The US currency continued the rise marked by gestures from the Fed, while the collapse of the Japanese currency boosted the price in the markets.

He global dollar rose in the early hours of Wednesday, driven by the collapse of the and in Japanese, which reached its lowest levels since 1986 and fueled operators’ fears regarding intervention by the authorities of that country.

The content you want to access is exclusive to subscribers.

to subscribe I am already subscribed

He dollar index —which compares the performance of the greenback with a basket of six internationally relevant currencies—, gained 0.44%, reaching 106.08 units, its highest since May 1. In contrast, the and in fell to its lowest level since 1986 against the dollar, keeping the foreign exchange markets alert for any sign of intervention by the Japanese authorities to boost their troubled currency.

In that sense, the US currency rose 0.7% and was trading at 160.697 yen, a level last recorded in December 1986, while the enormous difference in interest rates between both countries continued to weigh on the Japanese currency.

For its part, the euro fell 0.3%, to $171.625, after an official of the European Central Bank (ECB) talk about the possibility of further rate cuts this year, a notably different stance from that of Michelle Bowman of the Federal Reserve (Fed).

The difference in rates between the United States and Japan

According to analysts, operators are testing the determination of the Ministry of Finance and of Central Bank of Japanwhich spent $62 billion at the end of April and beginning of May to support the currency when it exceeded 160 units.

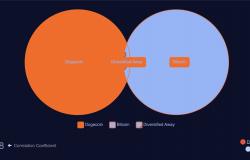

Japan’s low interest rates, compared with those in the United States, have hit the yen. While Japan has raised rates this year to a range of zero to 0.1%, U.S. rates of 5.25% to 5.5% mean investors are flocking to dollar-denominated assets for higher returns.

Investors are taking advantage of the large difference in rates in both countries by undertaking so-called strategies

“Unless the underlying dynamics change with the yield differential, it will continue to be penalized,” he told Reuters. Joe Tuckeyhead of currency analysis at the brokerage Argentex.