July 10, 2018. The cameras of countless media outlets focused on then-German Chancellor Angela Merkel speaking amicably with her counterpart, Chinese Premier Li Keqiang, framed by headlines praising their joint work to promote free trade.

In front of them, an image that can be considered historical although few of those who witnessed it noticed it. Two men in dark suits sat at a desk with identical leather-bound folders and pens in hand. Zeng Yuqun, CEO of Contemporary Amperex Technology Limited (CATL), the world’s largest battery company originally from China, and Wolfgang Tiefensee, a minister of the German state of Thuringia, had authorized the signing of an agreement that committed the giant Chinese manufacturer to build the first large battery factory for electric vehicles in Germany.

Lithium batteries have prevailed, they account for 90% of global demand

This scene described in detail by Akshat Rathi, senior climate reporter at Bloomberg, in his book Climate Capitalism, It could be considered the trigger for one of the pillars of the new global geostrategy. The image showed that Europe had thrown in the towel. It could continue producing cars in the future, but it handed over the philosopher’s stone of the car of the future, the production of its batteries, to China.

The result? Currently, the Asian country is the main producer of batteries in the world, with 83% of the market, according to data from the International Energy Agency (IEA). Before the pandemic, its market share was less than 75%. Now, China has 85% of the battery cell manufacturing capacity and 90% of the world’s cathode active material manufacturing (one of the bases of a battery) and 98% of the anode production (another of the bases).

The cheaper and safer sodium battery could be the West’s competitive option

Europe, although it already produces 20% of the world’s electric vehicles, barely participates in the global battery supply chain. It has 7% of battery cell production capacity located in Poland, Hungary and Finland. The US produces 10% of the vehicles, but only 6% of the battery chain. Even Tesla manufactures in China. Only Korea can compete with Chinese power. Of the world’s top 10 battery producers, six are Chinese. With 34% of the market, the great leader is the aforementioned CALT, which extends its tentacles throughout Europe, Latin America and the rest of Asia. It is followed by the Chinese BYD, with a 16% market share, and in third place is the Korean LG, with a close 15%. With almost half, in fourth place is the Japanese Panasonic, with a market share of 8%.

