The Central Bank of Chile (BCCh) chose on June 18 to cut its Monetary Policy Rate (MPR) by 25 basis points, to place it at 5.75%, as the market expected. Furthermore, this Wednesday, June 19, the CBC published its Monetary Policy Report (IPoM), in which it increased its inflation projections for 2024, estimating that December will end with 4.2% year-on-year (the last Report, published in March, forecast 3.8%).

“The projection considers that annual inflation would close 2024 at 4.2% and that in 2025 it would end at 3.6% (3% was expected in March), with average inflation that would be 1.1 percentage points higher during that year. . Its convergence to 3% will occur in the first half of 2026″, reflects the Central Bank’s Report.

Source: IPoM.

The document clarifies that the reduction in estimated inflation assumes that the transmission of the electricity cost shock will operate according to usual patterns. In addition, it considers some downward adjustments to rates starting in the second half of 2025.

See more: Chile awakens investor interest in lithium contracts despite falling prices

For activity, the scenario contains limited changes compared to March. For this year, the June Report projects that the Gross Domestic Product (GDP) will grow between 2.25% and 3%. The adjustment in relation to the range estimated in March (2-3%) is associated with better effective data on the spending side and the initial scope of the rise in the price of copper.

In the medium term, the effects of this last element are offset by the negative impact that adjustments in electricity rates have on household disposable income. This affects the maintenance of the growth range between 1.5 and 2.5% for 2025 and 2026.

What can happen with the Monetary Policy Rate?

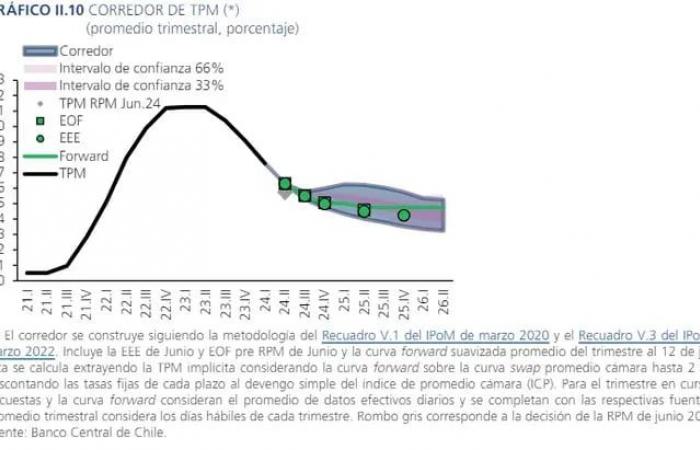

The Central Bank estimated in its report that, if the assumptions of the central scenario materialize, The Monetary Policy Rate would have accumulated the bulk of the cuts planned for this year during the first semester. In nominal terms, this trajectory is somewhat above what was contemplated in the last Report.

“However, the real MPR of the current central scenario is lower than that implied in the March scenario for the short term, although similar on average for the next two years,” the document states and clarifies that this is consistent with the framework of inflation targeting monetary policy, which allows supply shocks to be accommodated in the policy horizon and, thus, cushion their impact on activity, demand and employment.

The central scenario of the June Report considers that The MPR will continue to reduce during the monetary policy horizon, at a rate that will take into account the evolution of the macroeconomic scenario and its implications for the trajectory of inflation.

However, the CBC clarifies that There are scenarios where monetary policy could follow a different path than the central scenarioas reflected in the TPM corridor.

Rate broker.

The Central Bank indicated: “The Council will ensure compliance with the inflation target, evaluating, on the one hand, that the spread of the tariff shock is as expected and that inflationary persistence does not increase. On the other hand, monetary policy should adequately support the economy when it has entered a process in which its growth is gradually approaching levels consistent with its trend and the labor market improves.”

What does the market expect in terms of rates?

“For now, it seems appropriate to work with a MPR between 5.25% and 5.5% as of December 2024, where we also expect an upward adjustment in the annual inflation projection for 2024 and 2025,” said a Scotiabank report. published after the announcement of the 0.25 basis point cut.

The Scotia analysts also maintained: “The BCCh will wait to see the inflationary effects of the increases in electricity rates and the exchange rate transfer before continuing to cut the MPR, especially after the rate is at a level that is much more appropriate for the cyclical position of the economy, as we noted previously.”

The Scotiabank document stressed that the Central Bank statement, which accompanied the rate cut, showed a “cautious bias.”

Split decision

Yesterday the Central Bank of Chile made the decision to lower the interest rate by 25 basis points, taking it to 5.75%, as the market widely expected, although the decision was not unanimous, considering that the vice president voted for a reduction of half a percentage point.

Evolution of copper

The central scenario considers that the price of copper will average US$4.3 per pound between 2024 and 2026, above the US$3.85 assumed in March. It is estimated that more than half of the increase in said price since the beginning of this year would be due to more persistent factors. The projections include a positive impact of this adjustment on several dimensions, including investment, agents’ expectations and the current account balance.