According to a Bloomberg Lineal report, Buenos Aires and La Rioja are among the most complicated provinces, according to a report that follows the 14 jurisdictions that have debt issued in the market.

19:02 | Friday June 14, 2024 | La Rioja, Argentina | Fenix Multiplatform

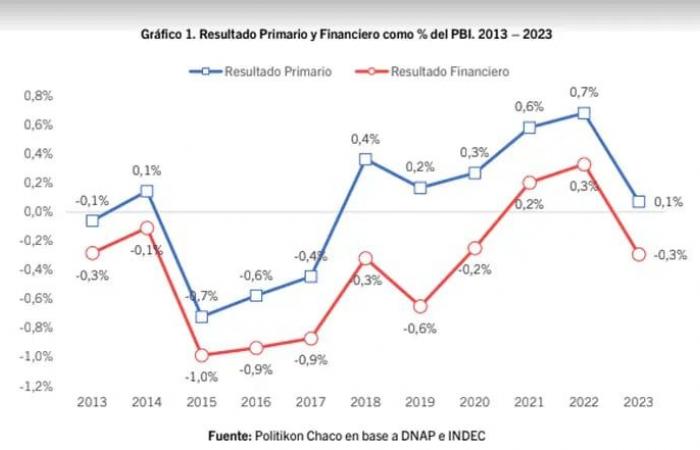

The Argentine provinces managed to chain, between 2018 and 2023, six consecutive years of consolidated primary surplus (that is, adding the 24 autonomous districts). However, the recently published data for the last year show that there was a deterioration in their accounts: in 2023 the primary surplus was just 0.1% of GDP, against 0.7% in 2022, and there was a financial deficit of 0.3%.

Going forward, a report published by the broker Facimex Valores maintains that the situation is “challenging.” The document details: “Leverage reached its highest level in 15 years due to the December devaluation, which left a very high real exchange rate. In the fourth quarter of 2023, the debt stock of the provinces reached 9.4% of GDP (it was 5.2% in the same period of 2022) and the net debt of deposits reached 6.5% of GDP (2 .8%)”.

Analysts report that these are the highest figures for leverage and debt net of deposits since 2007 and 2009, respectively. In terms of operating income, gross debt rose 25.1 points from the previous quarter, to 58.5%, and net debt rose 21.8, to 40.7%.

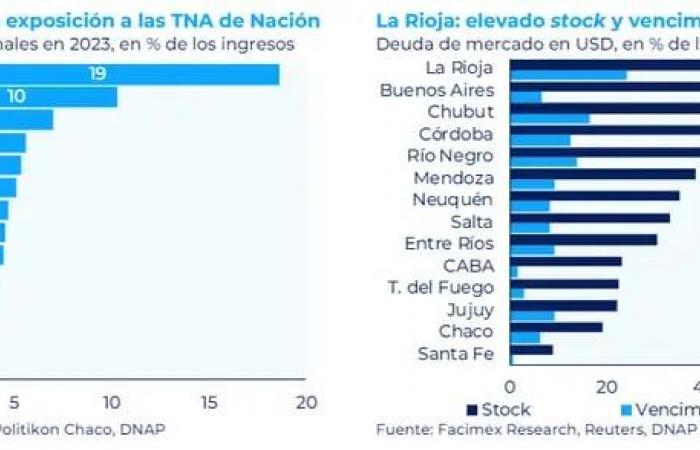

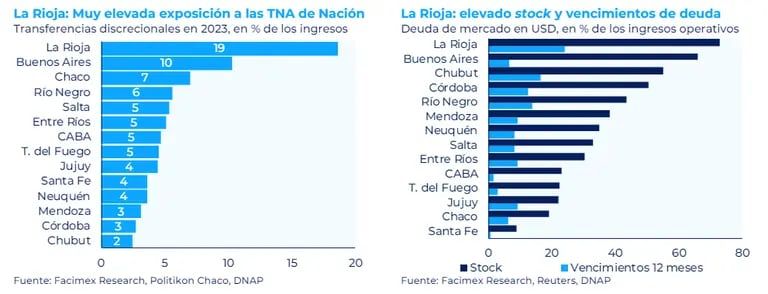

The Facimex Valores document analyzes in detail the 14 jurisdictions that issue market debt (Buenos Aires, Autonomous City of Buenos Aires, Chaco, Chubut, Córdoba, Entre Ríos, Jujuy, La Rioja, Mendoza, Neuquén, Río Negro, Salta, Santa Fe and Tierra del Fuego) and on them performs a ranking of fiscal vulnerability.

And, of that group, he clarifies: “CABA, Mendoza, Córdoba and Santa Fe are the top provinces in our ranking, while La Rioja, Buenos Aires and Entre Ríos are the most vulnerable.”

Province ranking

The aforementioned ranking evaluates:

- Operating margin / operating income for the last 5 years (with a weighting of 16.7% and positive valuation).

- Stock of net debt / operating income (16.7%, negative).

- Total deposits / debt stock (13.3%, positive).

- Primary result / income (13.3%, positive).

- Operating margin / operating income (10%, positive).

- Operating margin / interest (10.0%, positive).

- Market debt maturities in foreign currency / operating income (6.7%, negative).

- Own income / income (6.7%, positive).

- Personnel expenditure / operating expenses (3.3%, negative).

- Capital spending / primary spending (3.3%, positive).

Buenos Aires and La Rioja, the most vulnerable

This is how Facimex Valores analyzes the provinces that, in the opinion of its economists, are the most vulnerable:

La Rioja stands out for a weak operating result, low income autonomy, high net leverage and a challenging maturity profile.

- The Province of Buenos Aires stands out for its weak primary result and high net debt.

- Entre Ríos, due to its weak operating and primary results.

- And Río Negro due to its weak composition of spending.

To what was mentioned in the report, and with a view to the future, we must add that the Government of Javier Milei has been significantly cutting transfers to the provinces. In the period January – May 2024, non-automatic transfers fell by more than 80% in real terms year-on-year and automatic transfers by close to 10%.

The most solid

In the Facimex Valores ranking, CABA stands out above the rest and is followed by Mendoza, Córdoba and Santa Fe. The fundamental drivers are:

- CABA has high records in all indicators except for personnel spending.

- Mendoza has the advantage of having better indicators than the provincial median on all fronts, although it stands out for its high capital expenditure and its liquidity position (although transitory).

- Córdoba stands out for its excellent fiscal track record and its favorable spending composition.

- Santa Fe stands out for its low leverage, a clear maturity profile and its solid liquidity position.

Source Bloomberg (By Juan Pablo Álvarez)