The art market raised 57,000 million dollars last year, which represents a 12% drop compared to the previous year according to … Statistics from the latest report published by Art Basel. The decrease accentuates the recession initiated in 2023, when it contracted 4% and broke the recovery produced after the end of the pandemic. In addition, the incipient positive signs detected in this first quarter of the current year are questioned at the conflict derived from the sudden tariff increase of US President Donald Trump.

The decrease in 2024 contrasts with the 3% increase in the number of transactions, 40.5 million, a figure that responds to dynamism in the medium and low segments. This circumstance has been interpreted as a certain democratization of trade and has its reflection in the gallery field. Those smaller firms, which have a balance of less than $ 250,000, have increased their income by 17%, while those that exceed 10 million annually have receded 9% and even 39% in terms of works that exceed that price.

Uncertainty explains this stagnation. Inflation, international political insecurity, aggravated by war conflicts such as Ukrainian, and growing tensions between great powers, have negatively impacted the most exclusive section. The anxiety has altered the behavior of supply and demand in the secondary market. Thus, the owners do not bring their great works for sale in fear of not obtaining good auctions, while the acquirers aspire only to very high quality pieces. The 14% increase in private sales of auction houses corroborates this trend since distrust of its sale in the room and predilection for private transactions.

The geographical distribution of the crisis shows notable differences within a homogeneously negative scenario. The United States maintains its prominence with 43% of total sales despite experiencing a drop of 8% of its amount and Great Britain recovers second place with 18% of the world assembly and a 5% decrease. This predominance of Anglo -Saxon countries is favored by Chinese disaster, which retains 15% after retreating 31% in annual income, possibly weighed by their particular real estate crisis.

Template reduction

The big auction houses have suffered the onslaught of the recession. Christie’s has experienced a 16% decrease in the annual balance, while Sotheby’s, its traditional rival, has reached 23%. Both have arranged for shock measures such as the reduction of templates to face the situation or the celebration of events in countries such as Saudi Arabia, one of the emerging actors in the international market.

The programs, in any case, show the low presence of essential teachers and works, those that exceed 10 million dollars. That process has worsened. Throughout the last year, the disbursement for the 100 most expensive works was 1.8 billion, while in 2023 it had been 2,400 and 4,100 in the immediately previous period.

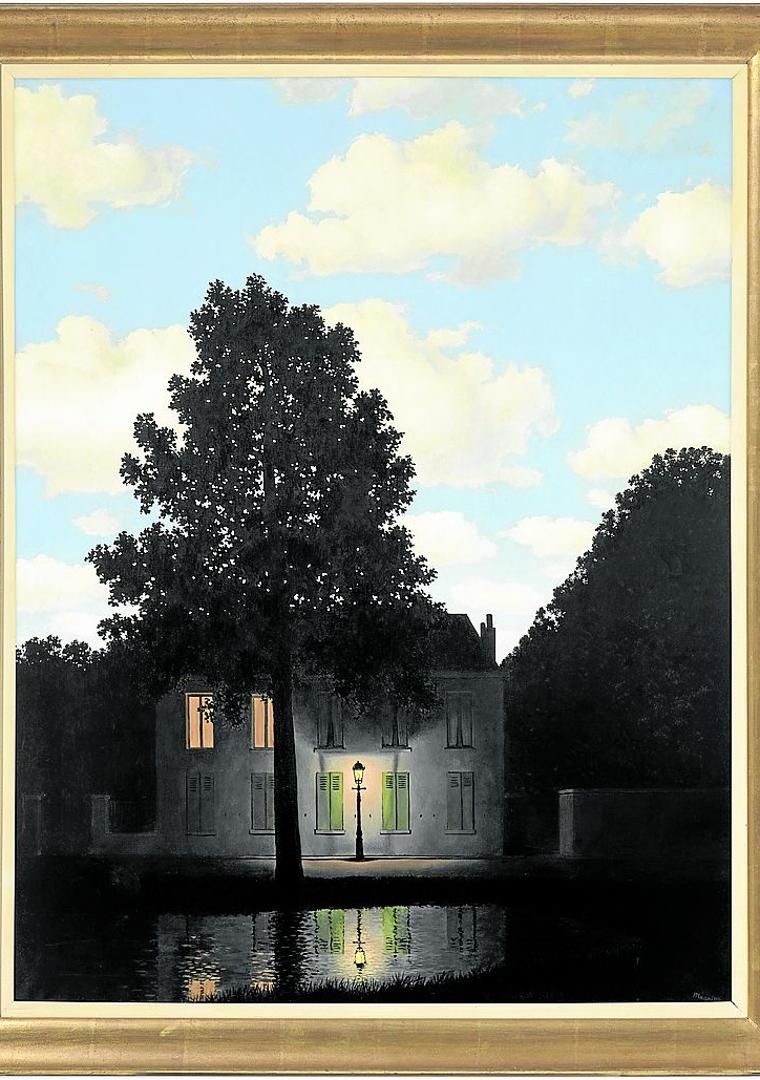

The records did not abound and surrealism was the great protagonist in that regard. The canvas ‘L’Empire des Lumières’ by René Magritte was sold at 121.1 million dollars in November, the highest figure achieved by the Belgian painter, on the other hand, Leonora Carrington has been among the most quoted artists thanks to ‘Dagoberto distractions’, one of his fundamental works and that the Argentine collector Eduardo Constantini acquired by 28,5 millions.