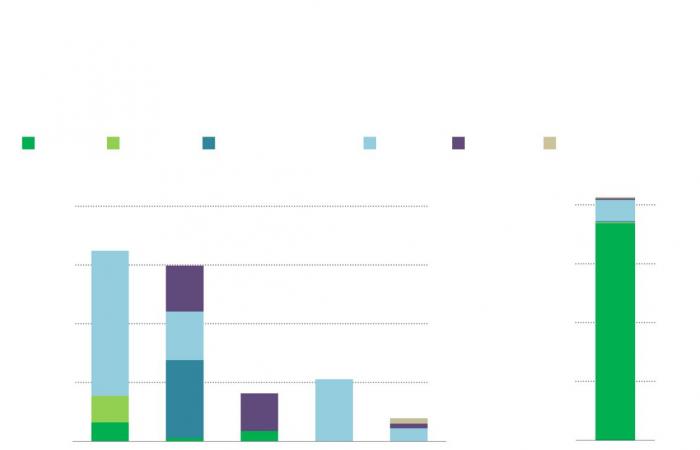

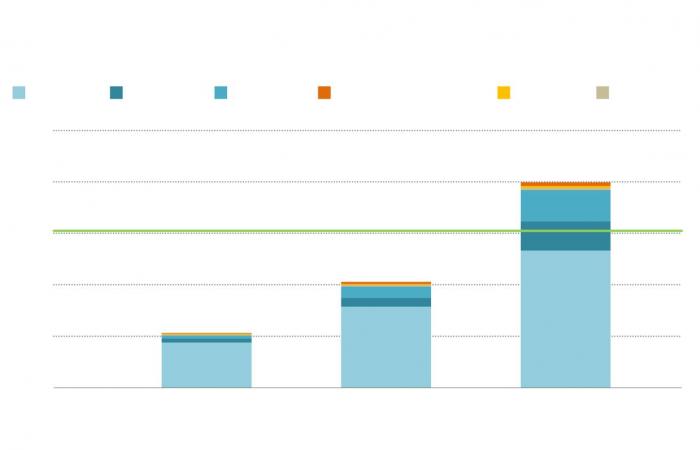

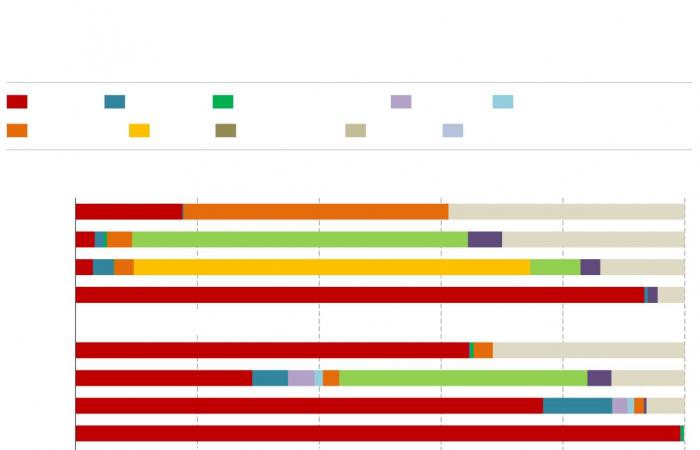

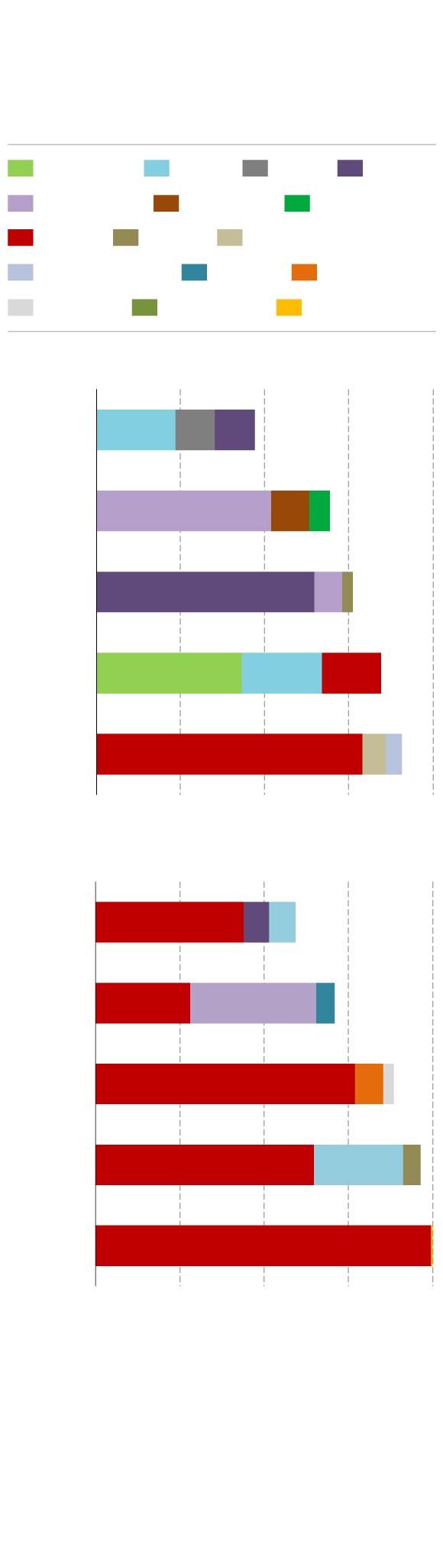

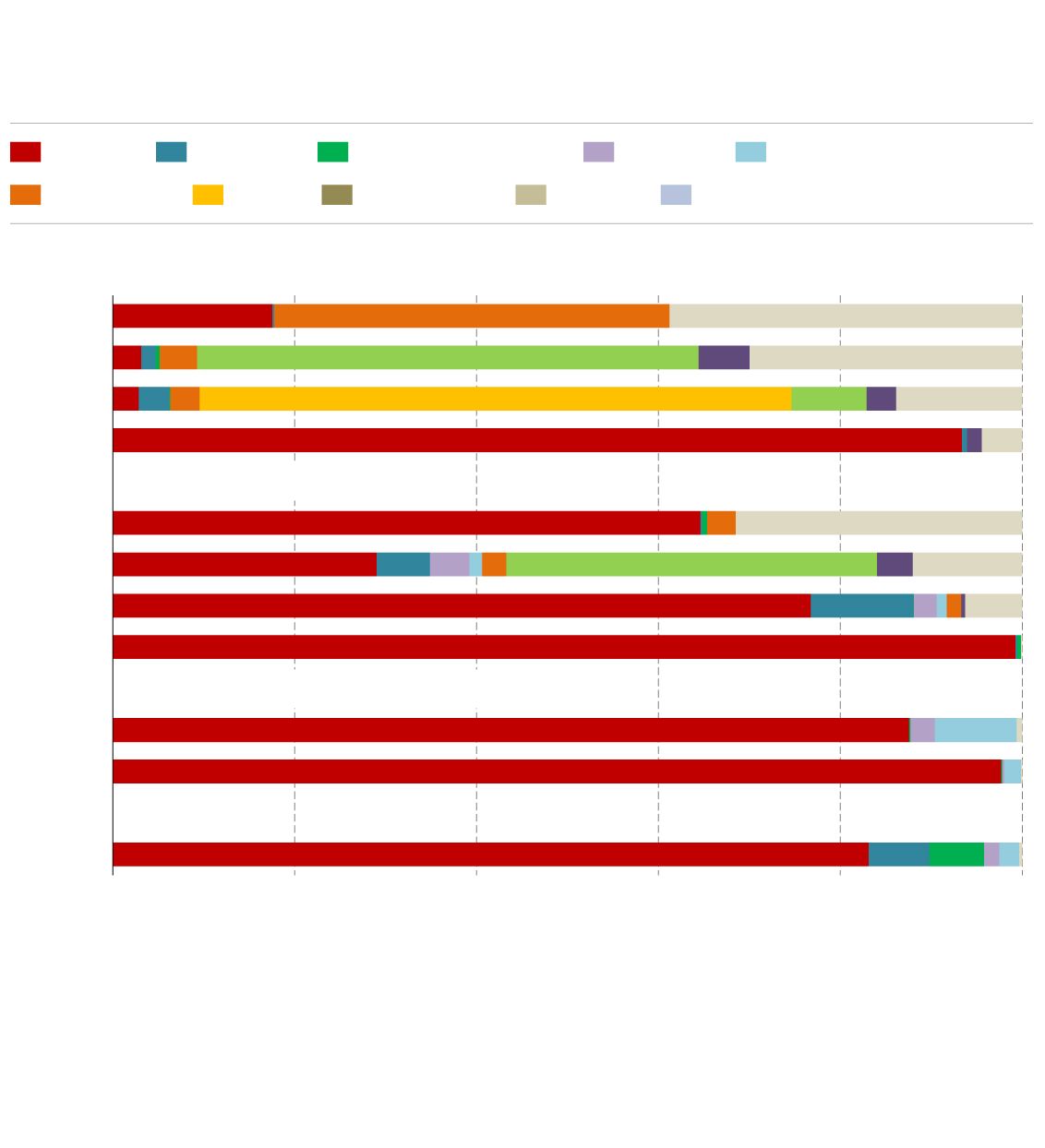

Manufacturing capacity of lithium-ion batteries in the world, according to the country of origin of the company they produce in 2023

Manufacturing capacity

lithium-ion batteries in the world, according to the country of origin of the company they produce in 2023

Manufacturing capacity of lithium-ion batteries in the world, according to the country of origin of the company they produce in 2023

Despite the relevance of the scene described by Rathi, 2018 is far from being year zero of China’s career in this sector. Ten years earlier, the Chinese Government already approved a package of almost 600 billion euros to encourage the energy transition and develop batteries. CATL was born in 2011 and in 2012 the country was already producing 40% of the batteries that the world needed for its energy transition. The support of public money has not stopped.

Mobile phones, the basis of Chinese dominance

Like the rest of Asia, China’s commitment to R&D in the field of batteries came from afar. It all had its origins in mobile phones and electronic devices that came from the East in the eighties of the last century. His commitment to adapting this technological battery to drive vehicles was no secret. China was never a leader in the production of combustion vehicles, but the Western factories of Volkswagen, BMV, etc. They settled in their territory seeking to reduce production costs. In exchange they gave up their know-how. “The basics were innovation and the supply chain and they already had that. For electric vehicles, much easier to produce than a combustion vehicle because they have many fewer parts, they have only had to adapt production to new needs. Once the battery has been adapted, you almost have the electric motor industry,” says Donia Razazi, senior industry expert at the consulting firm Ayming.

The strategy that China has followed to rise to global leadership is based on four strategic axes. The first has been to ensure access to strategic raw materials, with substantial investments in our own mines, but also throughout the entire planet, especially lithium, which is the material that 90% of the world’s batteries now demand. The problem is its high cost in the market: a ton of lithium has exceeded $13,657 at the beginning of 2004, and the high demand for water for its manufacture. The refining of those materials necessary to manufacture a battery has been another front in which China has invested in all these years. Generating the value chain for refining these materials has only been possible thanks to a very generous incentive policy. 74% of aid for battery manufacturing is applied in China, according to the IEA. A “doping”, as European competitors call it, that is now copied all over the planet. Europe and the US are pumping money into incentivizing battery manufacturing while slapping tariffs on electric vehicles from China. In the last week, the European Union has announced that it will tax electric vehicles from that country with up to 48%. Türkiye has imposed a 50% tariff and the US, 100%.

