In the program What Do We Do with the Pesos? (A24) alternatives were presented investment in assets for those who have a moderate profile and also for those who are willing to take more risks.

Those who seek to minimize risk and prioritize the security of their investments prefer safe and stable investments, with lower volatility and more predictable returns.

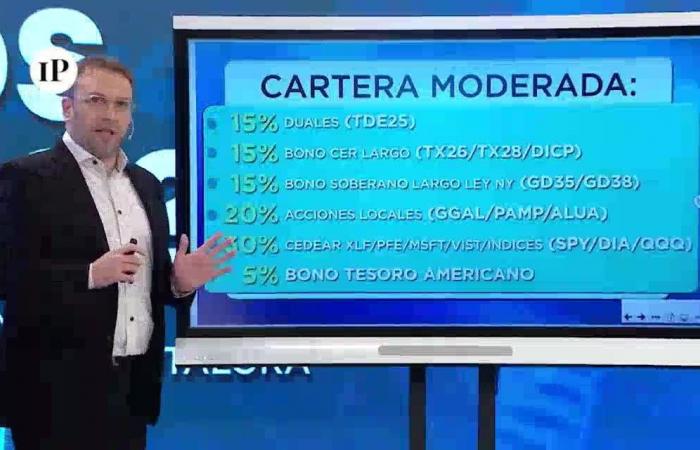

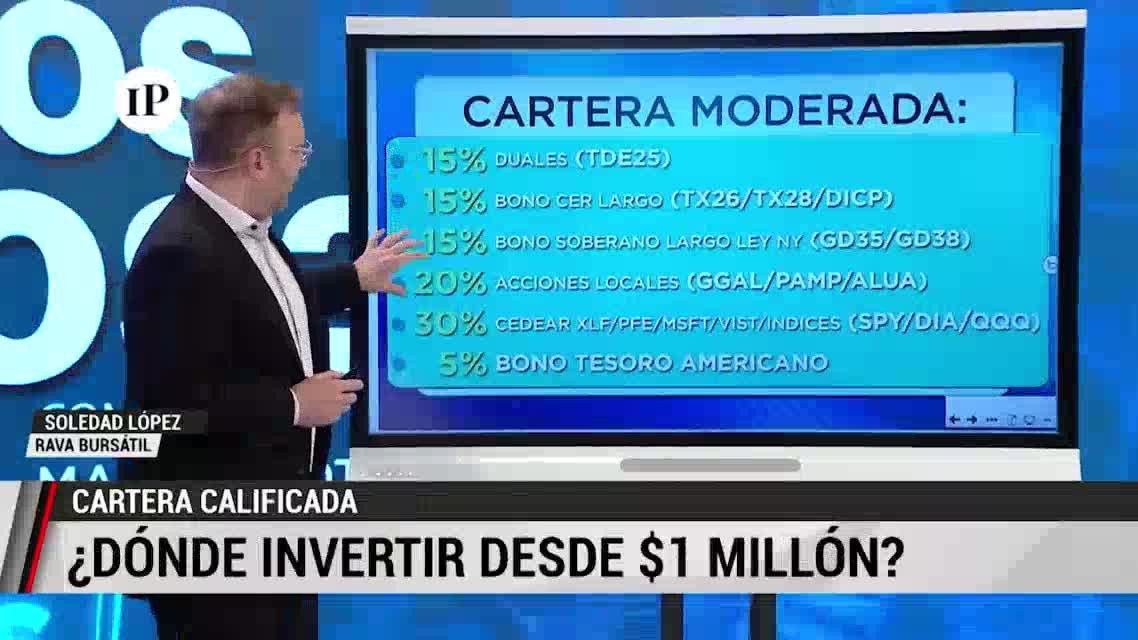

A portfolio for moderate-profile investors

Thus, for this profile, Soledad López de Rava Bursátil presented the following portfolio:

The fundamentals behind this portfolio stand out the importance of diversifying and protecting against inflation and exchange rate volatility.

15% Duals (TDE25): “The dual is an Argentine bond, which is from the treasury, which covers you in the official dollar or inflation. It seems fantastic to me at this moment where we continue discussing if the official dollar is behind, I would have duals in my portfolio“, assured López de Rava Bursátil.

15% Long CER Bonuses (TX26/TX28/DICP): “All short-term inflation instruments are expensive and have a negative IRR, which is why they are not recommended. Catching inflation with long bonds and a positive IRR seems fundamental to me,” he added.

15% NY Long Law Sovereign Bonds (GD35/GD38): According to López, “they pay very good coupons, they pay semiannually. New York Law seems to me yes or yes, if you are going to keep an Argentine sovereign bond, do not choose Argentine law.”

20% Local Actions (GGAL/PAMP/ALUA): “There I put Galicia, the main financier, it could be Galicia, Macro or Francés. Pampa, an energy company, which always has good balance sheets. And I put Aluar, because it is close to 850 pesos, 900. Any dollar you have , was left behind,” he said.

