- A larger number of addresses kept ONDO with a loss of $1…23, suggesting that the price could fall again.

- Network activity and open interest decrease, therefore the price could drop to $1.15.

After hitting an all-time high on June 3, ondo’s [ONDO], the price has already lost 7.11% of its value in the last 24 hours. At the time of this publication, ONDO price was $1.22. The price decline could be related to profit-taking by token holders.

However, this is not the first time that ONDO price dropped and then recovered. Therefore, this analysis would focus on short-term ONDO price prediction.

To start, AMBCrypto analyzed the Money In and Out of Money at Price (OIMAP) indicator. The Blockchain analysis platform provides information about the indicator.

There is no way out of decline

IOMAP shows the number of addresses that have a token in losses and those that have profits. It also gives an idea of the average price that these addresses purchased the cryptocurrency.

If a large number of addresses have profits and they are more than those that have losses, the price could act as support. Therefore, it would be difficult for the price to drop. However, if a larger number suffer losses, the average purchase price could act as resistance.

At press time, we note that 2,000 addresses purchased 76.50 million ONDO tokens at a weighted purchase price of $1.20. On the other hand, 2,660 addresses purchased 36.16 million tokens at an average price of $1.23.

Source: IntoTheBlock

Despite buying more tokens at a lower price, the upper $1.23 region could push back ONDO price. This is due to the larger number of addresses at that time.

If that happens, ONDO’s price prediction could be a drop to $1.15 in the near term. Another metric driving the potential price drop is active addresses.

Careful ! $1.15 wants to appear

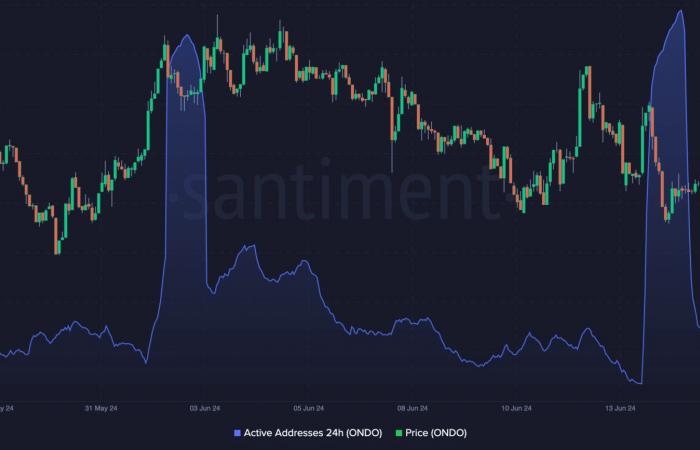

Active addresses show the number of users transacting on a blockchain. An increase in the metric denotes an increase in user activity. On the other hand, a decrease implies that users are refraining from active transactions.

AMBCrypto noted that ONDO price increased whenever activity on the network recovers. At the time of this publication, the 24-hour active addresses had decreased to 1,370. Therefore, considering the correlation between the price and the metric, the token could suffer another drop.

Source: Santiment

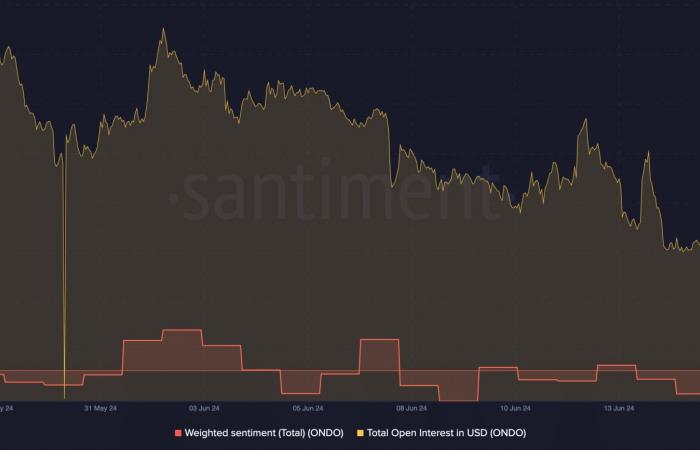

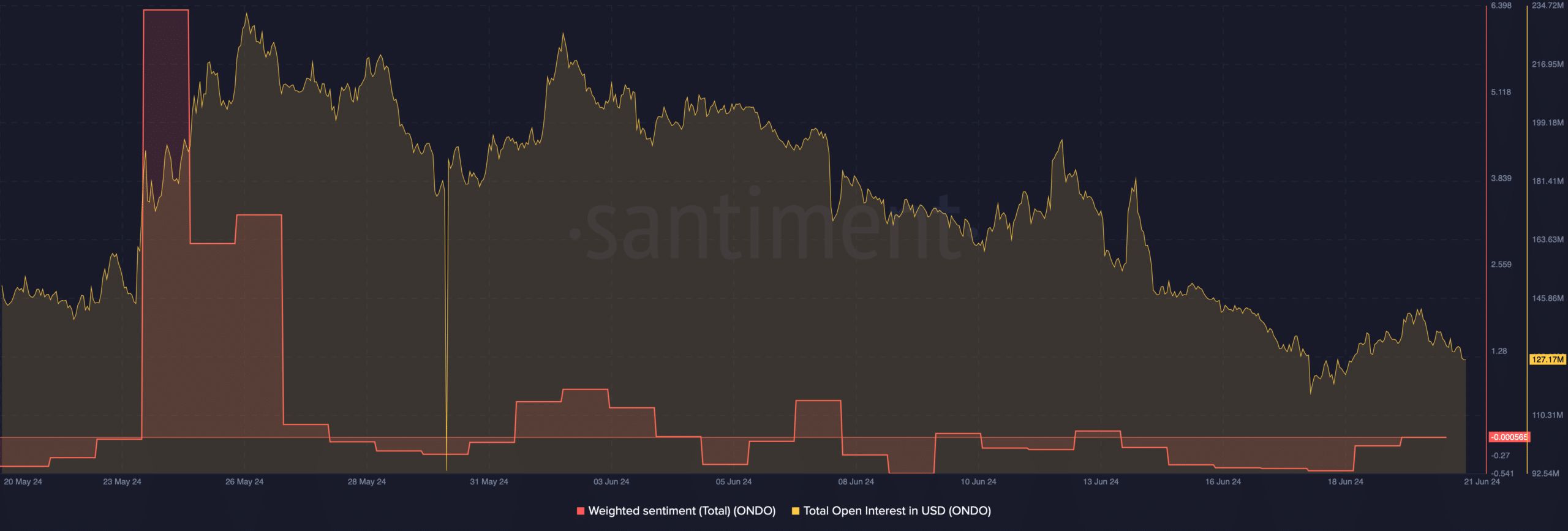

In addition to network activity, AMBCrypto checked the weighted sentiment. Weighted Sentiment uses social volume to measure comments about an online project. A positive reading of the metric implies that sentiment is bullish.

On the contrary, a negative reading suggests that there are more negative comments than positive ones. At the time of writing, we noted that the sentiment was negative. If this remains the case in the future, the ONDO price prediction could be a slide down the charts.

When it comes to Open Interest (OI), it wasn’t any better. An increase in OI would have meant an increase in speculative activity. If this had been the case, ONDO could be studying the possibility of recovery.

Source: Santiment

Realistic or not, here is ONDO Market Cap in terms of ETH

However, the OI at press time had been reduced to $121.17 million. A further decline in the indicator means less liquidity inflows for the token.

Therefore, the short-term ONDO price prediction could be a drop to $1.15 as mentioned above.

Next: Ripple’s next battle: lawsuit to determine XRP’s security status proceeds

This is an automatic translation of our English version.