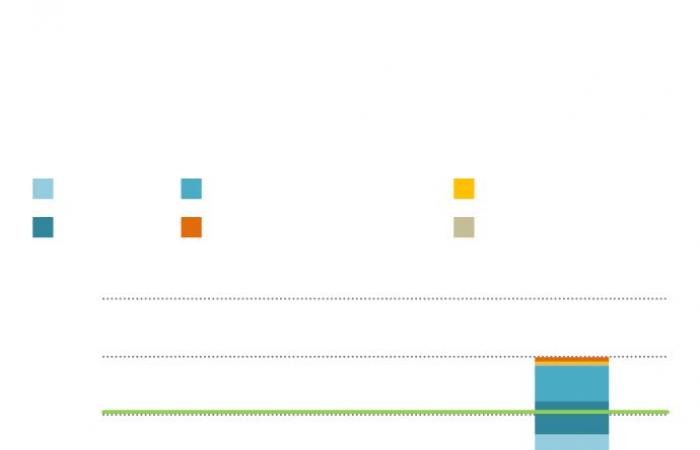

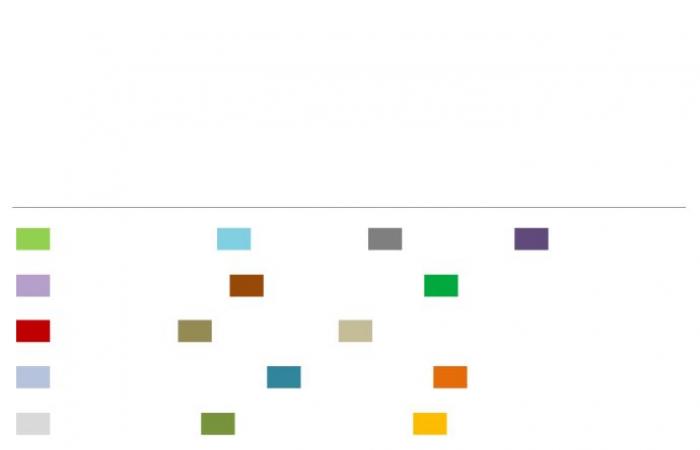

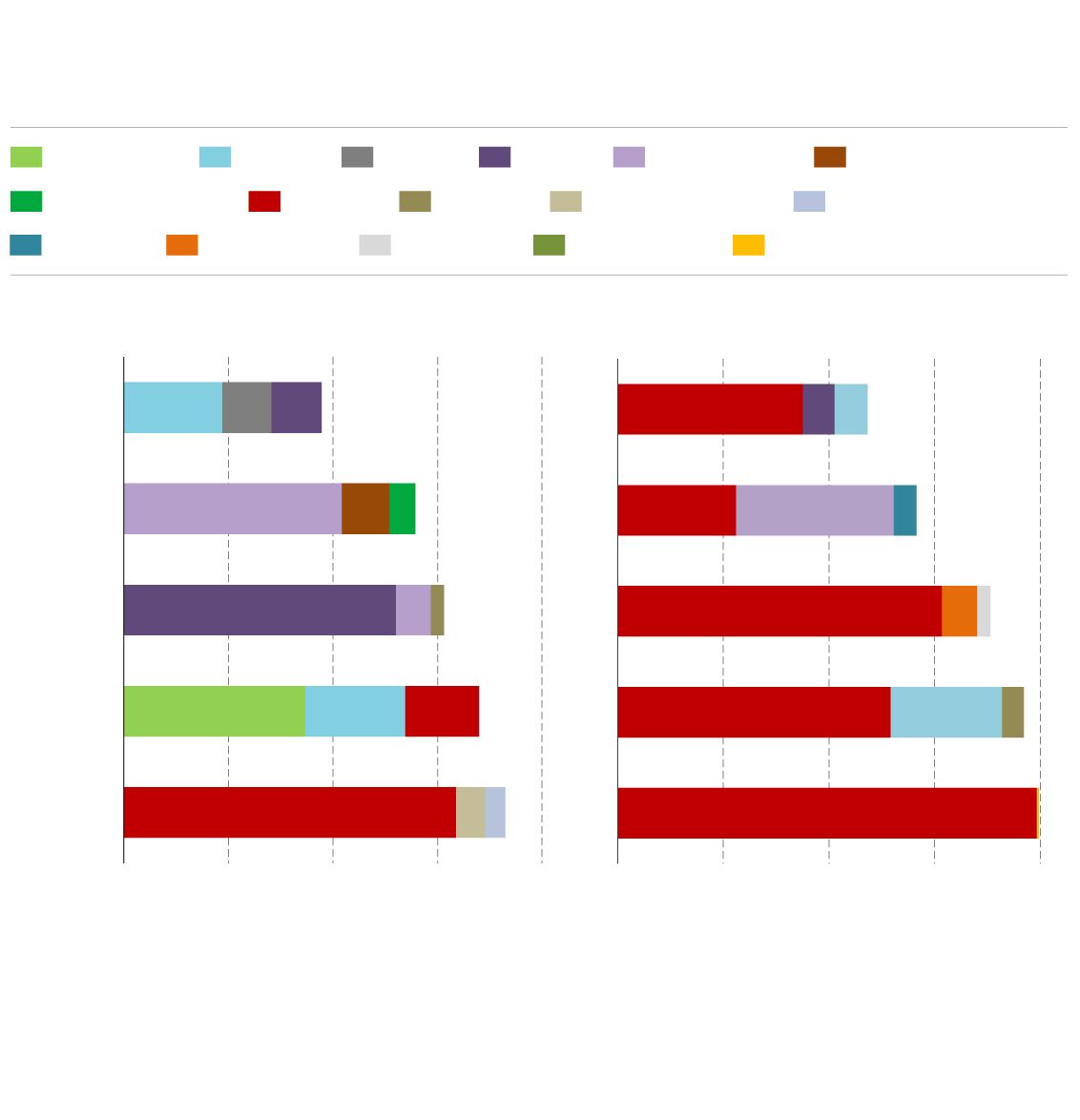

Maximum capacity

battery production

of lithium ion by region

USA

Rest of the world

NZE rollout in 2030

Maximum production capacity of lithium ion batteries

by region

USA

Rest of the world

NZE rollout in 2030

Maximum lithium-ion battery production capacity by region

NZE rollout in 2030

A huge market

It does not seem that China will suffer excessively. Despite the fact that in cities like Shanghai more than 90% of the vehicles that clog its streets are electric and silent traffic jams are already suffered. Only 3% of its more than 1.4 billion inhabitants have a car or electric motorcycle. “The market that lies ahead has no comparison with Europe, the increasingly emerging middle class is going to demand electric vehicles en masse only in China,” says Carlos Wan, director in Spain of Yadea, the leading electric motorcycle company in the market. world.

The tariffs are not so much to harm China as to protect an industrial shift in the West that must be well targeted. “China has an advantage in lithium batteries, but technology already indicates that sodium batteries could be more effective and less polluting. The race for batteries, electric cars, or green hydrogen is by no means decided. There are a lot of things to do. What Europe has to do is invest in technologies not yet dominated by China, to separate the energy transition from that dependence,” says Alicia González-Herrero, head of Natixis for Asia Pacific and senior researcher at the think tank Bruegel. Time to react is limited. The business, immense. The IEA predicts that battery storage will multiply by six until 2030 and total spending on them will rise by 400%. In China, aware of the limitations of lithium batteries for this challenge, they have been betting on these sodium batteries for years. In favor of the latter, sodium is a material 1,000 times more abundant in the Earth’s crust than lithium. That is, it is cheaper and within reach of almost all nations. Sodium is nothing more than salt. “The complicated thing is the extraction process to use it in batteries. “We have developed a methodology that allows us to reduce the production cost between 30% and 40%,” explains Jian Chen, CEO of HuaYu Sodium Battry Co, innovation subsidiary of the motorcycle manufacturer Yadea, the chief scientist who participated in the first white paper on the production of lithium batteries in China and which now leads that of sodium batteries. He is considered the author of the world’s first instruction manual for this new technology.