30% CEDEAR (XLF/PFE/MSFT/VIST/ Indices such as SPY/DIA/QQQ): “The CEDEAR is important for the investor to understand that it comes out of Argentine risk, because the CEDEAR is quoted in Argentina in pesos but it is a deposit certificate that reflects the share price in the United States,” highlighted the member of Rava Bursátil.

5% American Treasury Bond: “It seems like a good alternative to me. An American treasury bond yields 5% in dollars, it is risk-free, it is the safest instrument in the world,” he emphasized.

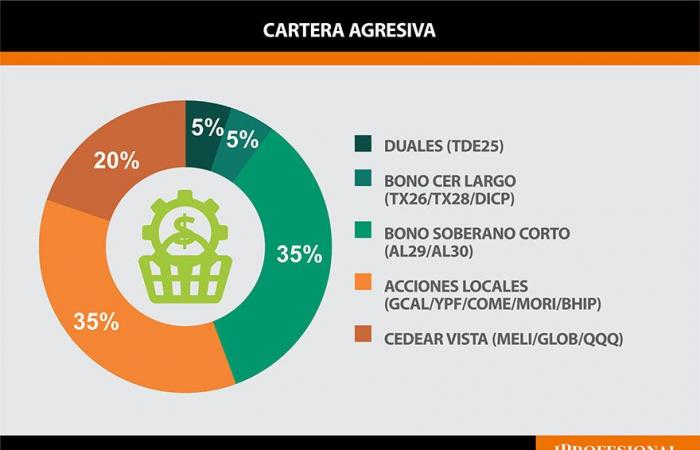

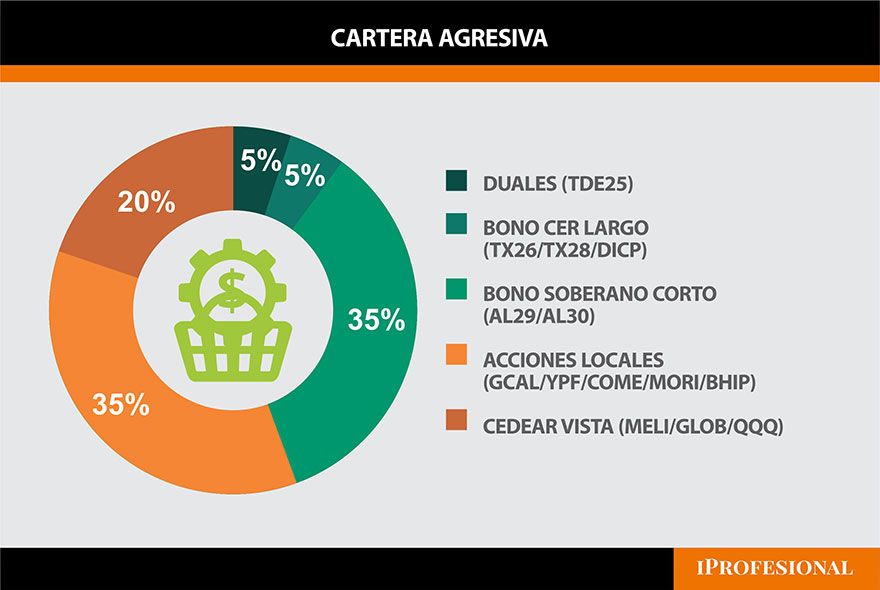

For riskier investors

The second portfolio is intended for aggressive investors, those willing to take greater risks in search of higher returns. They prefer investments with greater volatility and potential for rapid growth, although with greater probabilities of significant lossess. Ideal for those looking to maximize their short-term profits and are prepared to face potential market volatility.

The composition of this portfolio presented in the program What Do We Do with the Pesos? from A24 is the following:

López highlighted that this portfolio It is designed to take advantage of high-return opportunities in the short term, assuming greater risks.

5% Dual (TDE25): “I maintain 5% in duals, which is why I explained before the official dollar,” he noted.

5% Long CER Bonds (TX26/TX28/DICP): In this case, for López, “I maintain CER for inflation at a lower percentage.”

35% Short Sovereign Bonds (AL29/AL30): “Those who are investing in an aggressive portfolio think that in the short term the country risk is going to go down and this is going to make the price of the bonds go up. If one expects that to happen, the short bonds are the ones that have the highest percentages of go up,” he said.

35% Local Shares (GGAL/YPF/COME/MORI/BHIP): “We are adding more local stocks. Financial sectors, YPF, Morixe, their latest balance sheet was excellent, the target prices are very high. I have been saying that Comercial has a general fuel company and this makes it expected to have good prospects,” he said.

20% CEDEAR (VISTA/MELI/GLOB/QQQ): “Vista, Meli and Globant, three papers that are related in Argentina. Globant is destroyed, its balance sheet was not bad, but the expectation of the next balance sheet is expected to be higher,” concluded the Rava Bursátil expert.