Hedge funds have redoubled their bets on copper in the midst of the truce that the metal has offered after touching $11,000 and becoming the “new oil” for its key role in the energy transition of the global economy. There are still strong bullish bets in the market that the current decline is just a slight pause.

Copper became the financial asset of the year a few weeks ago when it surpassed $11,000 per ton for the first time in its history. He metal has fallen more than 10%in the midst of a certain market consensus that prices had entered a speculative spiral, which was not justified by the fundamentals of global supply and demand.

But just this week the bullish positions of a couple of hedge funds, which operate in raw materials, were revealed, which put the price of copper out of orbit. According to Bloomberg, Rokos Capital Management, a fund specialized in macro and bonds, bought calls, long-term options, to buy a ton of copper at $20,000 in the coming years. The bet has already generated significant benefits for the firm. It has made substantial mark-to-market gains on its copper positions this year, with options contracts, before prices took off in late 2023.

For Andurand Capital Managementcopper was the largest position by market exposure at the end of April, and predicted that prices could reach $40,000. The main commodity funds of Pierre Andurand, the visible face of the firm, rose between 13% and 30% in April, thanks in large part to the firm’s copper positions, the manager explained in a letter to clients .

“We believe we are at the beginning of the copper bull market and that the recent upward movement in prices is just the beginning,” he warned. “Copper faces a decade-long supply deficit driven by the confluence of rising demand due to the energy transition and persistent underinvestment in mine expansion.”

Who are Rokos and Andurand?

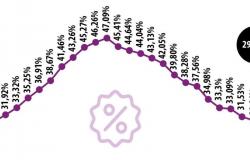

The investment thesis has been widespread in the market. The problems in some key mines and the theoretical demand for each data center project for artificial intelligence have led to the recent rally and support from the large investment banks with their perspectives. But despite the enthusiasm for the new oil of the energy transition, since copper is going to be essential for electric cars, turbines, solar panels and almost everything that has to do with electrification, the market consensus, collected by Bloomberg , predicts that by the end of the year, copper will end above $9,300. The most bullish entities, such as JP Morgan, anticipate a price above $11,000 by 2025.

Rokos Capital Management is owned by Chris Rokos, a well-known British investor, and is one of the best hedge funds in the macro category this year. The firm manages more than 17,000 million dollars and accumulates a profitability of 20% so far this year.

Billionaire Chris Rokos’ hedge fund cemented its position as one of the best-performing macro money funds so far this year, with gains now up around 20% year-to-date. The firm in its statements justifies the return on investments in bonds.

For its part, the Andurand fund is a veteran commodity operator, especially oil. Its main vehicle Andurand Commodities Discretionary Enhanced has a profitability of 20% and manages around $1 billion. His risky bets led him to accumulate losses of 22%.

Other funds have also been benefiting from the copper rally, such as David Einhorn’s Greenlight Capital. “Our thesis now is that copper supply is about to fall below demand, which will force prices to rise substantially“, the firm said in a letter to investors. “We believe that the best way to invest in that thesis is the most direct way, in this case through options on copper futures.”

Price containment arguments

For months, the copper market has been caught in a tug-of-war between bearish physical traders and investors with a much more bullish long-term view. The influx of new money into copper has baffled some industry experts, who point to weak demand in China and a metals market well supplied with supply for the rallies to cool. For some analysts, demand expectations due to the impact of the energy transition may be excessive. McKinsey believes technological advances will increase supply to 7.9 million tonnes.

Another argument in favor of a lower price is the possibility of using alternative metals as a conductor. Aluminum can work as a conductor, not as good as copper. Right now it’s four times cheaper.

Trafigura, the world’s largest copper trader and for years one of the market’s most vocal bulls, warned Thursday that the rally was not justified based on fundamental supply and demand conditions, but the market would adjust for the market conditions.