The approval of the 8th review of the Extended Facilities Program in force with Argentina frees the disbursement of 600 million Special Drawing Rights (SDR), equivalent to around USD790 million, an amount that exceeds the next amortization to the IMF (July 2024) of approximately USD645 million.

The payment scheduled for July is the last amortization payment to the IMF contemplated within the framework of the current program that expires in November 2024. From that payment and for the next 2 years (until September 2026) Argentina does not face any more amortization maturities. of principal with the IMF.

Flows with the IMF

The decision of the IMF Board of Directors occurs in a context in which the economic policy actions implemented by the current administration resulted in overcompliance with the quantitative goals established in the 7th review of the Program (accumulation of net International Reserves of the BCRA, fiscal balance of the Public Sector, and monetary financing of the Treasury).

Reserve accumulation goal

The Central Bank of the Argentine Republic (BCRA) accumulated USD9 billion of Net International Reserves (RIN) as of March 31 (at program prices), with the goal as of that date being USD6 billion. This comfortable overcompliance, added to the growth of the RIN observed in the following months, results in a cumulative recovery of USD11.3 billion as of today, which will soon be increased by the approved disbursement of USD790 million.

Given that the current level of reserve accumulation already exceeds that foreseen in the program for the entire second quarter (original goal of USD9.2 billion as of June 30, 2024), it was agreed to raise the second quarter goal to USD10 .9 billion, without affecting the original annual goal (which remains at USD9.7 billion as of December 31, 2024).

Consistent with the regulatory framework for the payment of imports and the seasonality of our country’s foreign trade provided for in the 7th revision, the 8th revision of the program maintains a downward path in the accumulation of RIN during the third quarter of the year to a level (increased in this review) of USD8.7 billion, and a subsequent recovery in the fourth quarter.

Accumulated variation since 10/12/23 of international reserves

net at program prices with IMF

Fiscal balance goal

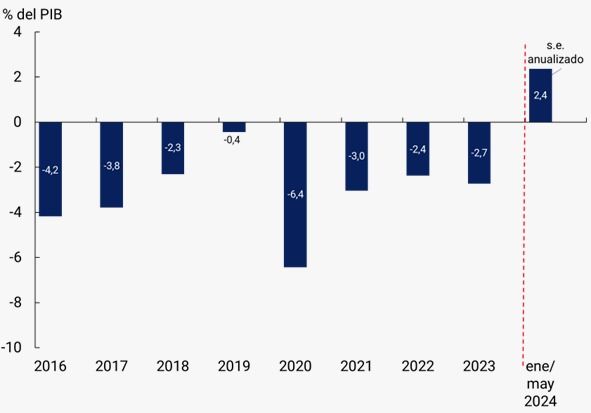

The Government’s strong commitment to the immediate implementation of a fiscal anchor was key to macroeconomic stabilization. The financial balance of the Non-Financial Public Sector achieved as of this year has eliminated the chronic need for financing the fiscal deficit via net indebtedness from the Treasury or monetary issuance. The financial balance objective contemplated in the Agreement was achieved in record time.

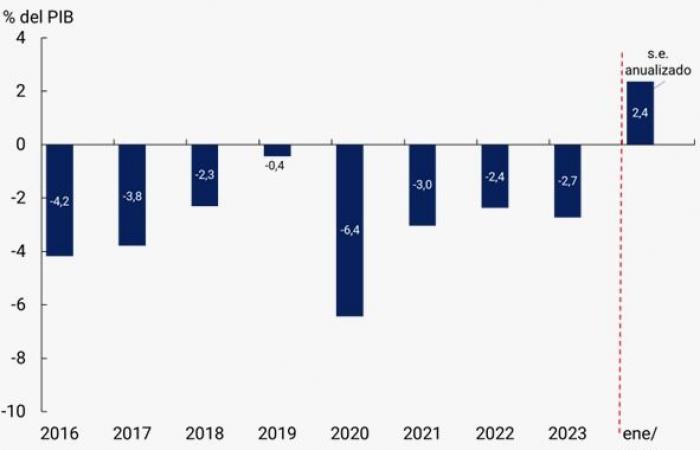

Starting from a financial deficit of 4.6% of GDP in 2023, in the first four months of the year the primary surplus amounted to 0.7% of GDP and the financial surplus to 0.2% of GDP. This result was achieved with a combination of permanent spending cuts and temporary tax increases. Primary spending was reduced by 32% yoy in real terms, with drops of 85% yoy in capital expenditures, 76% yoy in discretionary current transfers to provinces and 43% yoy in other current expenditures.

