- Tierra del Fuego leads cryptocurrency transactions in Argentina, taking advantage of tax incentives and cold weather for mining.

- Lemon Wallet’s “Crypto Cup” reveals Patagonia’s dominance in cryptocurrency transactions amid economic instability.

In Argentine Patagonia, cryptocurrency adoption is remarkably high, especially in the sparsely populated Tierra del Fuego region.

This area leads the country in digital transactions, largely due to its favorable conditions for Bitcoin mining. He Cold weather effectively cools mining equipment, and local tax incentives further enhance the sector’s attractiveness, as we have written in Crypto News Flash.

Lemon Wallet, an Argentine digital exchange, tracks and ranks provinces by their cryptocurrency transaction volume. Its recent “Crypto Cup” initiative revealed that Tierra del Fuego executed 19% of these transactions, the highest in the region. This activity takes into account the small population of the province and its harsh winters.

Other provinces in Patagonia, such as Chubut, Neuquén, Santa Cruz and Río Negro, also show strong use of cryptocurrencies. This is partly due to the high salaries needed to compensate for the high cost of living in such remote areas.

Neuquén, in particular, benefits from its proximity to the Vaca Muerta shale gas field, where excess gas fuels local Bitcoin mining operations, adding a layer of sustainability to the energy-intensive process, you can read more about it in our coverage in Crypto News Flash.

Nationally, Argentina’s engagement with cryptocurrencies is one of the highest in Latin America, with 18.9% of its population reported as users.

This is largely due to an attempt to mitigate the impact of severe inflation, which reached 211% last year.

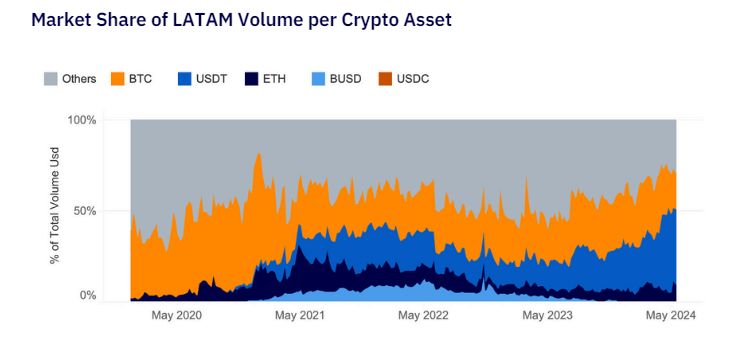

Argentines prefer dollar-pegged stablecoins such as USDC and USDT, which account for 60% of cryptocurrency purchases in the country. This preference helps protect your savings from the volatility of the Argentine peso.

ThePatagonia is the central mining company in Argentina’s Bitcoin market, not only because of its mining capabilities, but also because of the growing trust of its residents in digital currencies as a hedge against economic instability.

The region exemplifies how geographic and economic challenges can catalyze innovative financial practices, positioning Argentina as a pioneer in the global cryptocurrency market.