- Dogecoin, at press time, appeared poised to break a critical support line.

- On-chain metrics highlighted significant bearish sentiment across the market.

Dogecoin [DOGE]At press time, it was trading near the bottom line of its horizontal channel, within which it has been trending since April 13.

A horizontal channel forms when the price of an asset consolidates within a range over a period of time. The upper line of this channel forms resistance, while the lower line forms support. As for DOGE, the bears seemed to have created resistance at $0.17, while the bulls defended the coin’s price at $0.12, forming long-term support.

Source: TradingView

DOGE Bears Take Over

If the bulls fail to defend this support level, the DOGE price could fall to new lows on the charts. This would mean that the market has been overwhelmed by selling activity.

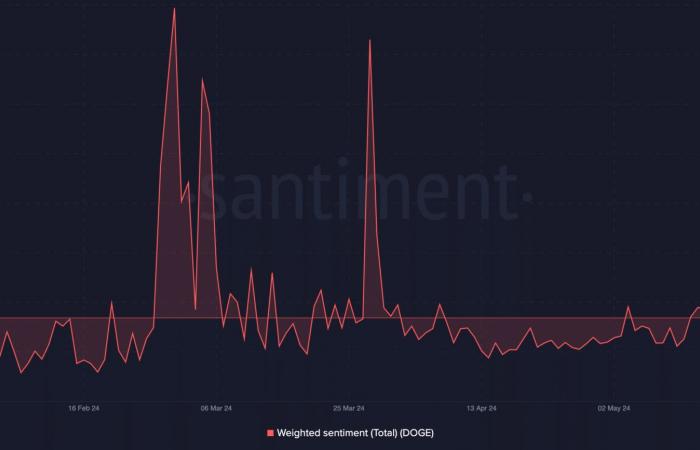

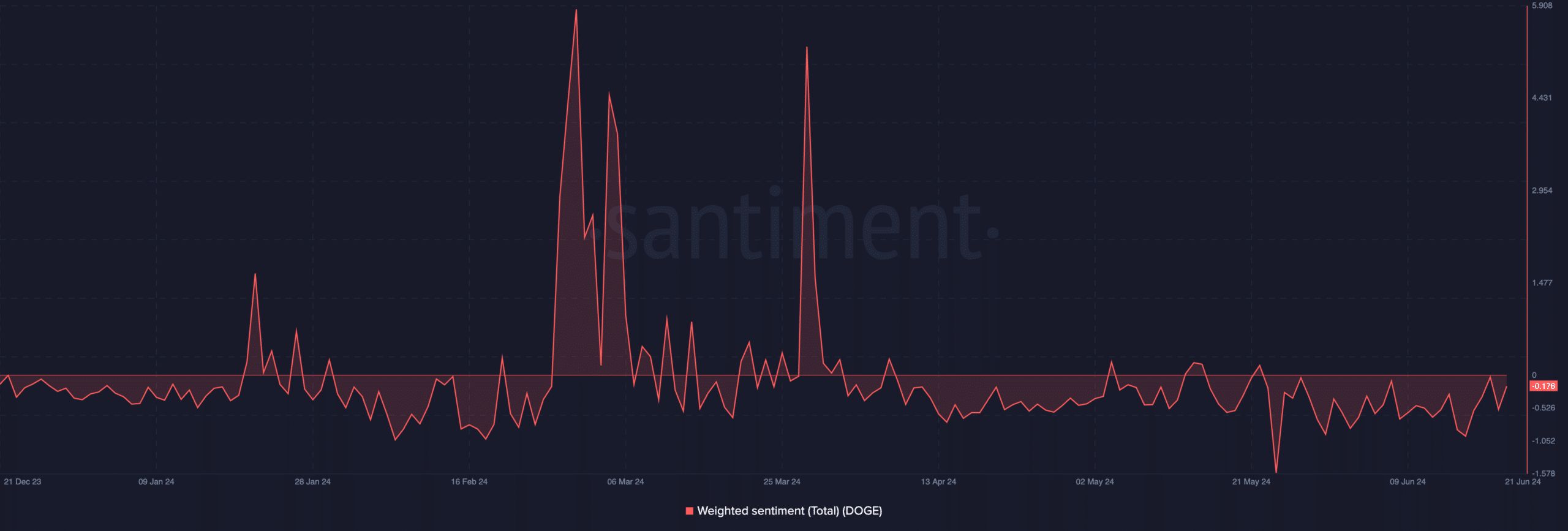

An evaluation of some on-chain metrics hinted at the possibility of this happening. For example, weighted memecoin sentiment has been mostly negative since March 31.