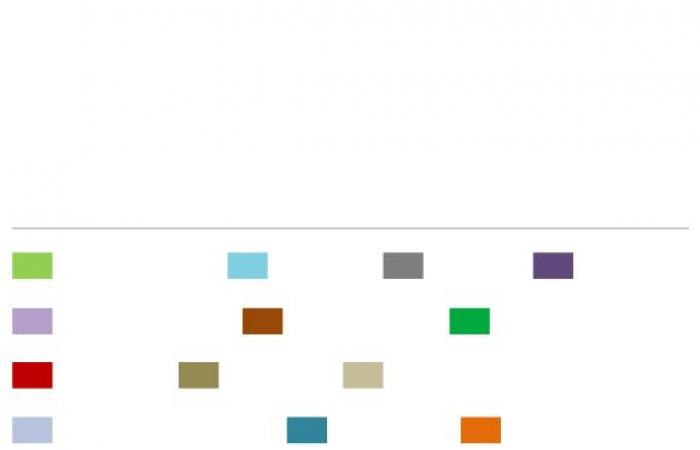

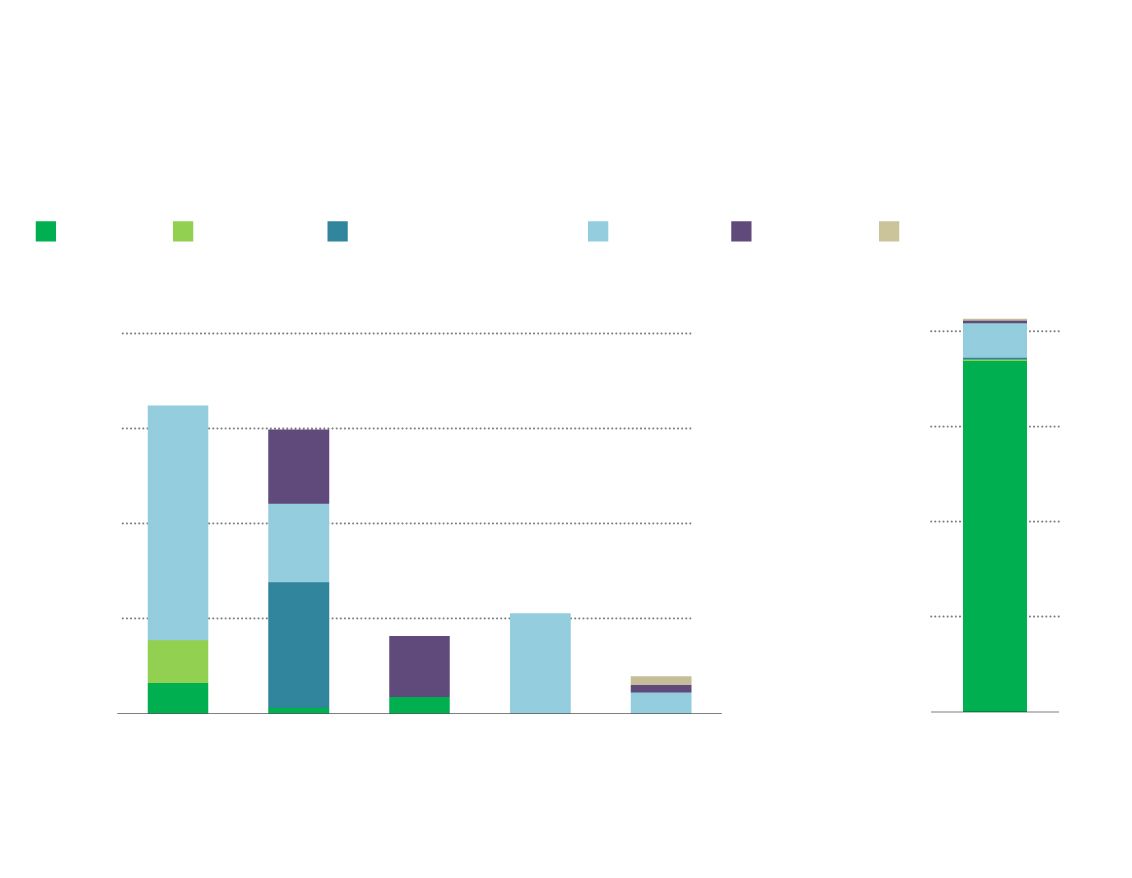

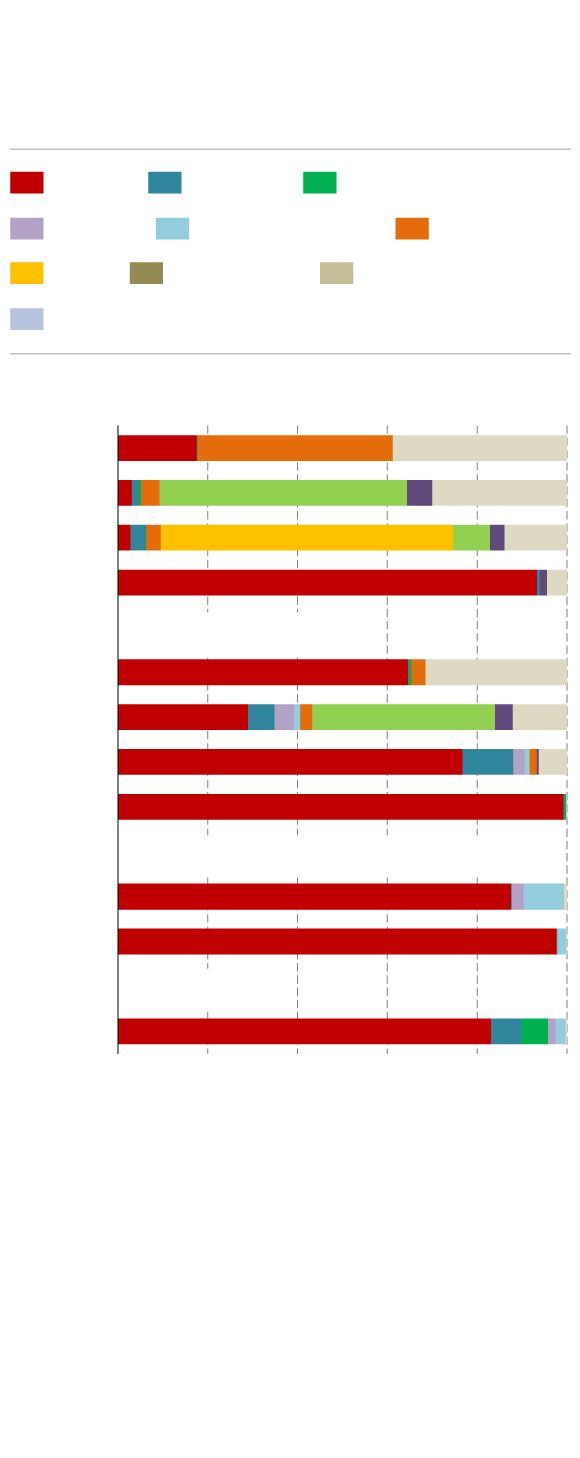

Main countries with extraction and refining capacity

of critical materials

for batteries in 2023

Notes: N. Caledonia = New Caledonia,

DRC = Democratic Republic of the Congo.