Primary Result of the National Non-Financial Public Sector

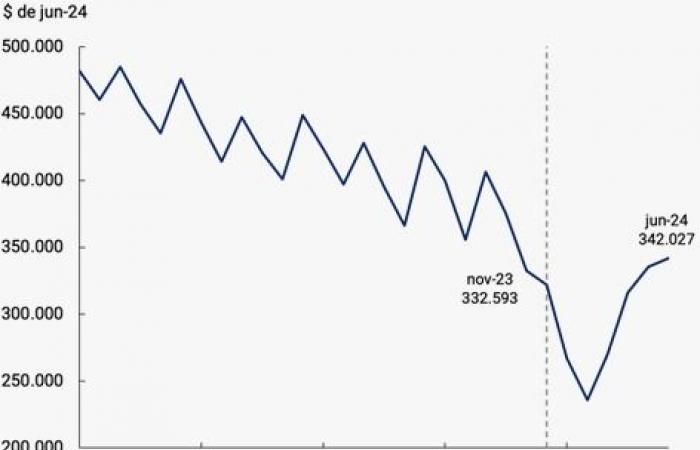

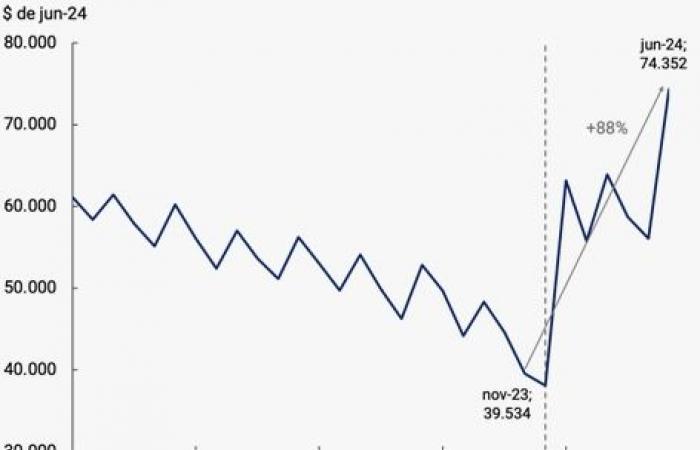

Fiscal balance was achieved without neglecting the most vulnerable population, significantly reinforcing social programs that, without intermediaries, reach the beneficiaries directly. In particular, the Universal Child Allowance increased 335% between November 2023 and June 2024, resulting in an estimated increase in real terms of 90%. The Alimentar Card and the First Thousand Days of Life program also showed real increases estimated at 4% and 470% in said period. Retirements without including the bonus registered an estimated increase of 3% in real terms, as a consequence of the 12.5% reinforcement granted in April and the change to an automatic update for inflation with a two-month delay enabled by the Necessity Decree and Urgency 274/2024 of the National Executive Branch. It is expected that retirements will continue to grow in real terms given the disinflation process underway

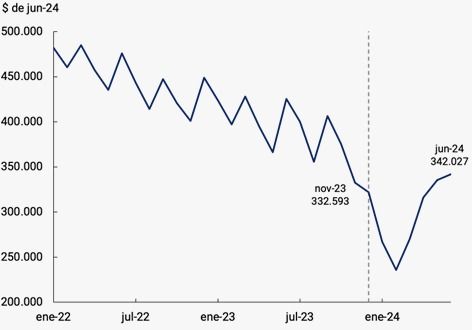

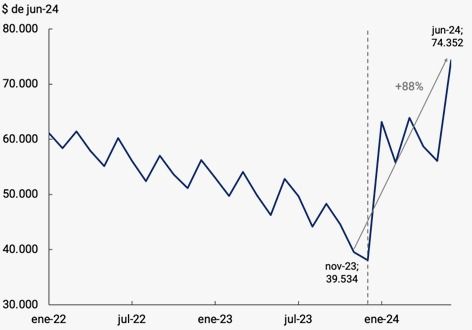

Evolution of Average Retirement Assets

Constant currency*

Universal Child Allowance

Constant currency*

In the second half, with the economy returning to growth and the full effect on the fiscal accounts of the changes in energy rates, the update in the fuel tax and the reduction in operating expenses, the Government hopes to initiate a significant reduction in the most distorting taxes, starting with the PAIS Tax once the Base Law is enacted. In this way, the non-quantitative commitments assumed in the Agreement would also be fulfilled.

