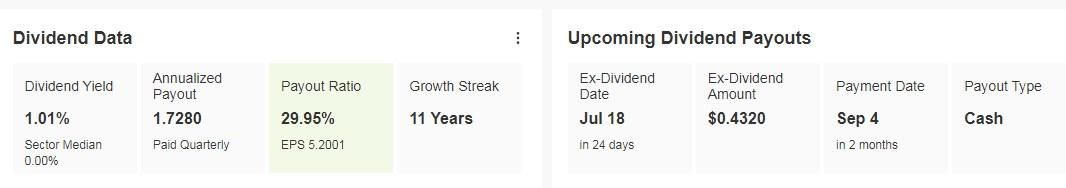

On September 4, it distributes a dividend of $0.4320 per share and in order to receive it it is necessary to own shares before July 18.

Source: InvestingPro

On August 1 it will publish its results. Looking ahead to 2024, the expectation is for an increase in EPS of 8.4% and revenue of 7.1%.

Source: InvestingPro

95% of its ratings are buy and there are no sell ratings.

Its beta is 0.88, so the stock has little volatility and therefore its upward and downward movements are generally less intense than those of the market where it is listed.

Source: InvestingPro

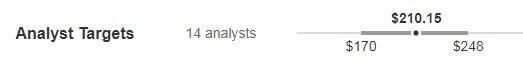

The average target price that the market sees for it is $210.15.

Source: InvestingPro

4. Schlumberger (SLB)

It is dedicated to the supply of technology for the energy industry worldwide. The company was previously known as Societe de Prospection Electrique. It was founded in 1926 and is headquartered in Houston, Texas.

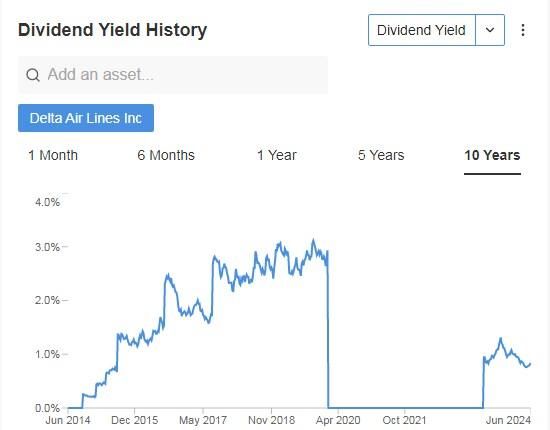

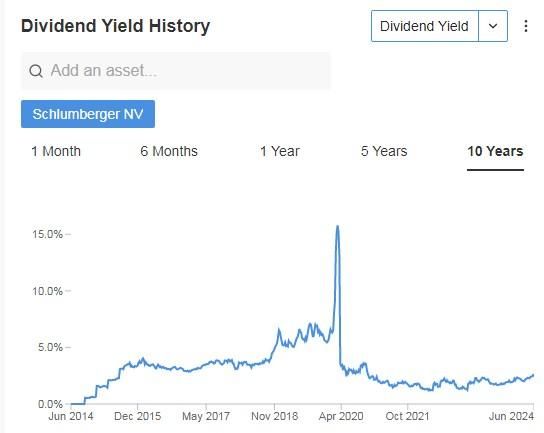

The profitability of its dividend is 2.41%, far from the 15% yield of four years ago.