Graphite mining is for natural flake graphite. Graphite processing is for spherical graphite.

Source: IEA, World Energy Outlook Special Report

Main countries with capacity for extraction and refining of critical materials for batteries in 2023

Notes: N. Caledonia = New Caledonia,

DRC = Democratic Republic of the Congo.

Graphite mining is for natural flake graphite. Graphite processing is for spherical graphite.

Source: IEA, World Energy Outlook Special Report

Main countries with extraction capacity

and refining of critical battery materials in 2023

Notes: N. Caledonia = New Caledonia, DRC = Democratic Republic of the Congo.

Graphite mining is for natural flake graphite. Graphite processing is for spherical graphite.

Source: IEA, World Energy Outlook Special Report

Manufacturing capacity China is the world leader in battery manufacturing, dominating 85% of production and has absolute dominance (98%) in the production of anodes

Beyond the possible economic incentives of this new technology (a ton of sodium is $290 compared to more than $13,000 for lithium), China has another advantage. “Most of the lithium battery production chain can be used for sodium, which is why we have an advantage over the West. We already have that progress,” Chen explains to The vanguard in the Hangzhou factory, 200 kilometers from Shanghai.

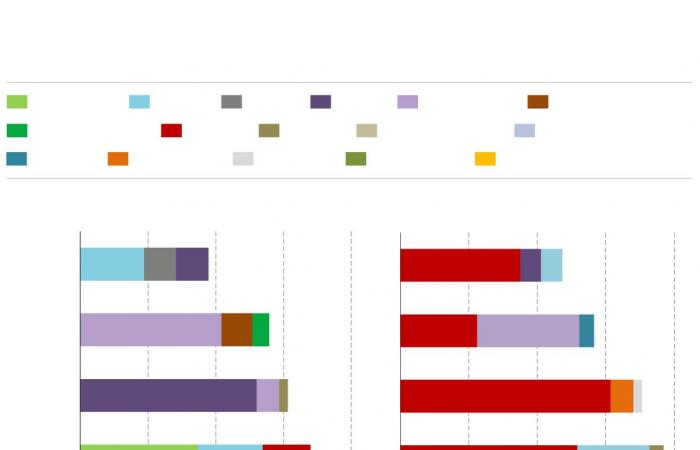

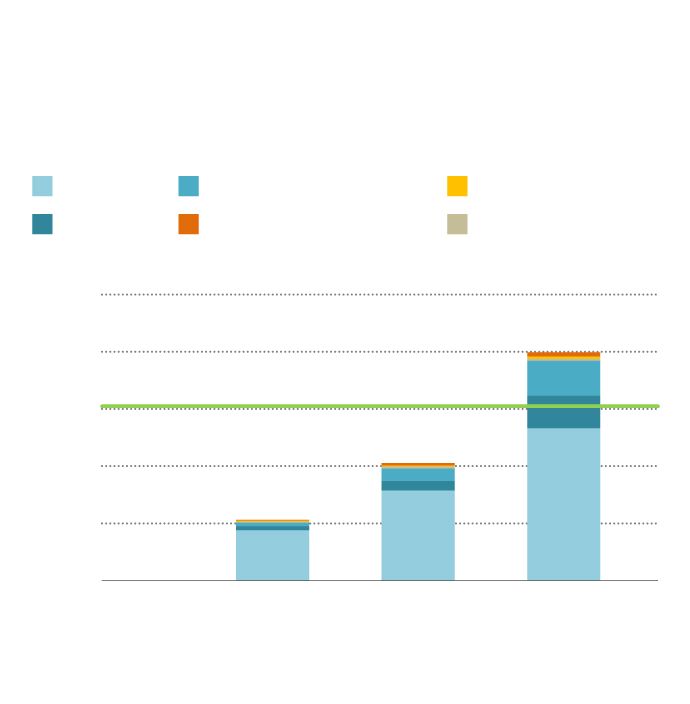

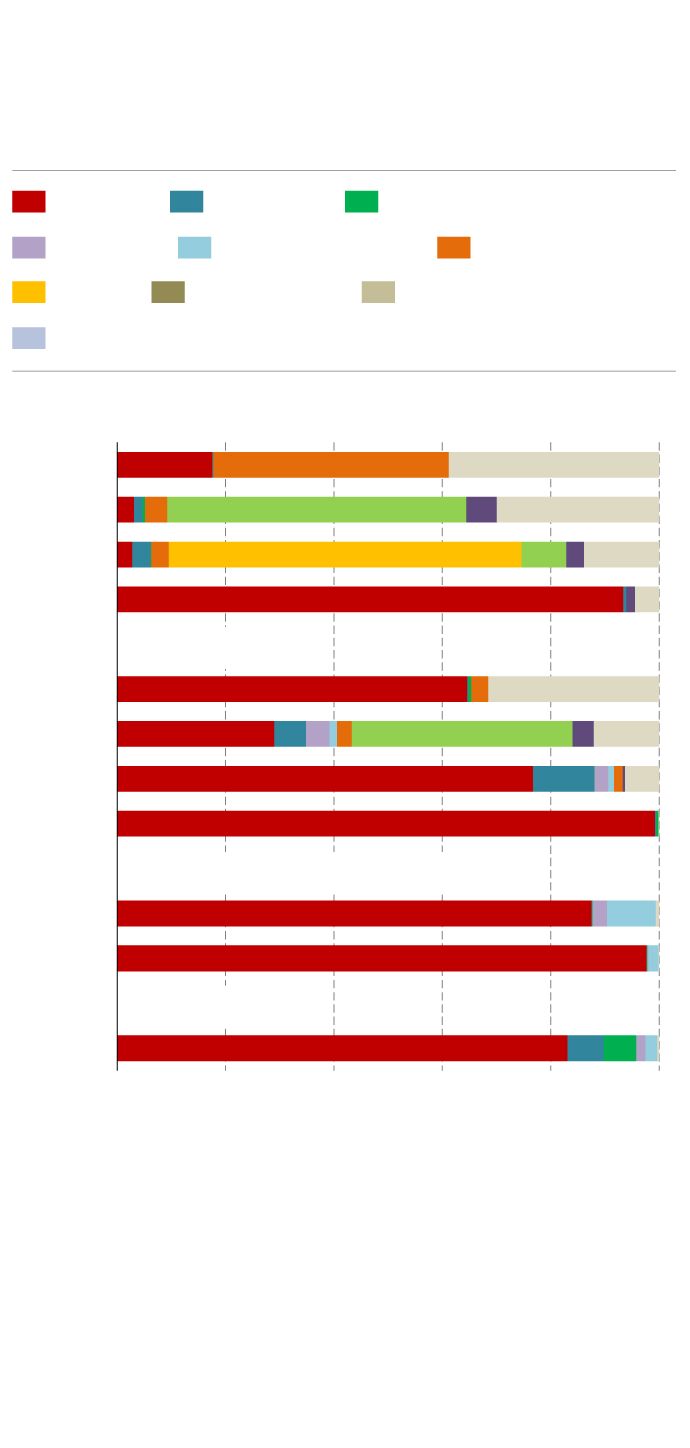

Geographic distribution of the battery supply chain in the world

Battery components

Notes: DRC = Democratic Republic of the Congo.

Graphite refining is solely the refining of natural graphite into spherical graphite. Mining and processing are based on production data. Cathode, anode and batteries are based on manufacturing capacity data.