Source: Santiment

This metric measures the general market mood regarding an asset. When it returns a negative value, the market for the asset is overwhelmed by negative sentiment and its price is expected to fall.

Still below zero at press time, DOGE’s weighted sentiment was -0.17. If memecoin continues to be dragged down by the bad sentiment, it will put downward pressure on its price. This could cause it to fall below the support level.

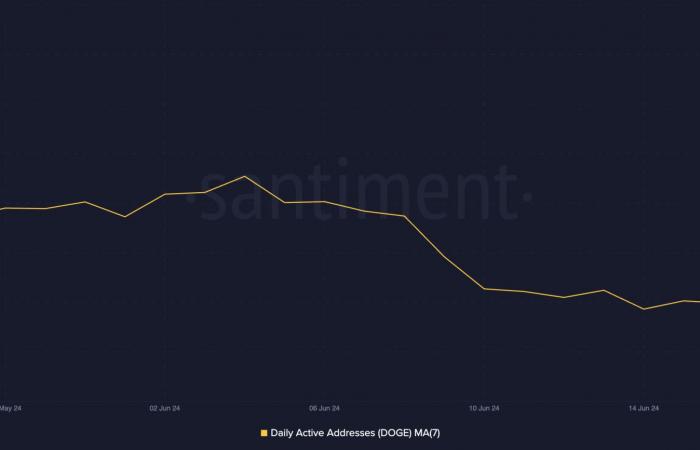

Furthermore, the overall market demand for DOGE also plummeted. In the last 30 days alone, the average daily count of addresses that have completed at least one transaction related to the popular memecoin has dropped by 13%, according to Santiment

.

Source: Santiment

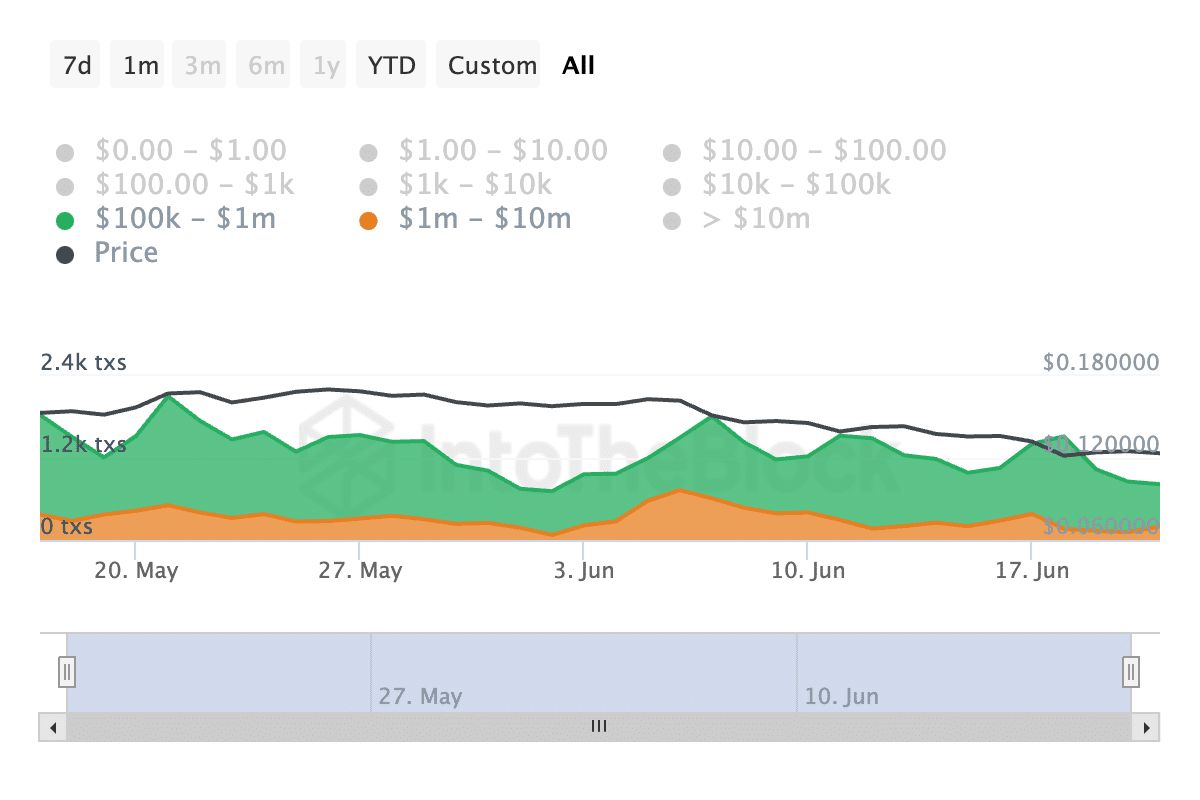

To avoid further losses on their investments, DOGE whales have gradually reduced their exposure to memecoin over the past month. According to Intotheblock, the daily count of large DOGE transactions has dropped significantly over the past 30 days.