Monetary financing goal

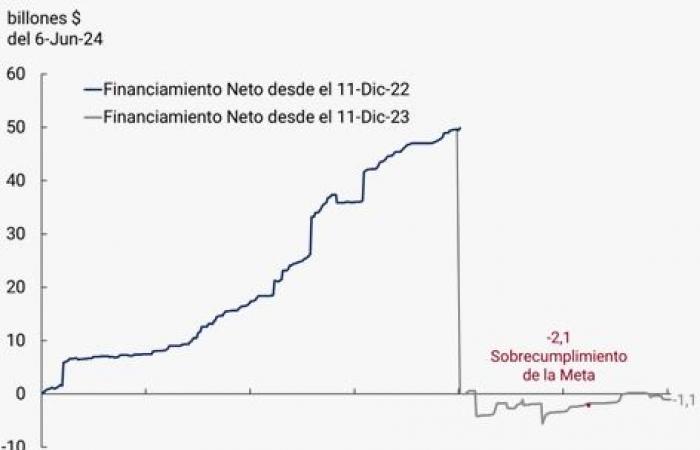

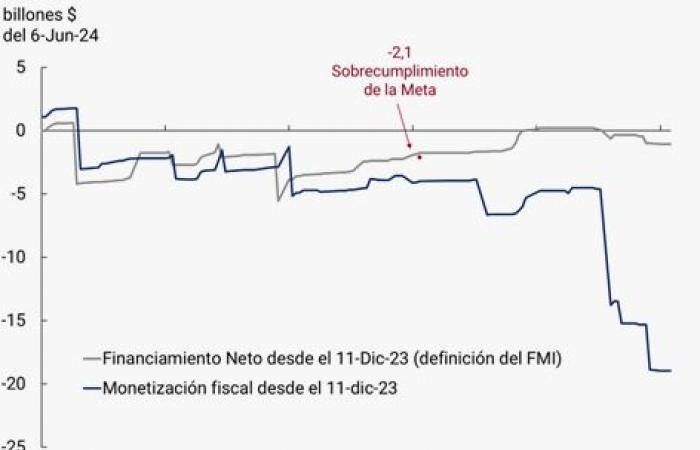

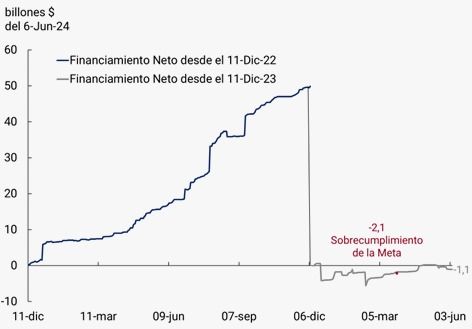

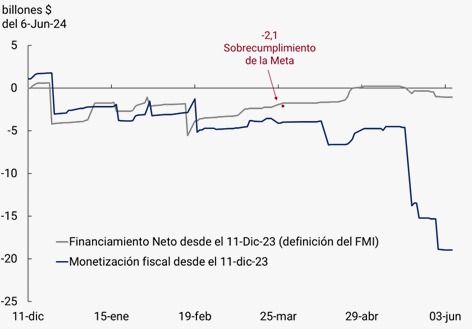

Within a framework of strict fiscal discipline, the BCRA was able to implement a radical change in the management of monetary policy. While in the 12 months prior to 12/10/23 the BCRA had financed, directly and indirectly, the Treasury by $50 billion (at June 2024 prices), these flows were reversed as of the new administration. At the end of the 1st quarter, net monetary financing from the BCRA to the Treasury showed a current balance of -$2.1 trillion, exceeding the quarterly goal that contemplated a limit of $0.

This balance represents a source of contraction in the amount of pesos in circulation, thus contributing to the cleanup of the BCRA’s balance sheet. However, it does not reflect the full monetary impact of Treasury operations. As of today, the goal of net monetary financing to the Treasury remains in negative territory (-$82 billion current) and the contractionary monetary impact of the Treasury’s operations results in a much higher total absorption of pesos by the BCRA, $17 billion. contributing to the disinflationary process.

Net financing to the Treasury (IMF definition)

