On Tuesday, gross reserves were close to US$30,000 thanks to the IMF payment. However, a report warns about the problem that is beginning to arise for Santiago Bausilli.

After the disbursement of US$800 million from the International Monetary Fund (IMF), The gross reserves of the Central Bank were close to US$30,000 million and although there was an improvement in the liquidation of agriculture, another factor added to the fact that the pace of purchases was much lower. These are energy imports that added another demand for the organization led by Santiago Bausilli.

The content you want to access is exclusive to subscribers.

to subscribe I am already subscribed

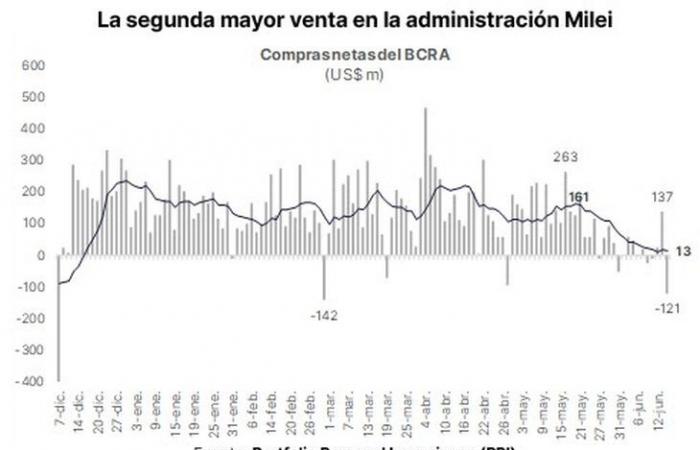

The monetary authority continues to struggle to recover the buying rhythm. On Friday it lost $121 million, the second largest sale in the current administration. This Tuesday, the volume traded in the market, an indicator that allows us to glimpse the dynamics of the export supply, was US$529 million, the highest figure since April 22. Despite that, The entity chaired by Bausili bought only US$82 million, a slower rate than a few weeks ago. It is worth remembering that the third quarter, seasonally, is usually more complex to accumulate reserves.

unnamed (1).jpg

The BCRA continues to fight against the lower pace of reserve purchases

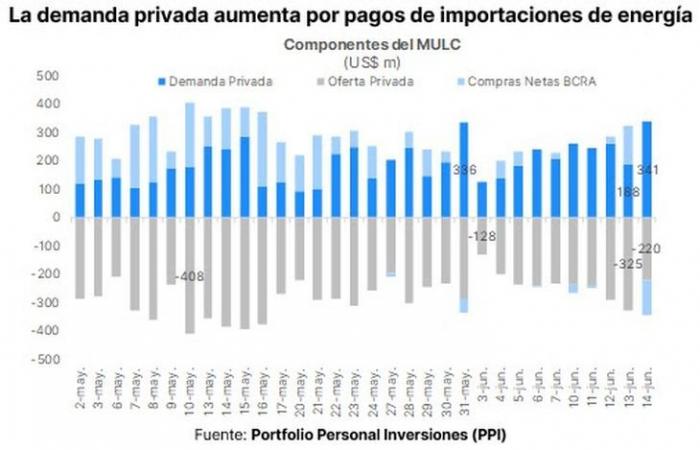

According to PPI, “both the supply and “private demand are beginning to conspire against the accumulation of reserves”. On the supply side, the irregularity in agricultural marketing was once again highlighted in recent days: “The perspective that the stocks could be dismantled in the short term, added to a low cost of leverage, would have encouraged producers to not sell their stocks, delaying the liquidation of exporters”.

unnamed (3).jpg

Energy imports and the low liquidation of agriculture threaten the accumulation of reserves

PPI stated that from the demand side “payments for energy imports would have been channeled, which have immediate access to the MULC instead of postdated”. They added that “there is also greater access for importers to the MULC, given that since 04/24 importers can access a quarter of the 25% quota in 30/60/90/120 days from 12/26.”

In this sense, he stressed that “The dynamics of recent days predict a worrying outlook for the third quarter if the stocks remain in place”since the BCRA “is usually a net seller in the third quarter, given that the seasonality of imports and “the agricultural supply begins to play against the accumulation of reserves.”