If the managers’ feelings were a song, this would be it right now. The show must go on, from Queen. The latest Bank of America (BofA) fund manager survey for June reveals continued optimism among investors.

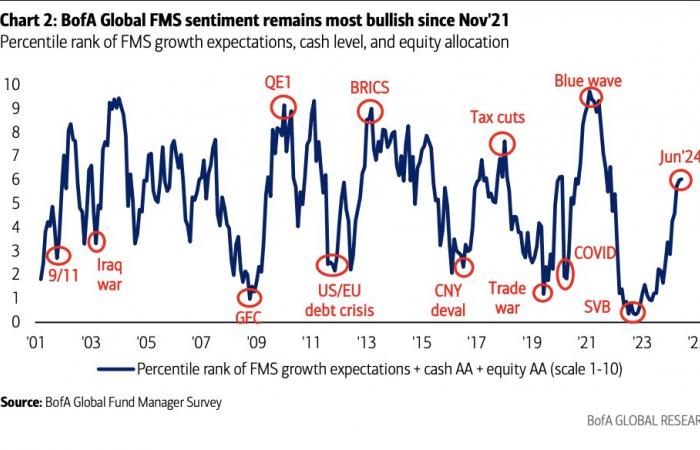

The managers have the lowest cash levels in the portfolio (4%) in three years, as well as a strong allocation to equities. In fact, the survey (which includes 238 panelists with $721 billion in assets under management) shows that he “Global FMS Sentiment” (study sentiment measure based on cash levels, equity allocation and economic growth expectations) remains at its highest level since November 2021.

Going into more detail about asset allocation, Investors are overweight in stocks (39%) as well as the largest underweight in bonds (-17%) since November 2022. European equities reached the largest overweight (30%) since January 2022, and allocation in Japan fell to its lowest level since April 2016.

There is also the largest overweight in banks since February 2023, the smallest overweight in technology since October 2023, and the smallest underweight in public services since July 2023.

“Recession? I don’t see it… at the moment”

Investors expect global growth to remain unchanged over the next 12 months. 73% of those surveyed rule out the possibility of a recession within a year, with a “no landing” probability at its highest (26%), a firm consensus on a “soft landing” (64%) and “hard landing” expectations at historic lows (5%). These expectations of a hard landing fall to this 5% from the 11% recorded in May.

More than 50% of panelists still do not expect a recession in the next 18 months, although this figure has dropped to 53% since May, with expectations of a recession in the second half of 2025 rising.

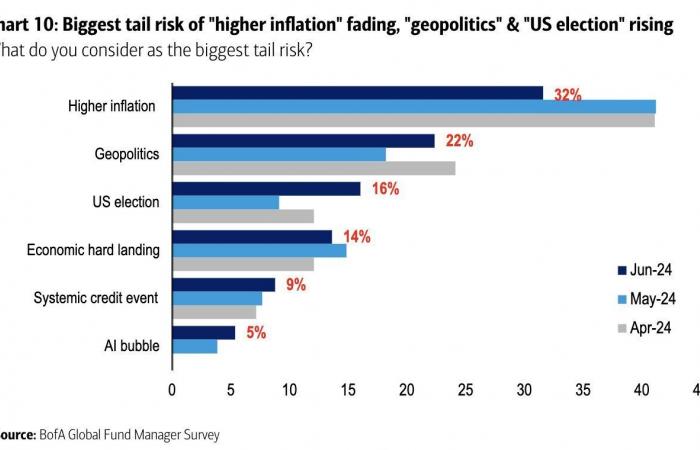

Higher inflation remains the biggest risk according to 32% of investors, although it has decreased from 41% in May. Geopolitical concerns have increased to 22% (from 18% in May) and risks associated with the US elections rose to 16% (from 9%).

Regarding rate cuts, only 8% of respondents predict that the Federal Reserve will not make cuts in the next 12 months, while 80% of investors expect two, three or more cuts, with the first cut anticipated for September 18.

And what will happen to all that money in the money market when rates drop? The managers believe that The biggest beneficiaries of the reallocation of funds from money market funds are US stocks (32%), government bonds (25%)global equities (19%), corporate bonds (12%) and gold/commodities (4%).

This content has been prepared under editorial criteria and does not constitute a recommendation or investment proposal. Investment contains risks. Past returns are no guarantee of future returns.