Consider this: the number of DOGE transactions valued between $100,000 and $1 million has fallen 46% over the past month. Likewise, the largest transactions, ranging from $1 million to $10 million, have fallen 39.1% during the same period.

Source: IntoTheBlock

DOGE Futures Traders Remain Resolute

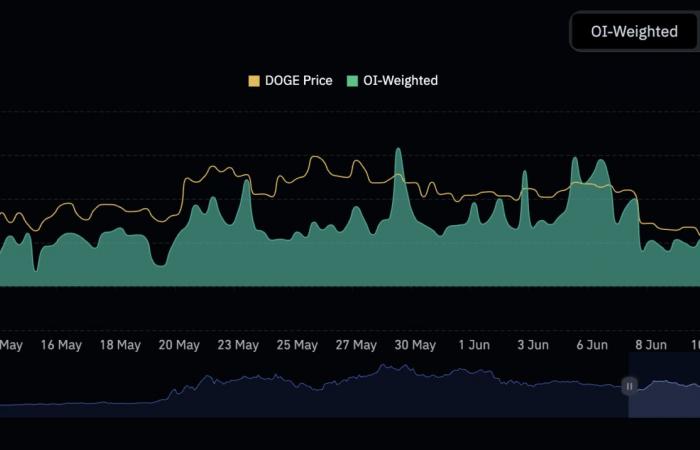

However, despite Dogecoin’s poor price performance, its futures traders have remained predominantly optimistic.

Is your wallet green? Check DOGE Profit Calculator

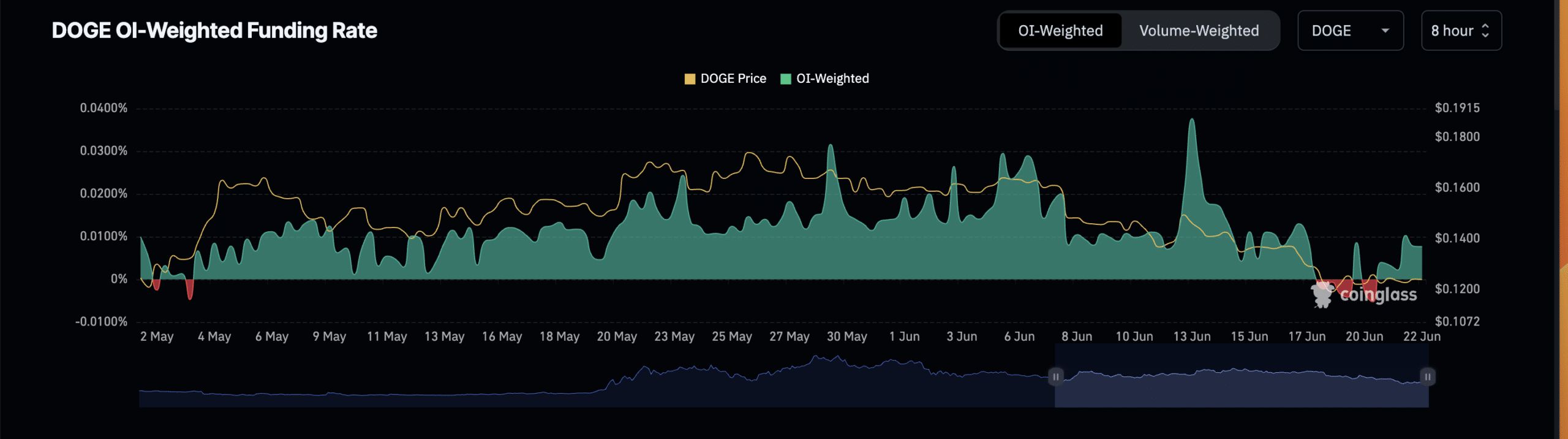

According to Coinglass an evaluation of the currency’s funding rate revealed that, apart from the negative values recorded on June 18 and 19, it has remained positive for the past two months.

Source: Coinglass

Funding rates are a mechanism used in perpetual futures contracts to ensure that the contract price remains close to the spot price.

When the funding rate of an asset is positive, it suggests that there is more demand for long positions. This means that there are more traders who buy coins expecting a price rally than those who buy in anticipation of a decline.

Next: Solana reaches the 30 million milestone: the chances of SOL price reacting are…

This is an automatic translation of our English version.