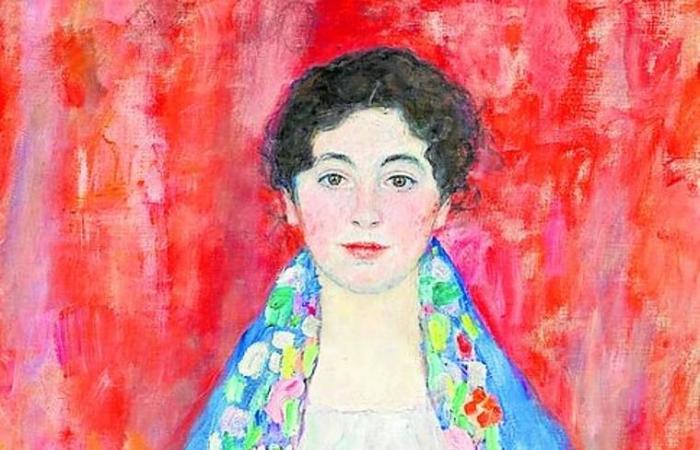

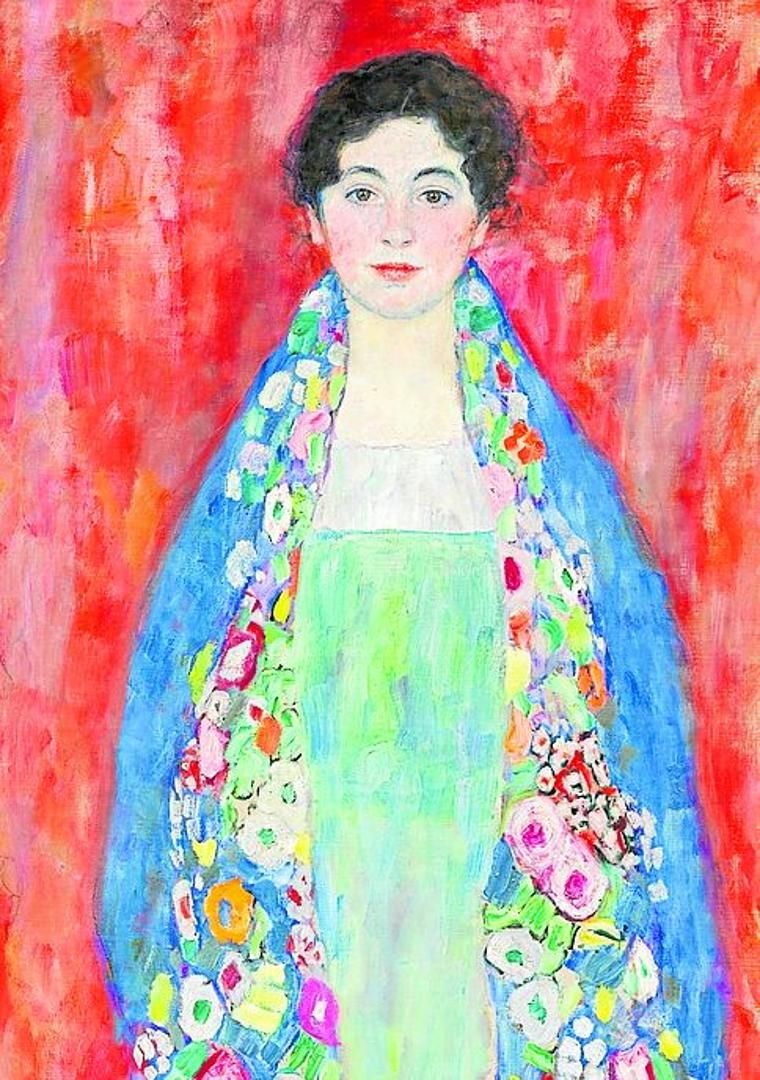

A certain conservatism was the general tonic among the best -selling paintings. ‘Portrait of Miss Lieser’ by Gustav Klimt constituted another milestone when he reached 70 million, while Andy Warhol, usual in the big appointments, was represented by ‘Flowers’, which obtained 58 million. Impressionism continues to demonstrate its refuge value after the auction at 34.8 million ‘Meules à Giverny’, signed by Claude Monet.

The recovery glimpses of the first third of 2025 can be spoiled if the White House tax strategy continues. There are not yet certainty that tax increases affect works of art, considered by local legislation as ‘informative materials’ and, therefore, protected by constitutional norms that arm public liberties.

Trump measures not only affect local trade. China, the main affected, has threatened to respond with the Talion Law. The announcement affects even before its effective application. Insecurity hinders market fluidity and deter those who wish to part with their best possessions. Also entrepreneurs and large collectors, in the case of Jeff Bezos, can expect better times to continue extending their magnificent collections.