At constant prices

Net financing to the Treasury, accumulated

At constant prices

Additional monetary actions and results

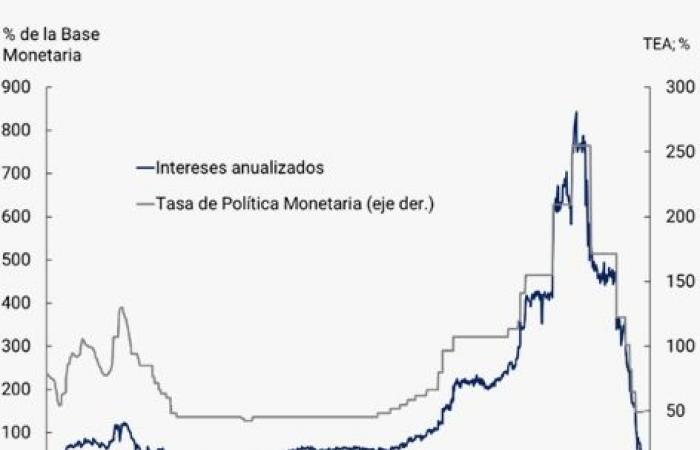

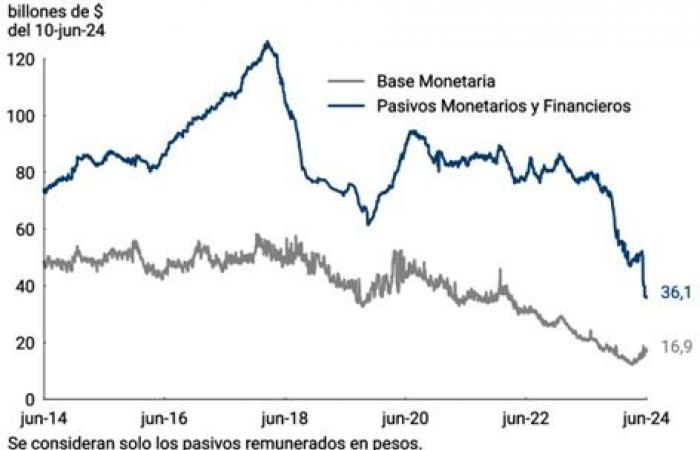

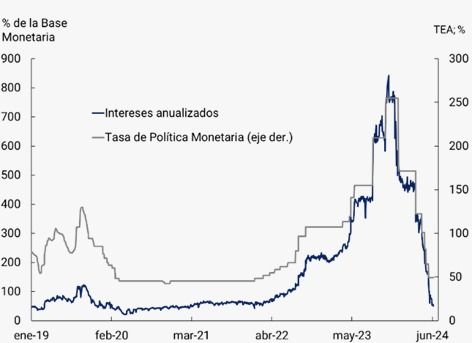

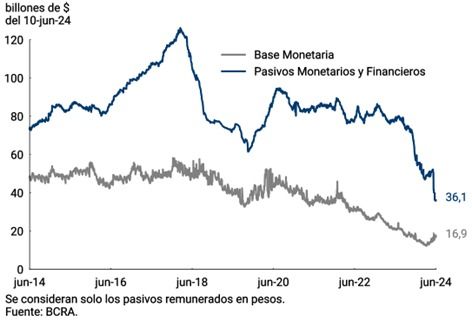

The Agreement does not contemplate quantitative monetary or exchange goals. The BCRA chose to prioritize actions with the objective of drastically reducing endogenous monetization originating from the interests of existing remunerated liabilities. Interest on remunerated liabilities of the BCRA fell by 80%, from more than $5 trillion in November 2023 (at current prices) to around $0.6 trillion per month currently, helping to anchor inflation expectations. Along with the strong progress in resolving the debt of importers, the surplus of the broad monetary base (monetary base plus remunerated liabilities) has been reduced, approaching levels of the monetary base that have historically been associated with periods of equilibrium in the money market. . The macroeconomic balance resulting from the over-fulfillment of the three goals established in the Agreement with the IMF together with the other actions of the authorities has contributed to a rapid reduction in inflation. Inflation in May was 4.2%, a rate that represents half of the inflation projected for that month in December by the private sector. The accumulated inflation of the last six months has been close to 50 percentage points lower than that expected by the consensus of market analysts (REM) in December.

Interest on liabilities paid in pesos

Monetary Liabilities

At constant prices

Finally, it is important to highlight two objectives of the Argentine economic authorities reflected in the Agreement that are ratified in the 8th program review with the IMF: the timely presentation of a monetary programming framework and the elimination, without conditioning of times or forms , of exchange controls.

Monetary programming framework

The BCRA will continue to conduct monetary policy in a flexible, prudent and pragmatic manner. Based on the progress achieved in the recovery of monetary policy tools and the control of money creation factors, the Agreement has foreseen the presentation to the IMF of a monetary programming framework at the end of June 2024. The end of this framework is to contribute to further reducing uncertainty by providing more information on the projected behavior of monetary variables consistent with the continuity of the macroeconomic stabilization process.

Elimination of exchange controls

The BCRA plans to advance in the release of exchange controls and greater exchange flexibility as long as these measures do not imply excessive risks for the process of reducing inflation and strengthening its balance sheet, as reflected in the Agreement. The process will be defined by the Argentine authorities themselves, contemplating the evolution of the relevant economic variables, who will share with the IMF the parameters that will be monitored, without including commitments of specific dates or measures.

Thursday June 13, 2024