Key facts:

-

“You have to wait for the speculators to be liquidated or to get bored and close positions,” says Woo.

-

For Nodecharts, bitcoin is “in a delicate situation.”

Bitcoin (BTC) is going through more than 3 months of boring lateralization. After reaching its historical maximum price in March 2024, it entered a range with a horizontal guideline from which, so far, it has not managed to exit.

Even though bitcoin goes up and down, as determined by supply and demand in the market, The price has remained fluctuating between $56,000 and $73,000as can be seen in the graph below:

According to trader and social media influencer, Willy Woo, Bitcoin would have several more weeks of lateralization left. Still, for him, it is not the time to go «to the moon«.

Woo explains that Speculators still need to be liquidated or “get bored and close positions”. “Then we can move on,” she anticipates. According to him, the best thing to do now is accumulate BTC in cash and wait.

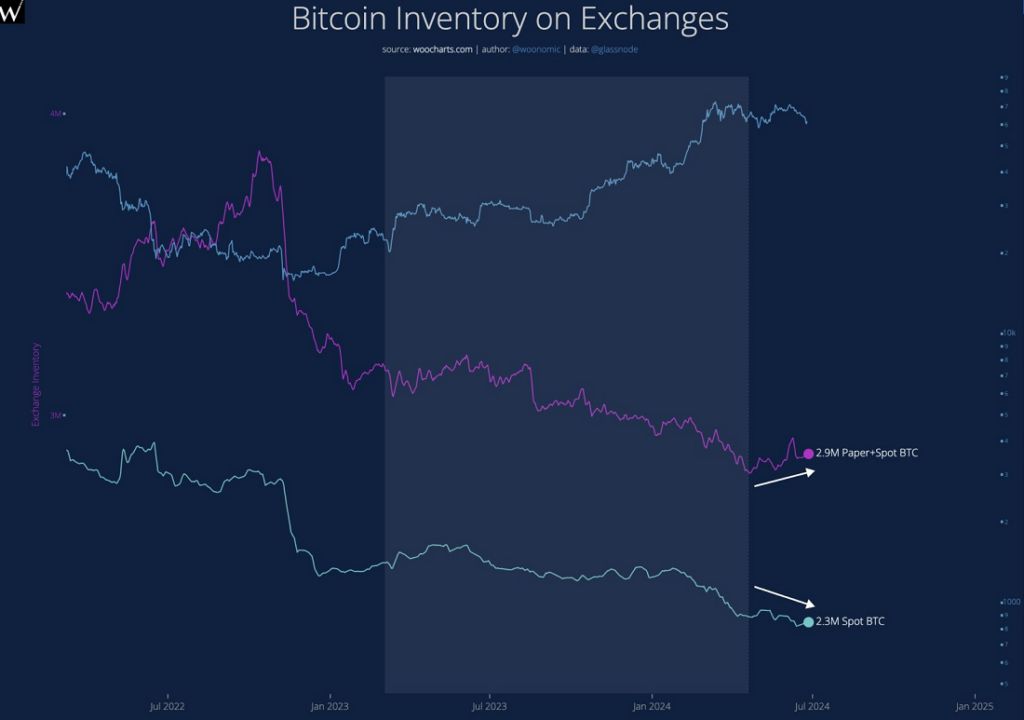

The influencer shows with on-chain data that traders are withdrawing bitcoin from exchanges.

This is potentially bullish for the digital currency because implies that those BTC are not easily available for sale. Investors could be adopting a long-term hodl strategy.

