Investment in artificial intelligence is on everyone’s lips, and its companies are flying on the stock market. With so much rise, is there still room to go up in these companies? Are there companies related to AI that have not run as far, but that may be linked and can grow in the medium term?

In its recent equity outlook report, Fidelity International highlights the continued potential of the technology sector, with a special focus on opportunities related to artificial intelligence (AI). According to Radhika Surie, chief investment officer at Fidelity International, Although AI has been a predominant theme and will continue to be so, the technological space offers a wide range of attractive opportunities for investors.

The technology sector will expand

According to the expert, the technology sector has demonstrated robust leadership in the market this year, and this trend is anticipated to continue. The S&P 500 IT Index has seen an increase of 16.9% through May 31, outperforming the overall S&P 500 Index, which has increased 10.7% over the same period. Within the technology sector, companies like Nvidia have stood out significantly due to their exposure to AI.

Surie emphasizes that although some of the most prominent stocks in the semiconductor and hardware space have high valuations, “There are many companies exposed to AI that can be bought at more attractive valuations throughout the value chain of this topic.“.

Companies that do not depend on rapid adoption of AI but still benefit from its growth, such as those in the cloud computing and certain semiconductor manufacturers, present promising opportunities. Furthermore, companies IT and data serviceswhich combine technological and industry expertise, are well positioned to drive the AI transformation across multiple industries.

More opportunities in technology

The tech industry is not just limited to AI. Areas such as video games, on-demand media and payment services They also present considerable growth potential, highlights the head of Fidelity International.

An example would be innovation in video games is leading to greater interaction with users, and AI can further enhance this sector. “The video game industry is entering a new stage of innovation in which interaction with users is likely to increase.. “AI can help the industry develop more attractive offers with more dynamic interaction,” says Surie.

On-demand media and music streaming remain under-monetized, but industry leaders are well positioned to benefit from further consolidation and diversification of audio formats. In terms of payment services, the growing demand for mobile transactions and the penetration of high-speed Internet are creating a favorable environment for growth.

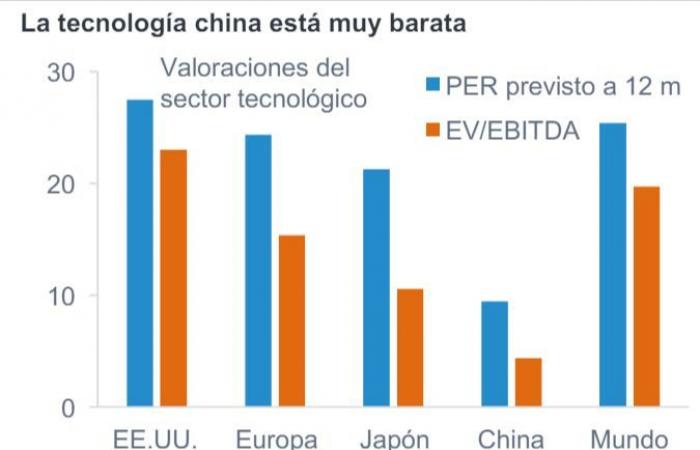

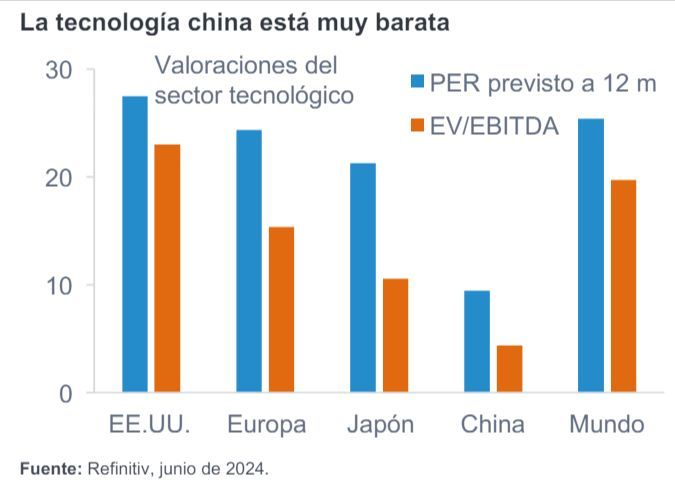

China’s technology sector, at reasonable prices

Despite the regulatory and geopolitical risks, The Chinese technology sector offers attractive opportunities at reasonable pricessays the expert. “Despite the regulatory and geopolitical risks, sYou can find quality Chinese companies at attractive prices, including some technology giants. “These companies remain strong, trade at low multiples and are developing more shareholder-friendly policies.”

“Looking ahead to the rest of the year, AI will be an important topic, but technology is a broad sector that houses a large set of opportunities that investors would do well to explore,” concludes Surie.

This content has been partially prepared with artificial intelligence, under editorial criteria and does not constitute a recommendation or investment proposal. Investment contains risks. Past returns are no guarantee of future returns.