Source: InvestingPro

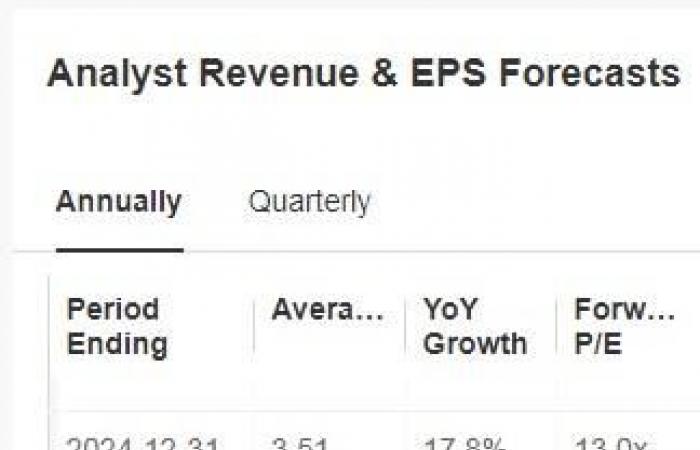

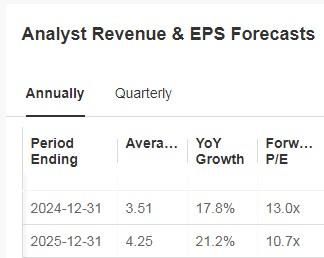

On July 19 we will have their accounts and for the current year an increase in EPS of 17.8% and revenue of 12.2% is expected.

Source: InvestingPro

Its recent acquisition of CHX was a strategic move that will strengthen its portfolio and improve its exposure to future growth markets.

Of note is revenue growth, margin expansion driven by its international positioning and artificial intelligence solutions, and trading at a discount to historical valuations. Additionally, the company’s commitment to distributing more than 50% of its free cash flow to shareholders reinforces its attractiveness to investors.

It has 95% buy ratings and no sell ratings.

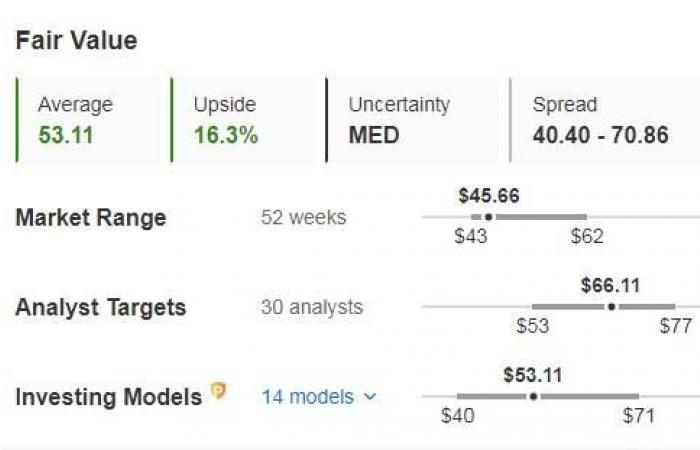

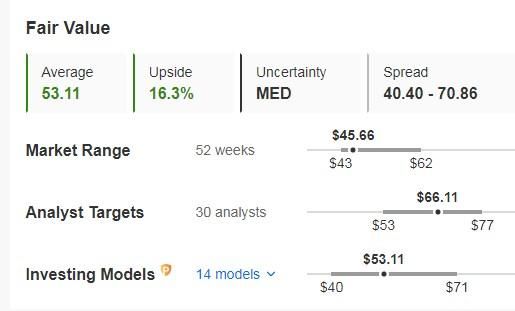

Its fair value or reasonable price based on fundamentals is 16.3% above its trading price at the end of the week, specifically at $53.11. The target price given by the market would be $66.11.

Source: InvestingPro

How to continue taking advantage of market opportunities? INVESTINGPRO IS HALF PRICE! Take advantage HERE AND NOW the opportunity to get the InvestingPro annual plan for just over 6 euros per month. Use the code INVESTINGPRO1 and get almost 50% off your 1-year subscription. Less than a Netflix subscription costs you! (And you also get more out of your investments.) With this you will achieve:

- ProPicks: AI-managed stock portfolios with proven performance.

- ProTips: assimilable information to simplify a large amount of complex financial data into a few words.

- Advanced Stock Finder: Find the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of shares: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, Not to mention those we plan to incorporate in the near future.

Act fast and join the investment revolution! GET YOUR DEAL HERE!