One of the variables that any successful economic policy has to include is the clear definition of the monetary policy that the government will carry out. In this sense Javier Milei It is not clear at all and enters into contradictions that generate uncertainty.

First of all, let us remember that one of his banners of his electoral campaign was that he was going to close the central bank and he was going to dollarize the economy.

In this regard, he said in an interview with Fantino that he already had the approval of one of the largest investment funds in the world, which assured him that it would lend him US$10 billion to dollarize.

When Fantino insisted if that was so, Milei I answer: Do you want me to show you my cell phone? Insinuating that he had a WhatsApp through which he had insured those US$10,000 million and then assured that with the bonds that the BCRA had in its assets he would cancel the paid liabilities. That is, the dollarization It was perfectly viable.

In another interview with Eduardo Feinmann, he maintained that they were no longer the ones who went out to look for financing to dollarize, but rather that different investment funds approached them to offer them the funds to dollarize.

Once he won the elections he announced that Emilio Ocampo was going to preside over the central bank and its function was going to be to dollarize the economy and close it.

As the days went by, Ocampo posted on A first step back.

A few days later, Ocampo stopped being a candidate for the presidency of the BCRA and instead Milei He appointed Santiago Bausili, partner in Minister Caputo’s consulting firm, who maintained that as long as he was president of the BCRA, said institution was not going to be closed. Another step back.

Then came a new proposal Milei regarding monetary policy and maintained that the monetary base (public circulation + bank reserves) was going to be frozen at the values at which it was.

Milei he said verbatim: “That is, the famous nominal anchor. That is, the way in which I am anchoring the price level is by setting the amount of money.

So, if since we took office in December the monetary base has been constant, despite the fact that we bought 15,000 million dollars, despite the fact that the puts skyrocketed, despite the fact that we had to pay the remunerated liabilities, the contraction by BOPREAL and the contraction by The fiscal surplus has been such that it compensated for all that and left the monetary base constant, which is why inflation is falling.”

The idea of Milei, which he expressed on another occasion, is that the monetary base remained constant and that if the economy demanded more money, that money would come from the dollars that were in people’s mattresses. In this way, as the demand for money increased, with the amount of pesos constant and an increase in the supply of dollars, the dollarization in fact.

A very big twist in the original speech according to which he had the approval of a large investment fund to dollarize and close the BCRA.

Textually Milei He said: “We are going to leave a minimum of pesos in circulation and the process of remonetizing the economy will have to take place by taking money out of the mattress.”

Obviously the average person does not keep pesos in their mattress and was referring to the dollars that people hoard.

This would be, for now, its last version of dollarization. Leave the amount of pesos constant and if the demand for currency increases, people will use the dollars they have saved and thus the economy will be dollarized.

But here another problem begins. The government is not fulfilling its promise to freeze the monetary base.

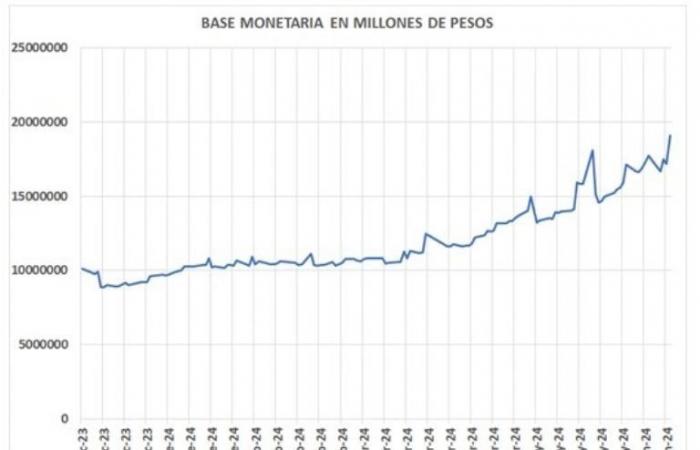

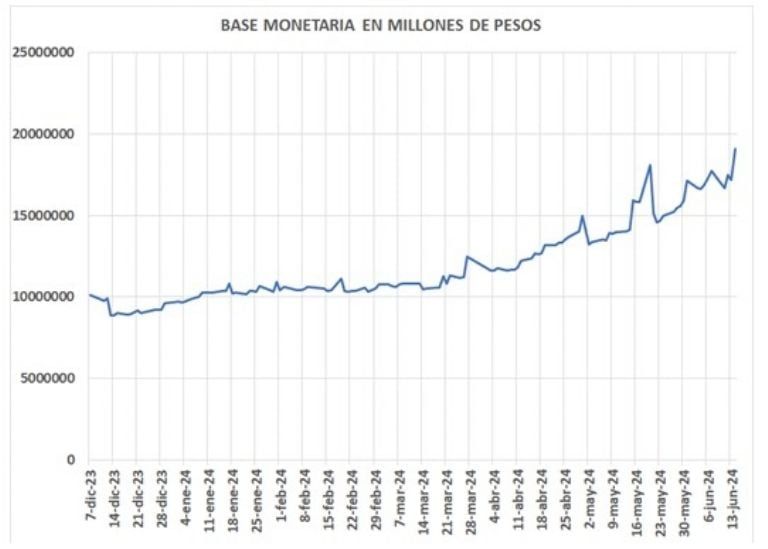

Between December 7 and June 14, the monetary base increased 88.3%. The monetary base is made up of currency and bank reserves. Currency in circulation increased by 75% and bank reserves grew by 113% as a result of a strong increase in bank deposits, particularly fixed-term deposits without adjustment for CER or UVA.

As can be seen in graph 1, starting in mid-March of this year the monetary base begins to grow and this growth accelerates in April.

Some economist may argue that the inflation rate must be subtracted from the increase in the monetary base.

But yes, as the followers of Milei repeating Milton Friedman’s phrase: “inflation is always and everywhere a monetary phenomenon”, it means that, given the increase in the monetary base in nominal terms, the solution is for the inflation rate to rise at the same time, with which inflation would become the solution to the inflationary problem since it would liquefy the monetary base to leave it constant.

To make it clearer, if the monetary base increases nominally, the solution Milei and its economists is that inflation will rise. Inflation would stop being a problem and become a solution!

A true conceptual nonsense that does not tolerate the slightest logical reasoning.

Since currency is a commodity like any other, the correct comparison is to see how much the amount of currency increases on the one hand and the supply of goods and services on the other. If the amount of currency grows faster than the supply of goods and services, we have guaranteed inflation.

To put it in simple terms, how does the relative price between potatoes and apples evolve if the supply of potatoes grows more than that of apples? Obviously, more potatoes will have to be delivered to acquire the same amount of apples. This is how easy and simple the analysis of relative currency prices is versus the rest of the goods and services.

If the amount of currency increases more than the rest of the goods and services, more currency will have to be delivered to obtain the same amount of goods. That’s called inflation.

In summary, everything seems to indicate that the proposal to dollarize and close the BCRA was shelved, but the government still does not know what monetary policy to apply. On this issue, it is entering into strong contradictions that will increasingly complicate the exit from the exchange rate trap, a topic that is left for another note.