With the price of the dollar rising, many people who have savings in this asset have wondered if it is time to sell. However, If you do not have a financial emergency and if you do not need immediate liquidity, the analysts assured that it is better to be patient, since the dollar could continue gaining ground in Colombia.

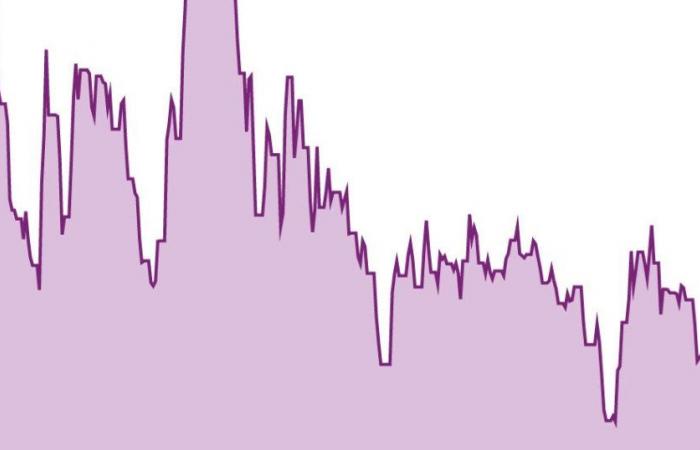

The dollar closed on Friday at $4,151.74. But in the intraday quotes of that day it managed to reach highs of $4,215 and in the last week it gained more than $200sufficient reasons for several people with savings in dollars to believe that there is no better opportunity to sell than now.

However, LR spoke with several analysts about this decision and they assured that, unless the investor does not have a financial emergency and does not need immediate liquidityyou better wait a little longer, because the dollar could reach $4,400 this semester.

“We changed a trend that was bearish, but at this time we can revisit the highs of $5,000. The country’s fiscal situation is complex, The Government is spending with both hands and income is falling more and more,” explained Juan Pablo Vieira, CEO at JP Tactical Trading.

In addition to these factors, he mentioned that investment continues its downward trend, which would be the complement to what Vieira called ‘the perfect storm’ so that the dollar maintains this trend and greater future gains can be achieved.

However, Edgar Jiménez, a finance specialist, explained that for short-term speculators it is a good time to sell and realize profits.

If you do not have this urgency, Sebastián Toro, CEO and founder of Arena Alfa, explained that having dollars is long-term protection. “The fact that the dollar has risen 5% or 10% should not be a reason to remove your hedges or your diversification because it really is a protection for greater risks, As savings, I believe that one should always have that exposure to the dollar, regardless of whether it is at $4,200 or if it drops to $3,900, it is long-term protection,” explained Toro.

Why so much volatility?

Mauricio Acevedo, strategist of foreign exchange and derivatives for Corficolombiana and Casa de Bolsa, for its part, explained that One of the main protagonists regarding the movement of the dollar are OffShore, that is, investment companies located abroad.

“When large foreign investment funds want to diversify, they distribute their resources in different areas of the world: treasures in the United States, bonds in European, Asian and Latin American countries”Acevedo said.

These portfolio investment flows are an international factor for the dollar moves, since their volumes cause the currency to fluctuate. Acevedo assured that the resources that arrive in Latin America reach five countries that share two essential characteristics. “First, organized markets, where these investors can enter and exit with their resources easily and with clear rules of the game; and second, that they are large enough so that they can receive the resources,” he said.

Those five countries are: Brazil, Mexico, Peru, Colombia and Chile. However, when governments do not generate that confidence in companies, they refrain from investing, which causes the dollar to gain more or less strength in the region.

“The dollar in Latin America is gaining a lot of strength, It is not time to go out and sell dollars yet, because this movement is still going to continue”Vieira concluded.