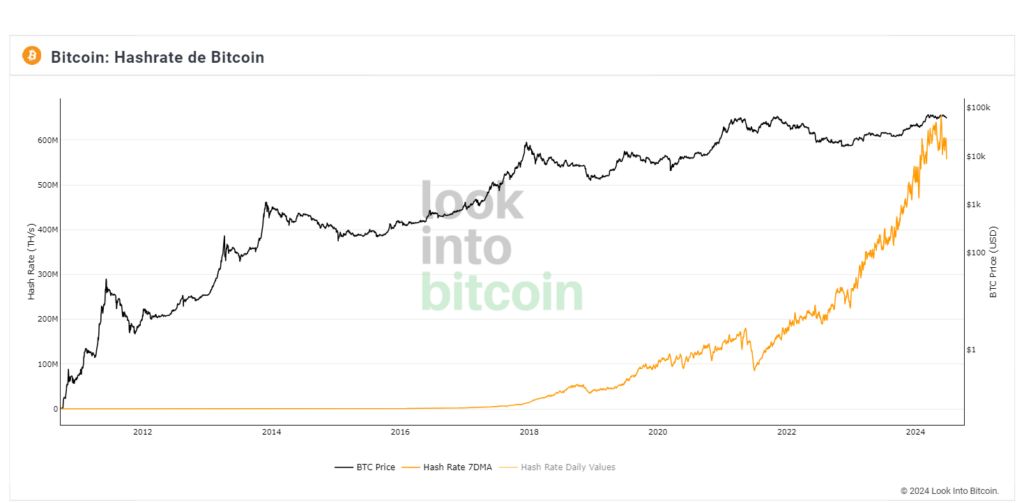

On the other hand, Woo sees the role of Bitcoin mining — which provides security to the network while serving to validate transactions and issue new BTC — as fundamental to the price of the currency. As can be seen in the chart provided by LookIntoBitcoin, the hashrate is close to its lowest points of the year.

The rebound in this hash rate, Woo explains, “will be an important sign that miners have stopped selling to finance hardware upgrades.”

Days ago, CriptoNoticias had reported that this same analyst said that the weakest miners (that is, those who had not updated the hardware to current requirements) must “die”. By this he meant that they capitulate, withdraw from the industry and, thus, stop selling bitcoin that they have in reserve.

“When Bitcoin shakes off the weakness, what happens is that inefficient miners that run old hardware and have high costs go bankrupt. Meanwhile, others are forced to upgrade to more efficient hardware. Because? Because your income is reduced by half while maintaining the same costs. Both cases force miners to sell their BTC to pay for losses or hardware upgrades. “Once that is over, the sale is over and there are only the strong ones left who accumulate waiting for higher prices.”

Willy Woo, trader and market analyst.

“Bitcoin is in a delicate situation”: Nodecharts

The on-chain data provider firm, Nodecharts, analyzes different metrics than those used by Woo, but reaches similar conclusions. According to Nodecharts, The fall that bitcoin has had in the last week and that took it below $60,000, put the digital currency “in a delicate situation”.

Now, bitcoin “needs to demonstrate strength in this price range” and, according to Nodecharts, “reaching new highs will take some time.”

«$60,000 should act as solid support. If not, the probability of falling back to $56,000 or $58,000 increases considerably.

Nodecharts, on-chain data provider company.

CriptoNoticias has explained that $56,000 is a key price for bitcoin Well, if it loses that level, it would enter a downward trend that could include important corrections.

What will happen to bitcoin in the remainder of 2024?

Despite occasional bearish corrections, overall, The market is optimistic about the price of bitcoin for the remainder of 2024 and 2025. Historical patterns, which tend to repeat themselves in each cycle, show that BTC has a large price increase about 6 months after each halving (and the most recent was on April 19), so by the end of the year the long awaited’bull run‘.

Furthermore, this year bitcoin has a bullish catalyst that it did not have before.: Spot ETFs in the United States, which greatly facilitate corporate and institutional investing. Large investment funds, individual traders, banks and even state governments are investing in bitcoin ETFs. All of this drives demand for BTC, impacting its price.

Regarding the possible behavior of bitcoin, spokespersons for the Argentine exchange Ripio shared some price projections with CriptoNoticias:

«In the medium term, analyzes suggest that the snowball effect of the halving + ETF combo, and that critical clash between decreasing supply and increasing demand, will lead prices to a scale that would range between $100,000 and $175,000. here in mid-2025. The most risky estimates even reach $400,000 per bitcoin.

Ripio, bitcoin and cryptocurrency exchange.

Ripio adds that “if you review these 15 years of history, bitcoin always had a general bullish path, to the point that at each halving the cryptocurrency always added another digit to its price.”