Source: IEA, World Energy Outlook Special Report

Geographic distribution of the battery supply chain in the world

Battery components

Notes: DRC = Democratic Republic of the Congo.

Graphite refining is solely the refining of natural graphite into spherical graphite. Mining and processing are based on production data. Cathode, anode and batteries are based on manufacturing capacity data.

Source: IEA, World Energy Outlook Special Report

Geographic distribution of the battery supply chain in the world

Battery components

Notes: DRC = Democratic Republic of the Congo.

Graphite refining is solely the refining of natural graphite into spherical graphite. Mining and processing are based on production data. Cathode, anode and batteries are based on manufacturing capacity data.

Source: IEA, World Energy Outlook Special Report

Yadea is not the only battery manufacturer that is betting on sodium. CATL has also been in that race for years and JAC Motors has designed the electric Yiwei, but its bets are still on prototypes. Currently, Yadea is the only manufacturer that, since 2023, has massively installed sodium batteries in five models of two- and three-wheeled electric cars only for sale in China. In its favor, not only cheaper production. “They are also safer. The cells do not catch fire or explode, like lithium cells. They perform much better in extreme temperatures and require much less water consumption. On the other hand, a lower energy density: for a vehicle to move faster the battery must be larger and therefore heavier. In the motor industry that may be a handicap, but “it has hardly any impact on the renewable energy storage batteries that the world already demands massively,” says Chen. A warning to the West.