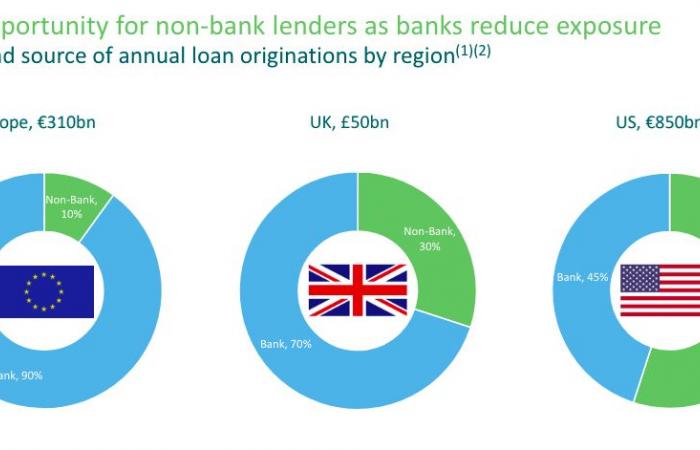

Recently, in the M&G European Media Day, Martin TownsDeputy Director of Real Estate, and Dan Riches, director of real estate financing, shared their perspectives. Towns mentioned that the rapid correction in the real estate sector could be coming to an end, creating opportunities. The stability of interest rates also helps investors feel that they can value the market better. While Riches commented that there is a high demand for debt financing, with the gradual withdrawal of banks.

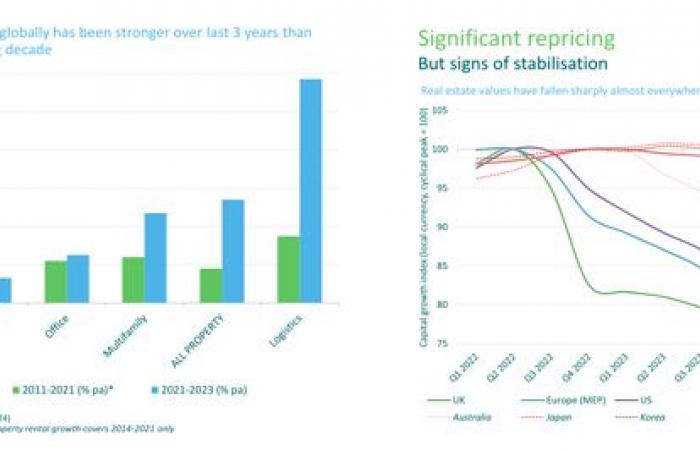

Towns began his presentation by talking about strong growth experienced in rental levels“increasing faster in recent years, especially in logistics. “We expect the upward trend in rents to continue as economies strengthen.” The expert adds that As inflation slows, rents could rise at least in line with inflationif not more, in certain market segments.

“If European economies improve, demand for occupancy will be boosted, leading to growth in rents and incomes,” the manager said. However, he also pointed out that “we must take into account the lack of supply of new properties on the market, as construction costs are higher. So if there is more demand from tenants and less stock, rents should rise faster.”

Strong divergence of real estate segments

A key theme that Towns emphasized was the growing divergence between prime and secondary real estate, especially in the office sector. The expert explained that in the last three years, from 2020 to 2023, the growth in rental levels of the best buildings, or prime, has been much greater than that of average buildings, attributing it to the evolution of the demands of the occupants. “Occupiers want buildings that are attractive to their staff, so they tend to be new buildings of higher quality and with many of the characteristics that in the real estate sector we call secondary,” he clarified.

Towns identified key opportunities in:

- Prime offices: New, energy-efficient buildings, for which occupants are willing to pay more.

- Logistics and industry: Driven by e-commerce, especially in the UK.

- Residential/multifamily: Increased demand for larger units due to teleworking.

- Asian markets: Less affected by recent volatility, with relatively stable capital values.

Regarding decarbonization and ESG, Towns sees an opportunity to build assets with appropriate environmental standards or upgrade existing buildings to reduce carbon footprint.

Booming regions and cities

Some European regions and cities, according to Towns, offer good investment opportunities. In certain parts of the London market, values are already rising, especially in the industrial sector. London remains attractive despite the uncertainties of Brexit.

He also highlighted Frankfurt, with strong demand for high-quality office buildings and good services. The city’s economic stability and central location in Europe make it a prime target for real estate investments. Likewise, the center of Pariswith its status as a global business center, and Madridwith a growing economy and urbanization trends, are attractive markets for real estate investments.

Opportunities in real estate debt

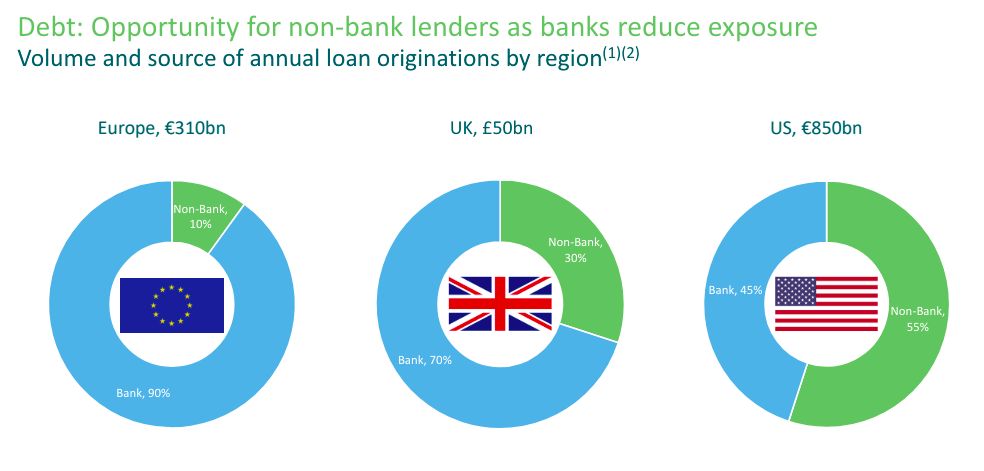

“There has been a significant change in the European real estate debt market in the last 15 years,” he explained. Dan Riches. He added that before the global financial crisis (GFC), Banks used to dominate almost 100% of real estate financing in Europe, but now that has dropped to 90% or 70% in the UK. The regulatory changes that followed the GFCas the application of Basel IV, have made it less attractive for banks to grant loans to the real estate sectorcreating opportunities for alternative lenders such as investment managers, insurance companies and pension funds to fill the gap.

According to Riches, The European real estate debt market currently moves between 1.5 and 1.6 trillion euros, with around 320,000 million of debt that needs refinancing each year. In his opinion, “this is a” perfect storm “for investors, with high demand for debt financing and banks withdrawing from the market.”

The expert points out that Current market conditions offer attractive risk-adjusted returns, with senior mortgages generating around 7-8% returns at 55% of appreciated property values (loan to value, LTV), while junior debt can offer returns of 12-15% with higher LTVs. Furthermore, the expert highlights that the drop in real estate valuations (around 20-23% in the United Kingdom and 15% in Europe) offers greater protection for investors’ capital, since loans are made at lower values.

“The combination of lower property valuations, higher interest rates and steady rental growth in key markets makes Real estate financing is a particularly attractive proposition for investors today“, concludes Riches.