Widespread development and use of synthetic fuels is still at least a decade away and depends on the successful deployment of other technologies, but companies that position themselves now are best placed for success according to the latest report from Wood Mackenzie.

The report: Adding fire to e-fuels” states that e-fuels are a synthetic alternative to fossil fuels and can decarbonize sectors that are difficult to electrify without the need to early scrap long-life equipment. This means that e-fuels can offer a solution to power critical transportation segments such as ships, long-haul aircraft and heavy commercial vehicles.

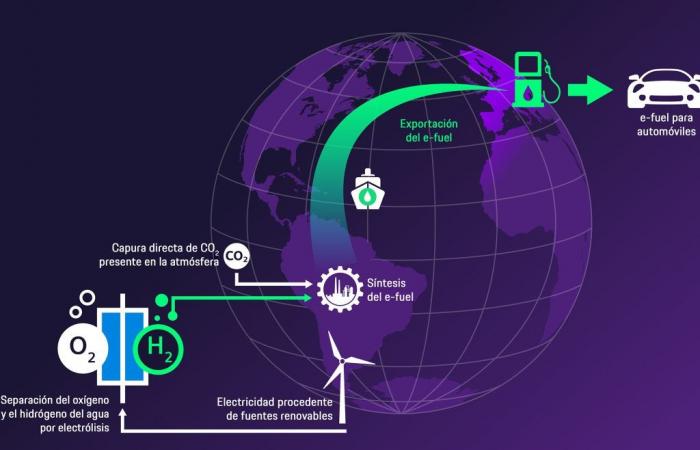

According to the report, e-fuels, also known as electrofuels, eFuels, synthetic fuels, Power-to-X (PtX), Power-to-Liquids (PtL) and renewable fuels of non-biological origin (RFNBO), are produced by combining electrolytic hydrogen (green), obtained by electrolysis of water using renewable electricity, with captured carbon or nitrogen. An e-fuel can be considered carbon neutral if the emissions released into the atmosphere during its combustion are equal to (or less than) the captured CO₂ used to produce it.

“Identifying pathways to transition from legacy fuels to low-carbon alternatives is a perennial challenge for traditional energy players,” said Murray Douglas, Vice President of Hydrogen Research at Wood Mackenzie. “E-fuels offer companies an exciting insight into the intersection of electrons and molecules, and the potential to capitalize on existing technical, commercial and marketing capabilities makes them an attractive, if difficult, opportunity for many.”

Challenges for large-scale implementation

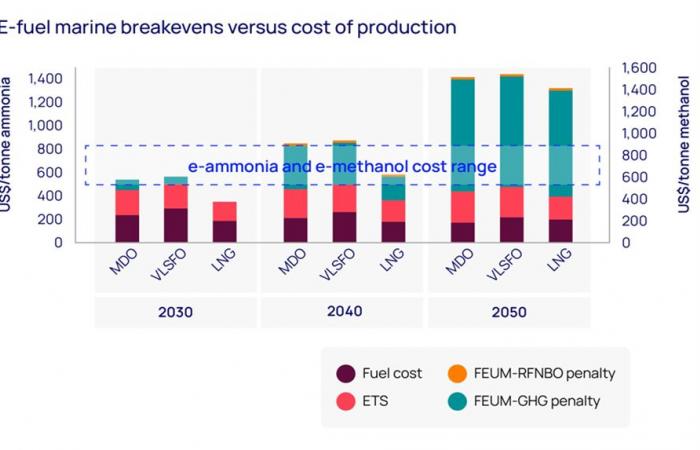

The report also points out that commercial viability is the main challenge when expanding e-fuel production, since both green hydrogen production and CO₂ capture costs are high. The subsequent conversion process into the final e-fuel product requires a lot of energy and capital, and delivery costs must also be taken into account.

“There is no shortage of buyers looking for low-carbon fuels, but the difference between the cost of production and willingness to pay is considerable,” says Douglas. “Each e-fuel has a fuel it aims to displace, and all of them are much cheaper, meaning their success will depend on policies that impose mandatory volumes, impose a cost on emissions and reduce production costs.”

Douglas adds that current conversion technologies differ depending on the final e-fuel desired, but the key challenge for all of them is the integration of green hydrogen, carbon or nitrogen, and its subsequent conversion into a commercial e-fuel production facility. on a large scale.

Policymakers will have to use both the carrot and the stick

The report points out that, currently, most e-fuel proposals aim to obtain CO₂ from various raw materials, with biogenic sources with a low capture cost predominating, such as biogas and ethanol plants. But as e-fuel production increases, the molecules available at those facilities will become scarcer and more dispersed. Costs will rise as e-fuel producers look for raw materials for their production.

This means that, in the long term, policymakers around the world will have to set the rules for where e-fuel producers source their CO₂. In Europe, point capture of CO₂ from fossil fuel electricity generation will only be permitted until 2036 and from other fossil fuel industries until 2041. Therefore, large volumes of net carbon dioxide removal technologies will be needed. carbon (CDR): direct airborne capture (DAC) and bioenergy with carbon capture (BECC).

“On a global scale, governments will need to take a holistic approach, introducing incentives and penalties to ensure that e-fuel production can reach the necessary scale,” says Douglas.

The report concludes that producers who can combine low-cost renewable energy and biogenic CO₂ sources will be the first to take the initiative. However, launching this type of complex and technologically intensive production model is a long process that must begin now so that large-scale production is underway by the mid-2030s.

“Electric fuels are, without a doubt, one of the longest-term bets in the energy transition,” says Douglas. “However, companies that set a strategic direction more quickly can position themselves to capture the most attractive elements of the value chain and carry those learnings forward.”